Sweet Authoritative Nothings The People’s Daily. “Authoritative Person” may be hiding somewhere in the picture to the left. There is a mysterious figure making regular appearances in China’s government mouthpiece “People’s Daily”, which simply goes by the name “authoritative person” (AP). This unnamed entity always tends to show up with bad news for assorted speculators, by suggesting that various scenarios associated with monetary and/ or fiscal stimulus are actually not in China’s immediate future (the details of AP’s latest pronouncements can be found here and here). Some observers seem to believe that this represents a “renewed shift in policy” – Bloomberg e.g. quotes an economist with Mizuho Securities as follows: “It is very significant and may signal a shift in China’s policies,” said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. “Each time they publish this, it is normally a warning.” Others are more careful – after all, this seems to be a case of “we’re saying one thing and doing another”, given a credit expansion of 4.6 trillion yuan in just the first quarter, which has sent narrow money supply growth soaring to more than 22% annualized. The more measured argument is that it could be a sign that the debate about future economic policy is ongoing, resp. has been revived.

Topics:

Pater Tenebrarum considers the following as important: authoritative person, Bureaucrats, China commodity futures turnover, China Money Supply M1, Debt and the Fallacies of Paper Money, Featured, growth of M1, growth of M2, newsletter, private fixed asset investment growth, real estate prices, Shanghai Steel Rebar futures, Shanghai Stock Exchange, state fixed asset investment growth, Steel Rebar

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Sweet Authoritative Nothings

There is a mysterious figure making regular appearances in China’s government mouthpiece “People’s Daily”, which simply goes by the name “authoritative person” (AP). This unnamed entity always tends to show up with bad news for assorted speculators, by suggesting that various scenarios associated with monetary and/ or fiscal stimulus are actually not in China’s immediate future (the details of AP’s latest pronouncements can be found here and here).

Some observers seem to believe that this represents a “renewed shift in policy” – Bloomberg e.g. quotes an economist with Mizuho Securities as follows:

“It is very significant and may signal a shift in China’s policies,” said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. “Each time they publish this, it is normally a warning.”

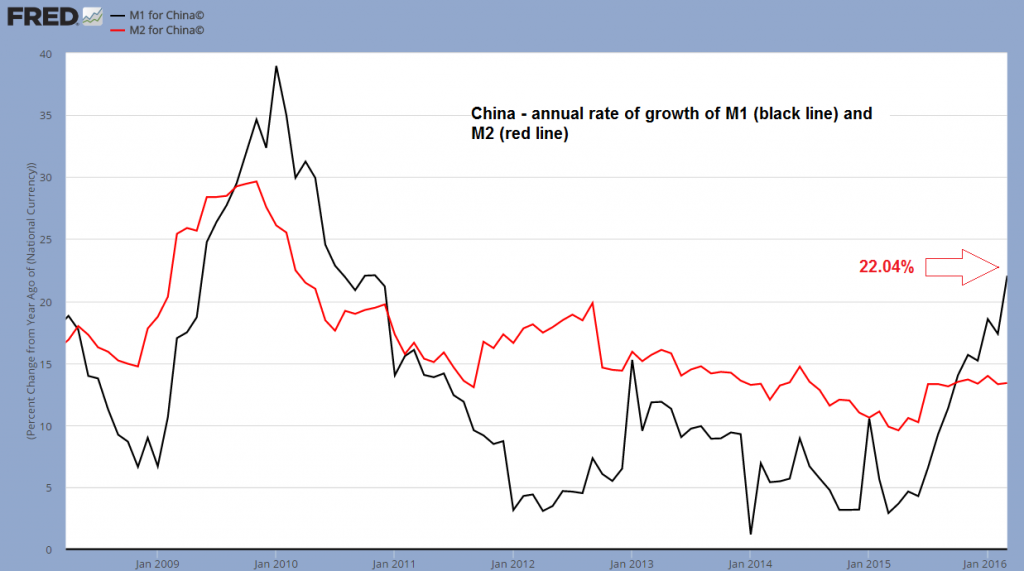

Others are more careful – after all, this seems to be a case of “we’re saying one thing and doing another”, given a credit expansion of 4.6 trillion yuan in just the first quarter, which has sent narrow money supply growth soaring to more than 22% annualized.

The more measured argument is that it could be a sign that the debate about future economic policy is ongoing, resp. has been revived. No-one really knows – it is basically the Chinese version of Kremlinology.

