There’s nothing especially special about 2.62%. It’s a level pretty much like any other, given significance by only one phrase: the highest since 2014. It sounds impressive, which is the point. But that only lasts until you remember the same thing was said not all that long ago. Back last March, the 10-year yield had then, like now, broke above 2.60%. In doing so, it surpassed the previous recent high set in December...

Read More »FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore. Another weight on...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended last week on a soft note, but still enjoyed a relatively positive tone for the week as a whole. Best performers last week were MXN, ZAR, and CNY while the worst were ARS, TRY, and CLP. With little on the horizon to give the dollar some traction, we think EM FX will likely continue to firm this week. However, we again urge caution and look for divergences within EM. Stock Markets Emerging...

Read More »Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the...

Read More »Nestlé to move chocolate research from Switzerland to UK

Swiss Economics Minister Doris Leuthard (left) and Nestlé Director General Petraea Heynike at the inauguration of the Chocolate Centre of Excellence at Broc in 2009 (Keystone) - Click to enlarge The Swiss food giant Nestlé is transfering its chocolate research centre from Broc in canton Fribourg to York in the north of England. Some 25 jobs are affected but the existing chocolate factory in the Swiss town is...

Read More »The Next Great Bull Market in Gold Has Begun – Rickards

The Next Great Bull Market in Gold Has Begun – Rickards on Peak Gold And Technicals – ‘Gold is in the early stages of a sustainable long-term bull market’ Rickards – Rickards believes the next bull market in gold will be even more powerful than those of 1971–1980 and 1999–2011 – This new rally could send gold $1,475 or higher by next summer thanks to Fed rate hikes – Warns of Peak Gold ‘Physical gold is in short...

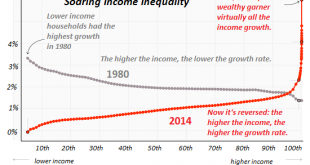

Read More »It’s Time to Retire “Capitalism”

Our current socio-economic system is nothing but the application of force on the many to enforce the skims, scams and privileges of the self-serving few. I’ve placed the word capitalism in quotation marks to reflect the reality that this word now covers a wide spectrum of economic activities, very little of which is actually capitalism as classically defined. As I have explained here for over a decade, the U.S. economy...

Read More »As the Controlled Inflation Scheme Rolls On

Controlled Inflation American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come. After an extended period of indulging in excessive moderation (left), the US consumer makes his innermost wishes known (right). - Click to enlarge On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to...

Read More »Swiss authorities to consider blockchain supervision

Reports South Korea and China could ban cryptocurrency trading has sparked worries of a wider regulatory crackdown (Keystone) - Click to enlarge The federal authorities have set up a special working group to look into how to properly oversee blockchain technologies and initial coin offerings (ICO). The Swiss taskforce is set to report back by the end of 2018. The State Secretariat for International...

Read More »Gold Bullion May Have Room to Run As Chinese New Year Looms

Gold bullion tends to rise January and February before Chinese New Year (see table) Gold is nearly 8% and $100 higher since Fed raised rates one month ago Options traders are bullish and suggest gold has room to run (see chart) Nervous in short term, positive in medium term – gold at $1,500 in 2018 From Bloomberg: Gold’s breakneck rally eased this week, but tailwinds in both physical and paper markets suggest it’s...

Read More » SNB & CHF

SNB & CHF