Lessons to be Learned from East Asia

The world should take a lesson from how East Asia ran itself in 2020. Japan had no lockdown. None. With an aging population, its death rate has been creeping up for many years. In 2020, it fell by 0.7%, as if Covid-19 was a life-saver.

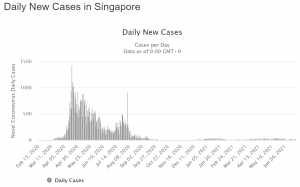

The Prime Minister of Singapore repeatedly appeared on TV to advise people to live normally and not let fear dominate. Taiwan had a total of 623 Covid-19 related deaths [ed. note: there were only 12 until mid-May; in the past few weeks there was a large spike]. Competent bureaucrats in South Korea organized a system to rapidly isolate those with the illness and never had to impose much of a lockdown. The same was the case in Hong Kong.

Maybe China is responsible for starting Covid-19, or perhaps

Articles by Jayant Bhandari

COVID in India

May 26, 2021India’s experience with the COVID pandemic was particularly unpleasant… [PT] – Click to enlarge

Scavengers Out in Full Force

I have just returned from a visit to my family in India. It was hard to escape. To get to the US from India, I needed a COVID test. The Indian government has seriously restricted who can provide COVID testing, treatment, and vaccination. Private doctors and hospitals that are not approved face brutal legal consequences if they provide COVID treatment.

Emergency powers were centralized early last year in the hands of the Indian Prime Minister, Narendra Modi. He gave himself direct control over the bureaucrats of the states, making local governments largely impotent and dependent on him.

Getting vaccinated, the Indian way.

Read More »The Decline of the Third World

June 23, 2020A Failure to Integrate Values

The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West.

Famous Greek philosophers: their thoughts are a cornerstone of Western culture. [PT]Western culture, which developed organically over at least the two and half millennia, starting from Greco-Roman philosophers, is not easy to duplicate. This culture requires thrift, honesty, hard work, liberty, individuality, dispassionate reason, objective justice, loyalty, honor, stoicism, a desire to rise

Purchasing Power Parity or Nominal Exchange Rates?

March 3, 2018Extracting Meaning from PPP

“An alternative exchange rate – the purchasing power parity (PPP) conversion factor – is preferred because it reflects differences in price levels for both tradable and non-tradable goods and services and therefore provides a more meaningful comparison of real output.” – the World Bank

Headquarters of the World Bank in Washington. – Click to enlarge

We have it on good authority that the business of ending poverty is quite lucrative for its practitioners (not least because employees of multilateral organizations such as the IMF and the World bank have to pay no taxes whatsoever on their income – and the perks certainly don’t end there). A number of long-serving employees of the

Japan: It isn’t What the Media Tell You

December 1, 2017Known for Being Terrible

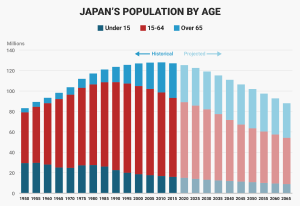

For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics.

Japan’s Population by age, 1950 – 2065A chart of Japan’s much-bewailed demographic horror-show. – Click to enlarge

Most people consider a declining population to be a bad thing due to the implications for assorted state-run pay-as-you-go Ponzi schemes, primarily those related to retirement. It is hard to be sympathetic, since it would have been possible to do something completely different from the outset. Even with respect to existing schemes, we don’t recall that anyone forced politicians to direct funds designated for funding social security

Marc Faber, Freedom of Speech & Capitalism

October 27, 2017Political Correctness Hampers Honest Debate

What would the world be like today had Europeans never colonized Americas, Africa, the Middle East, Australia, New Zealand, and South Asia?

Most of these societies would still not have discovered the wheel. It takes a huge amount of reality-avoidance and ineptitude for outsiders who travel there not to realize that a billion or more people in the Third World still wouldn’t have discovered the wheel. There is absolutely no evidence to suggest that the Third World would have independently found, discovered, or invented even a fraction — if any at all — of the sciences and technologies that exist today.

