A day after Bridgewater Associates Founder Ray Dalio claimed that bitcoin was “definitely in a bubble” partly because he said the digital currency was too difficult to spend, CoinTelegraph is reporting that the first-ever bitcoin-only real-estate transaction has been completed in Texas. The transaction “illustrates crypto’s potential to transform how financial transactions are conducted,” according to Futurism.com. The...

Read More »Swiss Trade Balance August 2017: Dynamism of Imports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

Swiss Franc The Euro has risen by 0.17% to 1.1477 CHF. EUR/CHF and USD/CHF, September 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The market has mostly interpreted the Fed’s action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses...

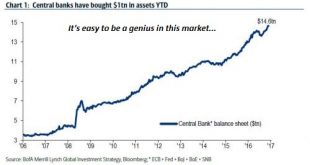

Read More »“This Is Where The Next Financial Crisis Will Come From” – Deutsche Bank

In an extensive, must-read report published on Monday by Deutsche Bank’s Jim Reid, the credit strategist unveiled an extensive analysis of the “Next Financial Crisis”, and specifically what may cause it, when it may happen, and how the world could respond assuming it still has means to counteract the next economic and financial crash.In our first take on the report yesterday, we showed one key aspect of the “crash”...

Read More »A Clear Anchor

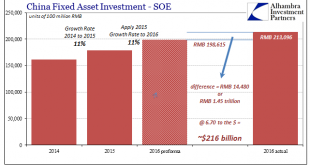

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE).By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP. It was about...

Read More »Boris Johnson Threatens To Resign If Theresa May “Goes Against His Brexit Demands”, Pound Rises

In confirmation that Theresa May’s upcoming Florence speech this Friday is not only what many have called “the most important day for Brexit since the referendum”, but also the most opaque, the Telegraph reports that UK Foreign Secretary Boris Johnson will resign as before the weekend if Theresa May veers towards a “Swiss-style” arrangement with the EU in her upcoming speech. The Foreign Secretary believes he will have...

Read More »Pourquoi l’accès à vos dépôts bancaires, épargnes et capital retraite est rendu difficile?

Les dépôts bancaires servent de base à l’activité bancaire classique. Réserves fractionnaires et autres créations monétaires bancaires privées vont prendre appui dessus. Qu’une part importante des clients retire ses dépôts et la banque s’écroule. Il est donc indispensable qu’on y touche le moins possible, spécialement quand votre confiance s’évapore…. Cela explique pourquoi, les « autorités » de toutes sortes légifèrent...

Read More »FX Daily, September 20: Shrinkage and Beyond

Swiss Franc The Euro has fallen by 0.01% to 1.1541 CHF. EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to...

Read More »Swiss Tourist Industry Wins Support from Parliament

Swiss hotel websites should be allowed to undercut prices offered by online booking platforms according to parliament (Keystone) A majority of parliament wants to restrict online reservation platforms in a bid to protect the Swiss hotel sector. The House of Representatives on Monday overwhelmingly approved a proposal and followed the Senate demanding that Swiss hotels will be allowed to offer lower prices for their...

Read More »Dear Jamie Dimon: Predict the Crash that Takes Down Your Produces-Nothing, Parasitic Bank and We’ll Listen to your Bitcoin “Prediction”

This is the begging-for-the-overthrow-of-a-corrupt-status-quo economy we have thanks to the Federal Reserve giving the J.P. Morgans and Jamie Dimons of the world the means to skim and scam the bottom 95%. Dear Jamie Dimon: quick quiz: which words/phrases are associated with you and your employer, J.P. Morgan? Looting, pillage, rapacious, exploitive, only saved from collapse by massive intervention by the Federal...

Read More » SNB & CHF

SNB & CHF