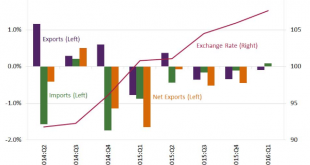

Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar’s appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP. It is clear that a strong dollar in this period was associated with a drag on growth from net...

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

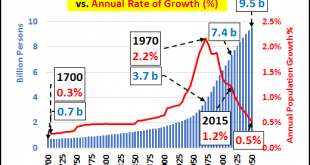

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

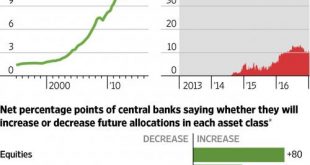

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

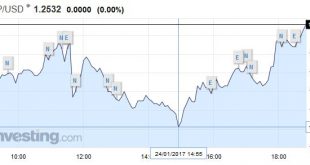

Read More »FX Daily, January 24: UK Supreme Court Requires May to Submit Bill on Brexit to Parliament

Swiss Franc EUR/CHF - Euro Swiss Franc, January 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Supreme Court ruling is finally upon us this morning which will determine whether or not UK Prime Minister Theresa May can invoke Article 50 to commence exit negotiations without as Act of Parliament. With so many political forces at work and a movement to keep Britain with as close ties as possible to...

Read More »The Trump Weak Dollar Report – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Currency Debasement Doesn’t Make Anyone Richer The action favored bettors this holiday-shortened week (Monday was Martin Luther King day in the US), with the price of gold up 13 bucks and silver up 26 cents. We noticed a worrisome remark by newly inaugurated President Trump. The strong dollar of the past 20 years, he...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »UK Supreme Court Decision: Anti-Climactic?

Summary: Sterling retreats on court ruling but key supports hold and it recoups initial loss. The US dollar is recovering with the help of firming US yields. Investors are still anxious for details of new US government’s tax, deregulation, and infrastructure investment plans. The UK Supreme Court will hand down its ruling tomorrow on the government’s appeal of a High Court decision that recognized the right of...

Read More »Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities. Even with a new and unconventional GOP president who vows to take on waste and overregulation,...

Read More »RTD Rewind: “The Dollar Is Failing” – Keith Weiner (Gold Standard Institute)

Subscribe and share the RTD Rewind to help others learn... Give it a thumbs up if you agree or down if you disagree? In this unseen RTD Rewind clip with Keith Weiner of the Gold Standard Institute, I ask him to share his thoughts on the future of the Federal Reserve Note (a.k.a Dollar). Listen to what he has to say and let us know your thoughts in the comment section? Watch the full interview and other great educational interviews on the future of the dollar at RTD UNIVERSITY. The best...

Read More »FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

Swiss Franc EUR/CHF - Euro Swiss Franc, January 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration’s economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European...

Read More » SNB & CHF

SNB & CHF