[embedded content]

Jayant speaks about Democracy, Welfare and Migration:

India: The Genie of Lawlessness is out of the Bottle

September 24, 2017Recapitulation (Part XVI, the Last)

Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all tyrants from the map, and eventually from people’s memory.

Photo via patrika.com – Click to enlarge

According to the Global Slavery Index, an estimated 18 million Indians, equivalent to half the total population of Canada, are bonded, modern slaves.

My interest has been mostly to use these events to

The Myth of India’s Information Technology Industry

July 28, 2017A Shift in Perception – Indians in Silicon Valley

When I was studying in the UK in early 90s, I was often asked about cows, elephants and snake-charmers on the roads in India. A shift in public perception— not in the associated reality — was however starting to happen. India would soon become known for its vibran

As more IT graduates from India moved to the US to work, they lobbied to change how India was viewed, not because India had actually changed or because they cared for India, but because from their tribal perspective, this reflected well on them. This process went hand in hand with the emerging trend toward political correctness in the West — people in the West became keen to exaggerate the successes of

India: The Lunatics Have Taken Over the Asylum

July 22, 2017Goods and Services Tax, and Gold (Part XV)

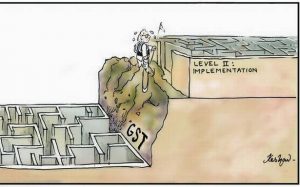

Below is a scene from anti-GST protests by traders in the Indian city of Surat. On 1st July 2017, India changed the way it imposes indirect taxes. As a result, there has been massive chaos around the country. Many businesses are closed for they don’t know what taxes apply to them, or how to do the paperwork. Factories are shut, and businesses are protesting.

[embedded content]

Increases in administrative costs have made economics of trading and manufacturing unfavorable for many. Most lack access to accounting and IT skills to implement the new system — India simply does not have that many skilled people. As many as half of all transportation trucks are not operating. The

India: Why its Attempt to Go Digital Will Fail

May 25, 2017India Reverts to its Irrational, Tribal Normal (Part XIII)

Over the three years in which Narendra Modi has been in power, his support base has continued to increase. Indian institutions — including the courts and the media — now toe his line.

The President, otherwise a ceremonial rubber-stamp post, but the last obstacle keeping Modi from implementing a police state, comes up for re-election by a vote of the legislative houses in July 2017. No one should be surprised if a Hindu fanatic is made the next President. India is rapidly entering a new phase.

Modi, a major world-traveler, who has run around quite a bit to please foreign governments and win the support of identity-lacking non-resident Indians, is no longer

India – Is Kashmir Gone?

April 21, 2017Everything Gets Worse (Part XII) – Pakistan vs. India

After 70 years of so-called independence, one has to be a professional victim not to look within oneself for the reasons for starvation, unnatural deaths, utter backwardness, drudgery, disease, and misery in India.

Intellectual capital accumulated in the West over the last 2,500 years — available for free in real-time via the internet — can be downloaded by a passionate learner. In the age of modern technology, another mostly free gift from the West which has significantly leveled the playing field, societies that wanted economic convergence with the West, such as Japan, Korea, Singapore, HK, China, etc., have either achieved it rapidly, or have strongly trended toward it.

More than 28,000 children less than six years of age have died in just one province, Madhya Pradesh, over the past year. Because these deaths were due to diseases resulting from malnourishment, the government attributed every single death to disease rather than malnourishment. Photo credit: Hemender Sharma, India Today – Click to enlarge

Given that Indian prime minister Narendra Modi has been at the helm for only three years, it is hard to blame him in general for any of the above mentioned monstrosities marring daily life in India.

India: The next Pakistan?

March 29, 2017India’s Rapid Degradation

This is Part XI of a series of articles (the most recent of which is linked here) in which I have provided regular updates on what started as the demonetization of 86% of India’s currency. The story of demonetization and the ensuing developments were merely a vehicle for me to explore Indian institutions, culture and society.

