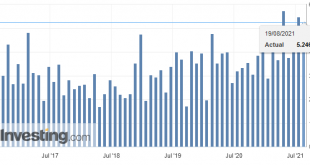

© Sudok1 | Dreamstime.com The latest figures on Covid-19 patients in intensive care in Swiss hospitals show a steep rise in numbers. On 18 August 2021, there were a reported 163 Covid-19 patients in intensive care wards across Switzerland. This number is far from the peaks of the first and second waves when ICU Covid-19 patient numbers exceeded 500, however the rise over the last month has been steep. On 18 July, there were fewer than 20 ICU Covid-19 patients. By 18...

Read More »Bretton Woods and the Spoliation of Europe

Having marked the quinquagenary of the destruction of the gold standard Sunday, August 15, it is natural to be a little nostalgic for the Bretton Woods system. After all, it might not have been the classical gold standard, but at least it wasn’t as bad as the fiat standard that succeeded it. As sites such as wtfhappenedin1971.com document, that year indeed looks to be a turning point in the economic history of the West. However, the suspension of convertibility of...

Read More »WaPo Editors: “Liberty” Requires Us to Implement Vaccine Passports

Mandating private and government employees to be immunized against covid-19 and requiring the use of standardized electronic passes as proof of immunization across the nation is what liberty is made of, the editors of the Washington Post argued last week. State governors such as Florida governor Ron DeSantis (R), who are blocking or attempting to block “government agencies, local businesses or both from mandating vaccination,” are engaged in “efforts that fly in the...

Read More »The Changing Role of Gold

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More »Swiss Trade Balance Q2 2021: secondary sector rose sharply in 2nd quarter 2021

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »Big Swiss companies obliged to report on climate risks from 2024

Firms will have to report on how they impact the climate, and how the climate impacts their bottom line. Keystone / Yaron Kaminsky From 2024, large Swiss firms will be legally bound to report on their climate-related risks. The government has now published guidelines on which companies and which risks will be involved. The rules will apply to public and private companies with over 500 employees, over CHF20 million ($21.9 million) or CHF40 million in annual...

Read More »The Smart Money Has Already Sold

Generations of punters have learned the hard way that their unwary greed is the tool the ‘Smart Money’ uses to separate them from their cash and capital. The game is as old as the stock market: the Smart Money recognizes the top is in, and in order to sell all their shares, they need to recruit bagholders to buy their shares and hold them all the way down. Once the catastrophic losses have been taken by the bagholders, then the Smart Money slowly builds up positions...

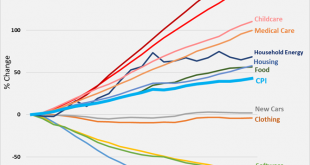

Read More »Two Percent Inflation Is a Lot Worse Than You Think

With June 2021 CPI growth being at a thirteen-year high, inflation has been on a lot of people’s minds lately. You can’t blame them, seeing as over 23 percent of all dollars in existence were created in 2020 alone. Although future inflation is certainly an important concern, in this article I instead focus on the chronic inflation this country has faced for over a century. Under normal circumstances, when most people think about inflation, they likely think of a...

Read More »Making Sense Eurodollar University Episode 95 Part 1

Inflation is a broad, sustained monetary phenomenon. Price deviations in a narrow set of economic sectors, though they last months, are just that: price deviations. Today's high CPI-readings will in all likelihood subsumed by the global monetary disorder, like in 2008 and 2011. Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Follow Twitter: https://twitter.com/JeffSnider_AIP Twitter: https://twitter.com/EmilKalinowski References There Is So...

Read More »Consolidative Mood Grips Markets

Overview: The dollar is consolidating yesterday's advance and is confined to fairly narrow ranges in quiet turnover. Most of the major currencies are within 0.1% of yesterday's close near midday in Europe. The $1.1700-level held in the euro. Most emerging market currencies have edged a little higher. Despite the largest fall in the US NASDAQ in three weeks and the largest fall in the S&P 500 in a month, the MSCI Asia Pacific Index rose for the first time in...

Read More » SNB & CHF

SNB & CHF