According to the Modern Monetary Theory (MMT), money is something decided by the state. The MMT regards money as a token. For instance, when an individual places a coat in the cloakroom of a theater, he receives a tin disc or a paper receipt. This receipt or a disc is a proof that the individual is entitled to demand the return of his coat.According to the MMT, the material used to manufacture the tokens is irrelevant—it can be gold, silver, or any other metal or it can even be paper. Hence, the definition of money, according to the MMT, is what the state decides it is going to be. MMT posits that the value of money is the outcome of the state that forces people to pay taxes with the money tokens that the state has decided upon. The state taxes have to be paid

Read More »Articles by Frank Shostak

The Relevance of the Natural Sciences Methods in Economics

December 18, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Subjective Valuation Versus Arbitrary Valuation

December 15, 2024Many assume an individual’s valuation scale, which is in his head, determines his choices. The decision to buy or not to buy a particular good is subjective valuation. Since the buying of goods is not linked to any particular goal, this buying is of a random nature. From this it may appear that subjective valuations are of an arbitrary nature. But is this the case?According to Murray Rothbard, valuations do not exist independently. Valuations are not even primarily about the “things” valued. Valuation is the outcome of the mind valuing things. It is a relation between the mind and things. According to Carl Menger, an individual ranks goods in accordance to the importance of serving a given subjective goal. Various ends that an individual finds important in a

Read More »Assumptions in Economics and in the Real World

December 15, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »The Keynesian Liquidity Trap Fable

December 9, 2024Many economists wrongly assume economic activity is accurately presented as a circular flow of money. Spending by one individual becomes part of the earnings of another individual; spending by another individual becomes part of the first individual’s earnings. Assuming this, recessions are because individuals—for whatever psychological reasons—have decided to cut down on their expenditure and raise their savings.For instance, if some individuals have become less confident about the future, they are likely to lower their outlays and “hoard” (save) more money. Therefore, once individuals spend less, this will necessarily worsen the situation of some other individual, who, in turn, also cuts his spending. A vicious cycle, therefore, sets in—the decline in an

Read More »Does the Fed’s Lowering the Interest Rates Strengthen Economic Growth?

December 3, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »The “Price Stability” Myth Undermines Our Economy and Well-Being

December 2, 2024For most commentators, a “stable price level” is the key for economic stability. For instance, let us say that there is a relative increase in consumer demand for potatoes versus tomatoes. This relative increase is depicted, all things being equal, by the relative increase in the price of potatoes. To be successful, businesses must pay attention to consumer demand. Failing to do so is likely to lead to losses. Hence, by paying attention to relative changes in prices, producers are likely to increase the production of potatoes versus tomatoes.According to many economists, if the “price level” is not “stable,” then the visibility of the relative price changes becomes blurred and, consequently, businesses cannot ascertain the relative changes in the demand for goods

Read More »Who Sets the Prices for Goods?

December 1, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Could an Increase in the Supply of Gold Cause a Boom-Bust Cycle?

November 25, 2024According to the Austrian Business Cycle Theory (ABCT), the artificial increase in the money supply via central bank expansionary monetary policy lowers the market interest rate. This, in turn, causes the market interest rate to deviate from the natural rate, determined by the market. Consequently, this leads to the boom-bust cycle. Understanding this, on the gold standard, where money is gold and—assuming that there is no central bank—an increase in the supply of gold will also result in the lowering of the market interest rates.This would cause a deviation of the market interest rates from the previous interest rate. Consequently, this is going to set in motion a boom-bust cycle. This means that even on the gold standard, without the central bank, we could still

Read More »The Relevance of the Natural Sciences Methods in Economics

November 18, 2024Popular understandings of economics often attempt to incorporate the methodology of natural sciences as the supposed key to economics. Some economic experts are of the view that the methods employed by the natural sciences, such as advanced mathematics, are important tools for the assessments of historical data to establish the state of an economy. It is also believed that the knowledge secured from the assessment of the empirical data is likely to be tentative since it is not possible to know the true nature of reality. Thinkers such as Milton Friedman held that the best approach to comprehend this elusive reality is to build a model that could generate accurate forecasts.For instance, an economist forms a view that consumer outlays on goods and services are

Read More »Assumptions in Economics and in the Real World

November 11, 2024Assumptions that some economists are employing in their theories appear to be detached from the real world. For example, in order to explain the economic crisis in Japan, Paul Krugman employed a theory based on the assumptions that people are identical and live forever. Whilst admitting that these assumptions are not realistic, Krugman nonetheless is of the view that somehow his theory could be useful in offering solutions to the economic crisis in Japan. Thus, Krugman wrote,The purpose of this paper is to demonstrate possibilities and clarify thinking, rather than to be realistic…. In this model individuals are identical and live forever, so that there are no realistic complications involving distribution within or between generations; output is simply given.If

Read More »Does the Central Bank Determine Interest Rates?

