GoldSeek Radio's Chris Waltzek talks to Charles Hugh Smith from Of Two Minds http://www.oftwominds.com/blog.html and to John Embry, Chief Investment Strategist at Sprott Asset Management. http://sprott.com/ http://www.goldseek.com/ http://radio.goldseek.com/

Read More »Slow wage growth to keep Fed on prudent normalisation track

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December)....

Read More »ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone. Euro area real GDP growth forecasts will likely be revised higher for the fifth...

Read More »Poverty risk high for Swiss pensioners despite high spending

A recent OECD study, which looks at retirement, shows the relatively large amount spent on pensioners in Switzerland. © Marian Vejcik | Dreamstime - Click to enlarge Switzerland consumes 11% of its GDP on retirees, compared to 9% across OECD nations. Despite this high spending, the risk of poverty is higher in Switzerland than across the OECD. According to the organisation, 19% of those over 64 in Switzerland are at...

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Could Central Banks Dump Gold in Favor of Bitcoin?

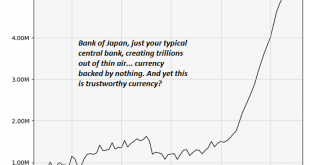

All of which brings us to the “crazy” idea of backing fiat currencies with cryptocurrencies, an idea I first floated back in 2013, long before the current crypto-craze emerged. Exhibit One: here’s your typical central bank, creating trillions of units of currency every year, backed by nothing but trust in the authority of the government, created at the whim of a handful of people in a room and distributed to their...

Read More »The Rug Yank Phase of Fed Policy

Bogus Jobs Pay Big Bucks The political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it. The short and sweet definition of democratic elections by eminent...

Read More »Swiss train rides: punctual and beautiful

Trains, train, trains: Diccon Bewes packs his bag and heads off for a day out on Swiss public transport. Along the way he manages to hop on board almost every type of moving vehicle that Switzerland has to offer. It turns out it's not the beautiful views that take his breath away, but the intricate train timetables he finds on the platforms. Diccon explains why he loves them, and what happens to them in December. (Diccon Bewes for swissinfo.ch) --- swissinfo.ch is the international branch...

Read More »Fed rate unlikely to move much above 2% next year

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the...

Read More »Uber to stop offering budget service in Basel

Pressure from taxi companies and fines imposed on drivers have resulted in the retreat of UberPop from Swiss cities (Keystone) - Click to enlarge The ride-sharing firm Uber has announced it will abandon its UberPop service in the city of Basel from June 1, 2018, as it is not profitable enough. UberPop has already been discontinued in Zurich and Lausanne. According to the company, the decision was taken due to...

Read More » SNB & CHF

SNB & CHF