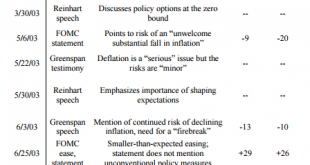

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More »All In The Curves

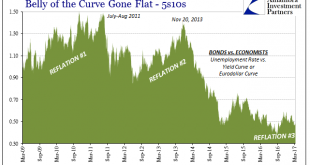

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December. Thus, despite two rate...

Read More »Switzerland’s economic prospects remain positive

Economic forecasts by the Federal Government’s Expert Group – spring 2017*. Swiss economic growth turned out disappointingly weak in the second half of 2016. However, the leading indicators are pointing to a clear upward trend in early 2017 and the global economy is sending out positive signals. The Federal Government’s Expert Group is therefore expecting growth in gross domestic product (GDP) to accelerate to +1.6% in...

Read More »FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

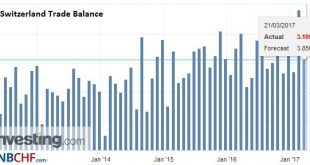

Swiss Franc Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The Swiss Franc continues to remain incredibly strong as it maintains its status as a safe haven currency in these uncertain economic times globally. The Swiss National Bank quarterly bulletin is released tomorrow afternoon at 14pm which is produced by the...

Read More »“People Need to Understand that their Biggest Asset is Individual Liberty” – an Interview with Claudio Grass

In his latest interview for the X22 Report, Claudio Grass shares his views on the future of the Euro, the Trump Presidency, the monetary system and the advantage of of owning gold in these times of global uncertainty. Preserving Liberty in a Difficult Time Claudio Grass, managing director at Global Gold As election season is upon us in Europe and political and economic tensions are heating up, Claudio Grass notes...

Read More »Technical vs. Fundamental Analysis – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Probabilistic Technical Analysis vs. the Mechanics of Arbitrage We talk about the supply and demand fundamentals every week. We were surprised to see an article about us this week. The writer thought that our technical analysis cannot see what is going on in the market. We don’t want to fight with people, we prefer to...

Read More »Swiss Trade Balance February 2017: imports “outperform” exports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners. On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to...

Read More »The Best Ways to Invest in Gold Today

The Best Ways to Invest in Gold Today – The cost of buying and selling gold – How to buy gold on the cheap – How to avoid paying capital gains tax (CGT) on your gold – Open an account with one of the online bullion dealers – the likes of GoldMoney, GoldCore or Bullion Vault – Gold Sovereigns and Gold Britannias make for a considerable saving on cost because of the CGT exemption Gold Britannias and Sovereigns are free...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the...

Read More » SNB & CHF

SNB & CHF