October 14, 2024Most experts agree that, through the manipulation of the short-term interest rates, the central bank can also determine the direction of the long-term interest rates. Some popular thinking alleges that the long-term interest rates are the average of the present and the expected short-term interest rates. Hence, it would appear that the central bank is the key in determining the interest rates. But is this valid?Individual time preferences and interest ratesAccording to thinkers such as Carl Menger and Ludwig von Mises, interest is the outcome of the fact that individuals assign a premium to present goods against identical goods in the future (i.e., time preference). The preference is not the result of capricious behavior but because life in the future is not

Read More »Does Technical Knowledge by Itself Drive Economic Growth?

October 11, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »The Keynesian Multiplier Fairy Tale

October 7, 2024Many incorrectly assume that the overall economy’s output increases by a multiple of the increase in expenditure by government, consumers, and businesses. For instance, if out of an additional dollar received individuals spend $0.90 and save $0.10, then if consumers spending were to increase by $100 million, it is held that the overall output in the economy is going to increase by the tenfold of the increase in consumers’ expenditure (i.e. by $1 billion). The following example provides the reasoning behind this way of thinking.Because of the increase in consumers’ expenditure by $100 million, retailers’ income increases by $100 million. Retailers, in response to the increase in their income, likewise spend 90% of the $100 million (i.e., they raise expenditure on

Read More »The Present Monetary System Is Heading for a Breakdown

September 30, 2024Many economists incorrectly assume a growing economy also requires a growing money stock, assuming that economic growth gives rise to a greater demand for money. It is held that failing to increase money to facilitate increased trade will lead to a decline in prices of goods and services, destabilizing the economy and leading to an economic downturn.Some commentators believe that the lack of a flexible mechanism coordinating demand versus the money supply is the major reason why the gold standard leads to instability. The idea is that, relative to the growing demand for money because of growing economies, the supply of gold does not grow fast enough. Thus, to prevent economic shocks from imbalances between the demand and the supply of money, the Fed must make sure

Read More »Does Technical Knowledge by Itself Drive Economic Growth?

September 24, 2024Some have argued that new technological ideas, unlike material inputs and labor, are not in themselves scarce. Consequently, it is further argued that new ideas for more efficient processes and new products can make continuous economic growth possible. So-called experts, however, are of the view that in a fully competitive environment, firms are likely to be concerned that competitors are going to copy any innovations they introduce. Therefore, it is alleged that firms are likely to become reluctant to make costly investments in research and development.To deal with this problem, “experts” believe that it is necessary to introduce policies, such as subsidies, for research and development. Hence, it is concluded that government policies play a critical role in

Read More »The Fable of the Economic “Soft Landing”

September 4, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »The Regime’s War on Cash Could Destroy the Economy

September 3, 2024According to some “experts,” there is an urgent need to remove cash from the economy. It is held that cash provides support to the “shadow economy” and permits tax evasion. Another justification for its removal is that, in times of economic shocks, which push the economy into a recession, the run for cash exacerbates the downturn—it becomes a factor contributing to economic instability. Moreover, it is argued that, in the modern world, most transactions can be settled by means of electronic funds transfer. Money in the modern world is allegedly an abstraction.The emergence of moneyMoney emerged because barter could not support the market economy. A butcher, who wanted to exchange his meat for fruit, might not be able to find a fruit farmer who wanted his meat,

Read More »The Fable of the Economic “Soft Landing”

August 26, 2024According to some commentators, to counter inflation interest rates in the US must increase to a level that effectively restrains the economy. It is held that this increase in interest rates does not have to cause a recession if Fed’s policy makers could orchestrate a “soft landing.” The economy is portrayed as a spaceship that occasionally deviates from a path of “stable” economic growth and “stable” prices. All that is required to fix the problem is for the central bank to give a suitable “push” to the economy (i.e., the spaceship) to bring it back to the right growth path.Thus, if the economy falls into a recession, the central bank is expected to bring it onto the “stable” growth path by artificially lowering interest rates. Conversely, if the economy appears

