While we are revising up our forecast for GDP growth this year, we expect the Bank of Japan will continue with its qualitative and quantitative easing policies.Japan’s GDP grew by 1.6% year-over-year in Q1 in real terms. On a quarter-over-quarter basis, the economy expanded by 2.2% annualised, the highest growth rate since Q1 2016. In light of the stronger-than-expected Q1 figure, we have decided to revise up our 2017 GDP growth forecast for Japan to 1.3% from 0.8% previously.Exports continued to be one of the key drivers of growth in the first quarter of 2017. Net exports contributed 0.6 percentage points to the 2.2% headline growth. Private consumption also grew solidly in Q1, mostly driven by the rise in durable goods such as motor vehicles.Looking ahead, we expect the Japanese economy to continue its moderate recovery for the rest of 2017 and to record 1.3% GDP over the year as a whole, although growth rates may ease in the near term.On the policy front, however, we do not expect the Bank of Japan (BoJ) to change its policy stance in the short term despite the stronger-than-expected growth picture. Crucially, the BoJ’s monetary policies hinge on the observed rate of inflation, which is still far below its 2% target. What inflation there is comes mainly from external factors such as the rebound in global commodity prices (oil prices in particular) and yen weakening.

Topics:

Dong Chen considers the following as important: Bank of Japan policy, Japan GDP, Japanese growth, Japanese inflation, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While we are revising up our forecast for GDP growth this year, we expect the Bank of Japan will continue with its qualitative and quantitative easing policies.

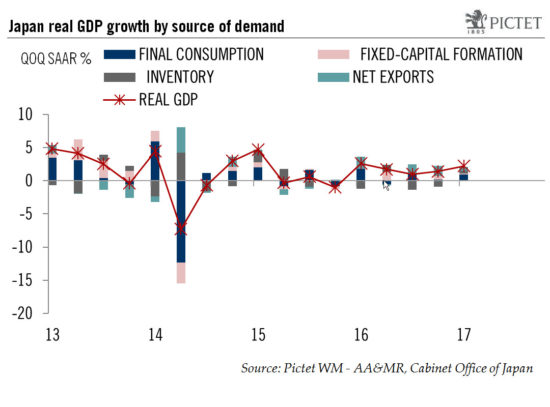

Japan’s GDP grew by 1.6% year-over-year in Q1 in real terms. On a quarter-over-quarter basis, the economy expanded by 2.2% annualised, the highest growth rate since Q1 2016. In light of the stronger-than-expected Q1 figure, we have decided to revise up our 2017 GDP growth forecast for Japan to 1.3% from 0.8% previously.

Exports continued to be one of the key drivers of growth in the first quarter of 2017. Net exports contributed 0.6 percentage points to the 2.2% headline growth. Private consumption also grew solidly in Q1, mostly driven by the rise in durable goods such as motor vehicles.

Looking ahead, we expect the Japanese economy to continue its moderate recovery for the rest of 2017 and to record 1.3% GDP over the year as a whole, although growth rates may ease in the near term.

On the policy front, however, we do not expect the Bank of Japan (BoJ) to change its policy stance in the short term despite the stronger-than-expected growth picture. Crucially, the BoJ’s monetary policies hinge on the observed rate of inflation, which is still far below its 2% target. What inflation there is comes mainly from external factors such as the rebound in global commodity prices (oil prices in particular) and yen weakening. But domestic drivers of inflation remain weak. The year-on-year changes in core price inflation excluding fresh food and energy, a measure favoured by the BoJ to gauge underlying inflation trends, dropped below zero again in March, having been positive since mid-2013.

As a result, we do not expect a major pick-up in inflation momentum in the near term, especially as we believe further upside for global commodity prices, oil prices included, is limited. Hence, we expect the BoJ to continue its quantitative and qualitative easing, including yield curve control, for the time being, most likely through the remainder of 2017.