Tribal cultures face an inherent contradiction. They create poison from within to grow more collectivist, controlling and tyrannical — members of the populace looks for nannies, and they readily find sociopaths to exploit that need. Their lack of organizational skills, their inability to engage in economic calculation and their irrationality lead to massive internal stresses and the ultimate devolution of such an unnatural society.

India finds itself in a situation where it is grasping for more totalitarianism to solve the problems that totalitarianism created. The demonetization exercise was an assertion of India’s underlying tribal and collectivist culture.

The Modimobile is making the rounds amid a flower shower. [PT] Photo credit: PTI Photo – Click to enlarge

Demonetization Pain Continues

Cashless ATMs continue to be the new normal in India.

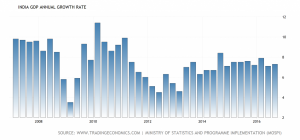

India: The World’s Fastest Growing Large Economy?

February 5, 2017Popular Narrative

India has been the world’s favorite country for the last three years. It is believed to have superseded China as the world’s fastest growing large economy. India is expected to grow at 7.5%. Compare that to the mere 6.3% growth that China has “fallen” to.

The IMF, the World Bank, and the international media have celebrated this event. Declining commodity prices and other problems in Russia, Brazil and South Africa have damaged the prospects of the BRICs (ex-India) and other emerging markets.

Commodity and currency markets have been very turbulent, and the Arab Spring has not only failed to keep up its pace, it has half-destroyed the Middle East, with fires raging in Syria, Turkey, Libya, etc. Migrant problems in Europe and the uncertain future of the US — as per the current narrative — leave India as the prime candidate to prop up global economic growth.

India GDP Annual Growth Rate 2008 – 2016India’s quarterly annualized GDP growth rate since 2008, according to MOSPI (statistics ministry) – Click to enlarge

It seems to be deeply emotionally satisfying to finally see the world’s largest democracy supersede the “communist dictatorship” of China. India’s GDP has also just surpassed that of the UK, its former colonial master.

Modi’s Great Leap Forward

January 2, 2017India’s Currency Ban – Part VIII

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, Part-V, Part-VI and Part-VII, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

India’s Pride and Joy

So-called educated Indians have latched on to the above visual, with full support of the Indian government. It has been shared far and wide in the national media. When you remind them that India’s population is twenty-one times that of the UK and on top of that, the British pound has taken a huge pounding because of Brexit and associated fear in the financial markets, expect to be ignored. You will be seen as anti-Indian.

Given the underlying irrationality and tribalism of India (read earlier updates for more on this), selected numbers are used to rationalize feelings and emotions. You see this everywhere in India: Science — very ironically — is used as a tool to rationalize superstitions and irrationalities.

India’s Rapid Progression Toward a Police State

December 30, 2016India’s Currency Ban – Part VI

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, and Part-V, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

There are undoubtedly many differences between the two gentlemen depicted above, but both appear to have mastered the age-old trick of extending one’s grip on political power by inflicting chaos. – Click to enlarge – Click to enlarge

As the deadline of 31st December 2016 approaches, Gresham’s law has been turned upside down. When they needed to be converted, the banned currency notes were trading for a 20% discount to their face value. In the meantime, the discount has disappeared and the banned notes are trading at a premium of 10%. The mafia which deals in the banned notes could not possibly be happier — it promises to be a big supporter of Modi going forward.

[embedded content]

See if you can spot a rich person here.

Modi’s Fantastic Promises

December 24, 2016India’s Currency Ban, Part VII

This article continues right where Part VI left off (for earlier updates on the demonetization saga see Part-I, Part-II, Part-III, Part-IV, and Part-V).

There is still huge support for Modi even among the poor. A big carrot is dangled before them, which makes many stay numb to their current suffering. During his election campaign in 2014, Modi promised to deposit more than Rs 1.5 million (~$22,000) in each poor person’s account once the government had seized all black money.