Read More »The Fed is warping the shape of the yield curve

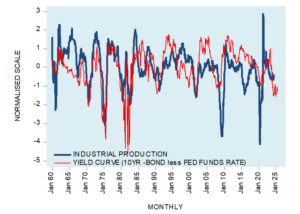

August 9, 2024Many commentators consider the spread between the long-term interest rate and the short-term interest rate as an important indicator to establish the future course of economic activity. An increase in the spread is seen as pointing toward good economic times ahead. Conversely, a declining spread raises the likelihood of an economic recession.Historically, in the U.S., the differential between the yield on the 10-year T-bill and the federal funds rate was leading the yearly growth rate of industrial production by 12 months (see Figure 1).Figure 1: Year-over-year U.S. industrial production versus 12-month yield curve lag (%)Source: Federal Reserve Bank of St. Louis (FRED)A popular explanation for the determination of the shape of the yield spread is provided by

Read More »Government regulation of competitive firms creates monopolies

July 28, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Government regulation of competitive firms creates monopolies

July 19, 2024Monopolies are believed to undermine individuals’ well-being, including being the cause of large increases in the prices of goods and services. According to Jean Tirole, the 2014 Nobel winner in economics, monopolies undermine the efficient functioning of the market economy by influencing the prices and the quantity of products, making consumers worse off.

Thus, monopolies supposedly cause market conditions to deviate from the ideal state of “perfect competition.” Effective enforcement of government regulations, then, is needed to control monopolies. Tirole has devised methods to strengthen the regulation of industries dominated by a few large firms.

The ‘perfect competition’ model

In the world of perfect competition, the following features characterize a market:

The Collapse of Real Savings Caused the Great Depression

July 12, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Does Increasing the Money Supply also Increase Economic Growth?

June 18, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »What Causes Stagflation?

June 10, 2024In the late 1960s Edmund Phelps and Milton Friedman challenged the popular view that there can be a sustainable trade-off between inflation and unemployment. In fact, over time, according to PF, loose central bank policies set the platform for lower economic growth and a higher rate of inflation, or stagflation.PF’s Explanation of StagflationStarting from a situation of equality between the current and the expected rate of inflation, the central bank decides to boost the rate of economic growth by raising the growth rate of money supply. As a result, a greater supply of money enters the economy and each individual now has more money at his disposal.Because of this increase, every individual believes he has become wealthier. This raises the demand for goods and

Read More »Does Increasing the Money Supply also Increase Economic Growth?

June 3, 2024Many economic commentators believe increasing the quantity of money can revive an economy. This is based on the view that with more money in their pockets, people will spend more and others follow suit, as they hold that money is a mere means of payments.Money, however, is not the means of payments but rather a medium of exchange. It only enables one producer to exchange his product for the product of another producer. According to Murray Rothbard, “Money, per se, cannot be consumed and cannot be used directly as a producers’ good in the productive process. Money per se is therefore unproductive; it is dead stock and produces nothing.” The means of payments are always goods and services, which pay for other goods and services. Money simply facilitates these

Read More »Can Data by Itself Inform Us about the Real World?

May 27, 2024In order to make the data “talk,” economists utilize a range of statistical methods that vary from highly complex models to a simple display of historical data. It is generally believed that one can organize historical data through quantitative methods into a useful body of information, which in turn can serve as the basis for assessing the economy.Now, it has been observed that declines in the unemployment rate are associated with a general rise in the prices of goods and services. Should we then conclude that decreases in the unemployment rate trigger price inflation? To confuse the issue further, it has also been observed that price inflation is well-correlated with changes in money supply.What are we to make out of all this? How are we to decide which is the

Read More »Lending without Saving Brings Recession and Poverty

May 23, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »What Is the Purpose of Economic Theory?

May 7, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Free-Market Profit Comes From Voluntary Exchange, not Exploitation

May 2, 2024In our modern political culture, many people claim that profits are the outcome of some individuals exploiting other individuals. Hence, anyone who is seen trying to make profits is regarded as an enemy of society and must be stopped before inflicting damage. According to Henry Hazlitt, “The indignation shown by many people today at the mention of the very word profits indicates how little understanding there is of the vital function that profits play in our economy.”Furthermore, Hazlitt held,In a free economy, in which wages, costs and prices are left to the free play of the competitive market, the prospect of profits decides what articles will be made, and in what quantities—and what articles will not be made at all. If there is no profit in making an article,

Read More »