Swiss Franc The Euro has fallen by 0.11% to 1.0681 EUR/CHF and USD/CHF, October 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and...

Read More »Introducing the Bannockburn World Currency Index

The Dollar Index is a popular way to think about and trade “the dollar.” However, it has become less relevant as a reflection of the dollar’s performance or representative of trade, capital flows, market capitalization. Economists often use a trade-weighted basket, and the Federal Reserve’s real broad trade-weighted index is an input in official and private-sector forecasts. As an alternative, we present Bannockburn’s World Currency Index (BWCI). It is...

Read More »Covid: UK study suggests natural immunity short lived

© Ilzekalve | Dreamstime.com Levels of SARS-CoV-2 antibodies wane quite rapidly after infection, researchers from Imperial College London have found. The team, which measured SARS-CoV-2 antibody levels in 365,000 people between June and September saw a decline of 26% in the number testing positive for antibodies. At the start, antibodies were found in 6.0% of those tested with prick blood tests. During September the percentage was 4.4%, a drop of 26% over roughly 3...

Read More »Coronavirus: a record 8,600 new daily cases in Switzerland

© David Herraez | Dreamstime.com On 28 October 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 8,616 new cases of SARS-CoV-2 infection over 24 hours, bringing the total to 135,658. Close to half of Switzerland’s laboratory-confirmed cases have been reported over the last two weeks (66,954). In addition, over the last two weeks, positivity – the percentage of tests coming back positive – has risen from 14% to 32%, a positivity rate higher than the...

Read More »Was Rothbard a Populist?

Why did Murray Rothbard embrace populism and why did he think it could work to limit the power of the state? In short, Rothbard believed that a small elite had seized the power of the state to fleece and oppress the majority. Rothbard was in part basing his ideas on the historical narrative of the Democratic populists of the nineteenth century who formed the party of sound money, low taxes, and decentralized power. This laissez-faire party also managed to win a lot...

Read More »What’s Going On, And Why Late August?

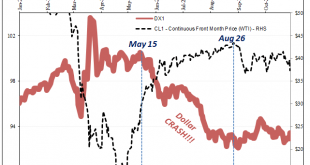

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here? What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below)....

Read More »Flying Blind: Clueless about Risk, We’re Speeding Toward Systemic Failure

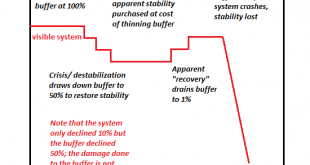

For all these reasons, the risks of systemic collapse are much higher than commonly anticipated. There’s an irony in discussing risk: since we all have an instinctive reaction to visible risk, we think we understand it. But alas, we don’t, especially when the risk is invisible and systemic. We even misjudge extremely visible risk. People routinely die rushing to save someone who foolishly waded into fast-moving water a few yards above a waterfall. The rescue is...

Read More »Making Sense Eurodollar University Episode 32 Part 2

Self-Reinforcing Self-Delusion of Econometric Models The world is complex. Too complex to model. Assumptions must be made. Is the exclusion of permanent shocks to the economy a reasonable one? Rational? Plausible? Acceptable? And yet econometricians -- with their hands on the wheel mind you -- say it is! That iceberg dead ahead? Not part of the model. Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, an innuendo. Artwork by the Unit Root, David...

Read More »FX Daily, October 28: Animal Spirits Called in Sick

Swiss Franc The Euro has fallen by 0.34% to 1.068 EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions. In 32 US states, hospitalizations have surged by over 10% in...

Read More »Should Covid be left to spread among the young and healthy?

© Dwfotos | Dreamstime.com Recent petitions from two groups of scientists clash over herd immunity. The Great Barrington Declaration On 4 October 2020, three public health experts launched the “Great Barrington Declaration”, a petition calling on governments to protect the vulnerable and allow the young and healthy to live their lives without restrictions. This group says it has grave concerns about the damaging physical and mental health impacts of the prevailing...

Read More » SNB & CHF

SNB & CHF