The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

Swiss Franc The Euro has fallen by 0.03% to 1.1533 CHF. EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The EU’s leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The...

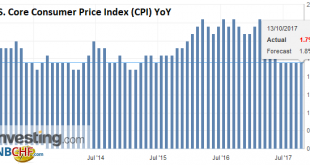

Read More »Dollar Dropped like Hot Potato After Core CPI Disappointed

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower. Retail sales were largely in line with expectations. The 1.6% headline increased missed expectations by 0.1%, which is exactly what the August series was...

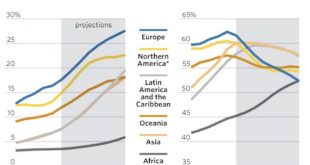

Read More »“This May Be The End Of Europe As We Know It”: The Pension Storm Is Coming

Authored by John Mauldin via MauldinEconomics.com, I’ve written a lot about US public pension funds lately. Many of them are underfunded and will never be able to pay workers the promised benefits – at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill. Readers outside the US might have felt safe reading those stories....

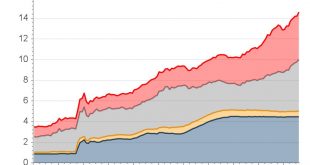

Read More »Global Outlook – Mad, Mad, Mad, MAD World: News in Charts

Global Outlook – Mad, Mad, Mad, MAD World: News in Charts by Fathom Consulting via Thomson Reuters Alarm bells are ringing for economic fundamentalists such as Fathom Consulting. Asset prices look increasingly out of step with fundamentals, and in some cases they look downright bubbly. And other geopolitical developments are similarly alarming. One might even describe them as… Central Bank Assets, 2007 - 2017 -...

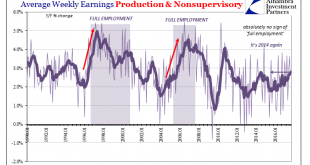

Read More »The Payroll Report To Focus On Is August’s, Not September’s

The hurricanes didn’t disappoint, causing major damage at least to the BLS. Precisely how much the statistics were affected by the disruptions in Texas and Florida really can’t be calculated, not that everyone won’t try. It makes this month’s payroll report a Rorschach test of sorts. You can pretty much make it out to be whatever you want. US Average Weekly Earnings, Jan 1990 - 2016(see more posts on U.S. Average...

Read More »Swiss Producer and Import Price Index in September 2017: +0.8 YoY, +0.5 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »Jeffrey Snider: Eurodollar University Part 2

Erik Townsend and Jeffrey Snider are back for Part 2 of the Eurodollar University. Erik and Jeffrey discuss the case of the missing money and the transformation of banking into a wholesale model. They look and the radical monetary evolution and put it into context in understanding the great inflation of the 1970s.

Read More »FX Daily, October 12: Discipline Argues Against Consensus Narrative

Swiss Franc The Euro has risen by 0.09% to 1.155 CHF. EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Following the release of the FOMC minutes from last month’s meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This...

Read More »The new 10 Swiss franc note hand mystery

The third in a series of gorgeous new Swiss franc bank notes will be released by the Swiss National Bank (SNB) on October 18th. The 10-franc note keeps its yellow colour, but most everything else in the design and construction is different. What’s most remarkable about the new bank note? Not the 40 centimes or so it takes to make each note, nor that each note is projected to last only about a year. Not the sophisticated...

Read More » SNB & CHF

SNB & CHF