How he arrived at this fantastic figure is anyone’s guess. But given India’s GDP of $1,718 per capita, Modi has promised to deposit 1,300% of annual GDP in individual bank accounts. The total amount would be larger than the entire GDP of the US. Evidently, this does not even remotely add up.

Massive problems have been reported with the new bills. Some have been printed on defective paper and are simply falling apart. The inferior quality of the print job is generally often on the appalling side of deplorable. The new notes are counterfeited with great abandon, quite likely to a much greater extent than they ever were in the past. So much for Modi’s plan to stop counterfeiting.

Read More »Gold Price Skyrockets in India after Currency Ban – Part V

December 6, 2016A Brief Recap

India’s Prime Minister announced on 8th November 2016 that Rs 500 and Rs 1,000 banknotes will no longer be legal tender. Linked are Part-I, Part-II, Part-III, and Part-IV, which provide updates on the rapidly encroaching police state.

Expect a continuation of new social engineering notifications, each sabotaging wealth-creation, confiscating people’s wealth, and tyrannizing those who refuse to be a part of the herd, in the process destroying the very backbone of the economy and civilization.

There are clear signs that in a very convoluted way, possession of gold for investment purposes will be made illegal. Expect capital controls to follow. Chaos from people’s inability to access the money in their bank accounts is now spreading to the people who have so far been unaffected: the middle class.

This is a completely unnecessary man-made disaster, with the single aim of glorifying Narendra Modi.

Indian prime minister Narendra Modi

Photo credit: Reuters – Click to enlarge

Fracturing Institutions

Several petitions in various courts across India were immediately filed against the central bank, the Reserve Bank of India (RBI), for repudiating its IOU obligation which the currency bills represent, after Modi’s announcement on 8th November.

Gold Price Skyrockets in India after Currency Ban – Part IV

December 3, 2016A Market Gripped by Fear

The Indian Prime Minister announced on 8th November 2016 that Rs 500 and Rs 1,000 banknotes would no longer be legal tender. Linked are Part-I, Part-II and Part-III updates on the rapidly encroaching police state.

The economic and social mess that Modi has created is unprecedented. It will go down in history as an epitome of naivety and arrogance due to Modi’s self-centered desire to increase tax-collection at any cost.

Fear has gripped the bullion market, for one is deemed to be guilty until proven otherwise. People with perfectly legal cash are afraid of cameras recording their purchases and having to pay outrageous bribes. After an adjustment period people will buy more — not less — gold. For now, the gold market has gone mostly underground with the gold price hovering around US$1,700 per ounce. Did Modi want to boost the informal economy?

Indian jewelry merchant

Photo via indiatimes.com – Click to enlarge

The Cultural and Political Undercurrent

The individual has been reduced to a cog in a big machine that exists in Modi’s imagination. The country is expected to rally behind him, for his glory.

Gold Price Skyrockets in India after Currency Ban – Part III

November 26, 2016When Money Dies

In part-I of the dispatch we talked about what happened during the first two days after Indian Prime Minister, Narendra Modi banned Rs 500 and Rs 1000 banknotes, comprising of 88% of the monetary value of cash in circulation. In part-II, we talked about the scenes, chaos, desperation, and massive loss of productive capacity that this ban had led to over the next few days.

Indian prime minister Narendra Modi – another finger-wagger, as can be seen in this photograph. Beware finger-wagging politicians, as we always point out. Modi now plans to impose income tax penalties on large bank deposits; the State’s rapaciousness knows no bounds and evidently the mere possession of some arbitrary amount of money considered “too large” now means one is deemed a criminal a priori in India. It goes without saying that the concept of property rights is alien to Modi. [PT]

Photo via indianexpress.com – Click to enlarge

Now, two weeks later, the situation is getting much worse, and more desperate. It is obvious that Modi single-handedly took the decision to ban the banknotes, with most people in his cabinet and virtually all in the central bank oblivious to his plan.

