Das Depot hat ordentlich einkassiert, Dank dem Corona-Virus. Allerdings hat das neue Nachkaufmöglichkeiten geschaffen, ich habe nun meine Swiss Re Position weiter ausgebaut und besitze jetzt insgesamt 80 Stück. Hier geht’s übrigens zum letzten Aktien Kauf Royal Dutch Shell. Kauf von Swiss Re Ich möchte nach wie vor weiterhin jeden Monat für 8-10’000 CHF in Aktien investieren, deshalb habe ich mir 33 Aktien vom Unternehmen Swiss Re ins Depot gelegt. So habe ich für...

Read More »Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order

Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order http://financialrepressionauthority.com/2020/03/05/the-roundtable-insight-yossi-kaplan-and-charles-hugh-smith-on-the-virus-and-the-new-world-order/

Read More »Credit Suisse linked to list of 12,000 Nazis found in Argentina

“Work sets you free”: The entrance to the Auschwitz extermination camp. After the Second World War many Nazis took refuge in Latin America. (Keystone / Frank Leonhardt) A list of 12,000 Nazis who are said to have lived in Argentina from the 1930s onwards has been found in Buenos Aires. Many of the Nazi sympathisers reportedly paid money into one or more accounts at Schweizerische Kreditanstalt, which later became Credit Suisse. “We believe it is very probable that...

Read More »Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order

Yossi Kaplan and Charles Hugh Smith on the Virus and the New World Order http://financialrepressionauthority.com/2020/03/05/the-roundtable-insight-yossi-kaplan-and-charles-hugh-smith-on-the-virus-and-the-new-world-order/

Read More »Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table) ◆ G7 officials say there will be “appropriate” policy moves in a desperate attempt to prevent the...

Read More »Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

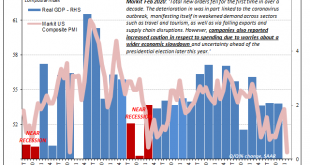

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January. Today’s update to that flash estimate with more survey responses in hand validated the 49.6....

Read More »“Heritage” Designation of Old Buildings Is Both Wasteful and Arbitrary

An old red barn in London, Ontario was recently given heritage protection by City Council. Two days later, after dark, the barn was demolished. Owner John McLeod, citing legal advice, wouldn’t comment when asked if he’d demolished the barn but said, “I’m delighted that it’s down.” McLeod had fought the heritage designation for the Byron barn, calling the push for it at city hall “complete stupidity.” City Hall responded to the demolition by issuing a stop work...

Read More »FX Daily, March 5: The Capital Markets YoYo Continues

Swiss Franc The Euro has fallen by 0.04% to 1.0648 EUR/CHF and USD/CHF, March 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 4.2% rally in the S&P 500 yesterday helped lift Asia Pacific markets earlier today, and the five basis point backing up of the US 10-year yield pushed regional yields higher. However, the coattails proved short, and Europe’s Dow Jones Stoxx 600 is snapping a three-day advance...

Read More »Chinese economic disruption hits Swiss supply chains

Data published this week showed China’s factory activity contracted at its sharpest pace on record in February (Keystone / Xu Changliang) China’s sharp contraction in economic activity over the past month due to the coronavirus epidemic is sending shockwaves across the globe. Switzerland is one of the top ten countries exposed to Chinese supply disruptions, a United Nations report reveals. Over the past month China, which has a central role in global supply chains,...

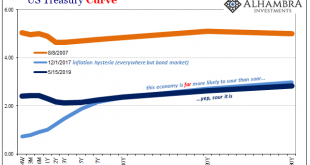

Read More »The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events. The short version: monetary authorities as well as the “experts” describe almost perfectly risk averse behavior among the central money dealing system in outbreaks like September’s repo – but...

Read More » SNB & CHF

SNB & CHF