Interior Minister Alain Berset was more successful at convincing Swiss abroad of his reforms than those at home (Keystone) - Click to enlarge Unlike their compatriots in Switzerland, Swiss voters who live abroad came out massively in favour of a wide-ranging overhaul of Switzerland’s old-age pension scheme. Eleven of Switzerland’s 26 cantons count the votes of Swiss expats separately. An analysis of Sunday’s...

Read More »First autonomous transport service in Switzerland inaugurated

The shuttles were designed by French company Navya with an operating platform developed by Swiss firm Bestmile (Marc Striffeler/tpf) - Click to enlarge The launch of two autonomous shuttle buses in Fribourg on Friday marks the first time in Switzerland that such vehicles have been inducted into the regular transport network. The “self-driving” electric minibuses link the Marly Innovation Center (MIC) in the...

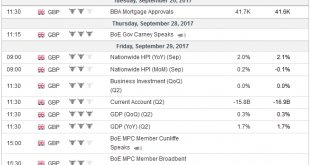

Read More »FX Weekly Preview: Old and New Drivers in the Week Ahead

Last week’s developments will continue to shape the investment climate in the week ahead, and at the same time, new inflation readings from the US, EMU, and Japan will add incrementally to investors’ information set. We do not expect the results of the German election to have much market impact. The most likely result is a strong signal of continuity with a return of the Grand Coalition. At the same time, French...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was mostly firmer on Friday, but capped off a week of broad-based losses. US rates gave back some of post-FOMC rise, and that weighed on the dollar. Not much in the way of US data until Friday’s core PCE reading and Chicago PMI. Stock Markets Emerging Markets, September 20 Source: economist.com - Click to enlarge Singapore Singapore reports August CPI Monday, which is expected to remain...

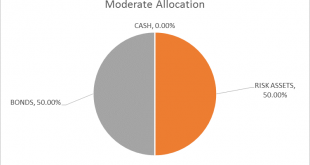

Read More »Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a...

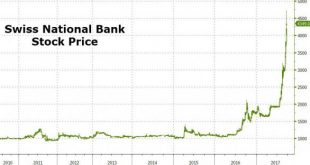

Read More »Is The Swiss National Bank A Fraud?

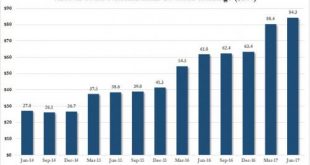

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. SNB Stock Price, 2010 - 2017(see more posts on Swiss National Bank Stock, ) - Click to enlarge That sounds like a ‘tulip’ bubble-like ‘fraud’… Bitcoin and SNB, 2013 - 2017(see more posts on Bitcoin, Swiss National Bank Stock, ) - Click to enlarge The SNB is up over 120% in Q3 so far – more than double...

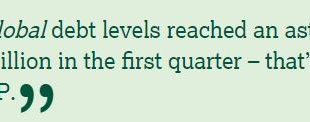

Read More »Gold Investment “Compelling” As Fed Likely To Create Next Recession

Gold Investment “Compelling” As Fed Likely To Create Next Recession – Is the Fed about to kill the business cycle? – 16 out of 19 rate-hike cycles in past 100 years ended in recession – Total global debt at all time high – see chart – Global debt is 327% of world GDP – ticking timebomb… – Gold has beaten the market (S&P 500) so far this century – Safe haven demand to increase on debt and equity risk – Gold looks...

Read More »Abe and BOJ

Summary: BOJ is unlikely to change policy. A snap election suggests continuity of policy. US 10-year yield remains one of most important drivers of the exchange rate. There is practically no chance that the BOJ changes policy. BOJ shares the common dilemma among major central banks. Growth is ok–above trend, which in Japan is seen as about 0.8%, but price pressures remain weak. The core rate in Japan, which...

Read More »India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last) Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More » SNB & CHF

SNB & CHF