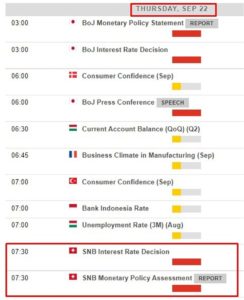

1730 GMT/1230 US Eastern time: Speech by member of the board of the Swiss National Bank Petra Tschudin and Thomas Moser, "The Swiss Repo Market: 25 Years of Success for the Financial Centre and the National Bank", Money Market EventPetra Tschudin is the a member of the Governing Board of the Swiss National Bankalso Head of Department III (Money Market and Foreign Exchange, Asset Management, Banking Operations and Information Technology, as well as the Singapore branch office) in ZurichThomas Moser is an Alternate Member of the Governing Board of the Swiss National Bank.[embedded content]

Tags: central-banks,Featured,newsletter

Read More »