Gold Price Skyrockets in India after Currency Ban – Part II

November 16, 2016India’s prime minister Nahendra Modi, author of the recent overnight currency ban

Photo credit: indiatimes.com – Click to enlarge

Chaos in the Wake of the Ban

Here is a link to Part 1, about what happened in the first two days after India’s government made Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes illegal. They can now only be converted to Rs 100 (~$1.50) or lower denomination notes, at bank branches or post offices. Banks were closed the first day after the decision. What follows is the crux of what has happened over the subsequent four days.

Today India is on the verge of a major social-political crisis, unless either the government backs off from the decision of banning the currency or some real magic happens. There is chaos in the streets and daily life is slowly but surely coming to a full halt.

What Modi did was not only heavy-handed, hugely arrogant, and of no value, it has been very badly implemented to boot — as everything in India always is — and carries the real potential of escalating and snowballing into something horrific. They could have seen that this was not going to end well by simply using primary school math.

Gold Price Skyrockets in India after Currency Ban

November 10, 2016India’s Government Makes Banknotes Worthless by Decree Overnight

As I write this in the morning of 9th November 2016, there are huge lines forming outside gold shops in India — and gold traded heavily until late into the night yesterday. Depending on who you ask, the retail price of gold has gone up between 15% and 20% within the last 10 hours.

At some places, it was sold for as much as US$ 2,294 per ounce. That is, if you can actually find physical gold — gold inventories at stores are rapidly depleting. All of this happened well before the international price started to move up because of the election results coming out of the US.

Last night (8th November 2016), India’s government banned the use of Rs 500 (~$7.50) and Rs 1,000 ($15) banknotes. This pretty much made most currency-in-use illegal. Banks and ATMs are closed today. The government believes that doing this will help eradicate corruption and push counterfeit money out of circulation. According to the Indian government, the counterfeit money tends to come from Pakistan and helps finance terrorism.

Gold quotes in India – gold traded for as much as Rs 49,000 per 10 grams or US$ 2,294 per ounce – Click to enlarge

My first instinct when I heard the news was that people would be on the streets this morning.

Gold Trends: The Myth of Leverage

August 23, 2016Mining Stocks, Gold Prices and Commodity Price Trends

Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much below its cost of production. Moreover, depending on the jurisdiction, owning gold might have resulted in lower (or no) tax liabilities.

I am often amused when investors talk about leverage that mining equities offer— a large proportion of investors in the mining sector are driven by this, a sort of casino mentality. As experience over the last 16 years shows, leverage has been a myth and has actually been negative. In their chase for leverage, investors missed out on value-investing and profiting from wealth-creation. Let’s dissect this.

South Deep gold mine in South Africa Photo via mining.com – click to enlarge.

As you can see in the following three graphs, there is often a very close correlation between the prices of commodities.

Energy and Fertilizer Prices

Energy and fertilizer prices – click to enlarge.

Gold vs.

Read More »Gold and Brexit

June 20, 2016Summary

The pain of negative yields and social chaos will be very long lasting and very good for gold. So, gold must go up, but Brexit is not one of the reasons why it should.

This tells me that in the short term there will likely be a correction in the gold price, creating an opportunity to trade

Going Up for the Wrong Reason

Gold is soaring. It should—and a lot—but in my view not for the reason it is. Indeed gold is insurance for uncertain times, a time that Brexit seems to represent. But insurance is an administrative cost — one must minimize its use.

Moreover, insuring against Brexit might ironically be equivalent to insuring against a good event.

The market believes that Brexit will lead to wealth-destruction (based on its statist views, in which those running our institutions are omniscient, when they actually are quite naive, incompetent, and incapable of understanding the concept of complexity).

Austrian Economics knows (“knows” because Austrian Economics is the only real economics) that Brexit will actually aid wealth-creation, by reducing the impact of European bureaucracy on the UK.

August gold contract, daily – gold has been strong of late, but this seems to be driven by “Brexit” fears – click to enlarge.

Brexit will also enable more control over migration into the UK.