In this episode of Radio Rothbard, Ryan McMaken and Tho Bishop discuss the cancellation of Tucker Carlson's Fox News show and the similar treatment of Murray Rothbard by Bill Buckley. What does Tucker's cancelation mean for the growing anti-regime trends on the right, and why do "conservative" gatekeepers prefer the company of the left more than their audience? We look at this and more on this episode of Radio Rothbard. [embedded content] New Radio Rothbard...

Read More »The Failure of the Federal Reserve: The Covid Boom and Unnecessary Intervention

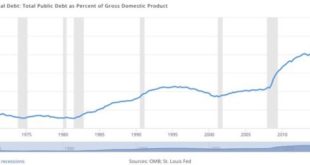

After years of inflationary intervention, the Federal Reserve has no more rabbits to pull out of the hat. Original Article: "The Failure of the Federal Reserve: The Covid Boom and Unnecessary Intervention" [embedded content] Tags: Featured,newsletter

Read More »Will a New BRICS Currency Change Anything? Maybe

Money first originated through the voluntary exchange of commodities, such as gold and silver, in order to eliminate the inefficiencies of barter. As Austrian school of economics founder Carl Menger explained: Money is not an invention of the state. It is not the product of a legislative act. Even the sanction of political authority is not necessary for its existence. Certain commodities came to be money quite naturally, as the result of economic relationships that...

Read More »You Don’t Like It? Leave! The Telling Sophistry of Tax Apologists

What better way to “celebrate” tax season than to talk taxes? Stop me if you’ve heard this one: Taxation is not theft. It’s just the law of the land. You want to live in this country, you pay the long-established, constitutional, customary tax. If you’re not okay with that, there are plenty of other countries to choose from whose customs and edicts you may find more agreeable. Just go live there, and best of luck to you! So as long as you have that right of exit, the...

Read More »Chapter 20: Abolish Slavery! — Part VII

Starting in January of 1967, Rothbard churned out fifty-eight columns, the last one written in the summer of 1968. In those two crucial years, there was, as they say, never a dull moment. Narrated by Jim Vann. [embedded content] Tags: Featured,newsletter

Read More »Chapter 39: The Vietnam Crisis

Starting in January of 1967, Rothbard churned out fifty-eight columns, the last one written in the summer of 1968. In those two crucial years, there was, as they say, never a dull moment. Narrated by Jim Vann. [embedded content] Tags: Featured,newsletter

Read More »Chapter 21: Abolish Slavery! — Part VII

Starting in January of 1967, Rothbard churned out fifty-eight columns, the last one written in the summer of 1968. In those two crucial years, there was, as they say, never a dull moment. Narrated by Jim Vann. [embedded content] Tags: Featured,newsletter

Read More »Chapter 37: The State of the War

Starting in January of 1967, Rothbard churned out fifty-eight columns, the last one written in the summer of 1968. In those two crucial years, there was, as they say, never a dull moment. Narrated by Jim Vann. [embedded content] Tags: Featured,newsletter

Read More »Chapter 31: Jim Garrison, Libertarian

Starting in January of 1967, Rothbard churned out fifty-eight columns, the last one written in the summer of 1968. In those two crucial years, there was, as they say, never a dull moment. Narrated by Jim Vann. [embedded content] Tags: Featured,newsletter

Read More »Chapter 12: “Rebellion” in Newark

Starting in January of 1967, Rothbard churned out fifty-eight columns, the last one written in the summer of 1968. In those two crucial years, there was, as they say, never a dull moment. Narrated by Jim Vann. [embedded content] Tags: Featured,newsletter

Read More » SNB & CHF

SNB & CHF