China – annual rate of growth of M1 and M2At the end of March, China’s narrow money supply measure M1 was growing at more than 22% y/y. |

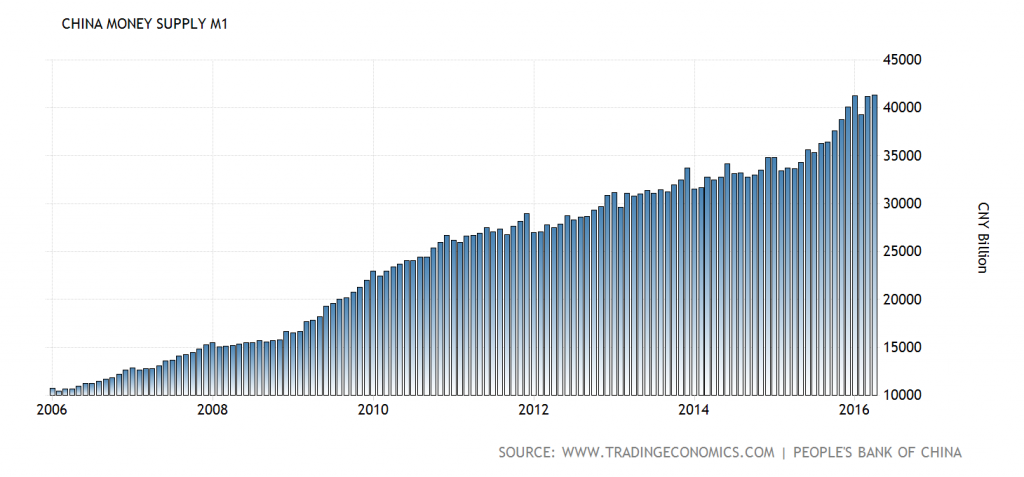

Although the extension of new yuan loans has slowed significantly in April from January’s heady pace (555 bn. vs. 2.5 trn.), there has still been enough pumping in the system to push M1 up again in March-April from a brief dip in February – in other words, if there is indeed a change in policy, it is not really visible yet.

China Money Supply M1M1 growth has resumed in March- April after a brief dip in February. |

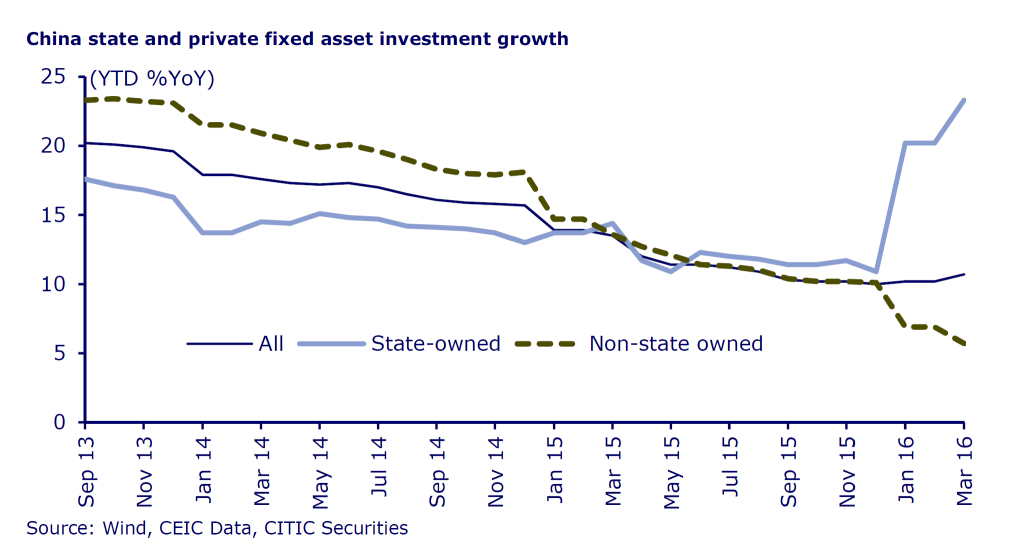

Another sign that the stern admonishments of “authoritative person” are so far more a sign of something that might happen, but certainly hasn’t happened yet, is seen in the chart below from CLSA. It shows fixed asset investment growth by China’s state-owned enterprises (SOEs) vs. that of private enterprises. One would think that if “AP” actually had the upper hand right now, there would be a slowdown in SOE capex. The exact opposite is the case:

China state and private fixed asset investment growthChina’s SOEs are on a capex spree again. |

In short, what we have here is – at least so far – a case of “sweet authoritative nothings”.

Clueless Bureaucrats

As we have often pointed out, one of China’s saving graces is the well-developed entrepreneurial spirit of the country’s population. There is a “can do” mentality and a willingness to take risks and put in the necessary hard work to succeed in the marketplace. However, we strongly suspect that the political leadership is essentially clueless when it comes to economics – after all, why should Chinese politicians be different from any others in this respect?

Central economic planning in practice. Without market prices, there is no way to allocate resources efficiently.

Back when communism still existed in practice, the economic planners in the Soviet Bloc and China always had to keep a close eye on Western market economies. Watching prices in capitalist economies was the only thing that allowed them to occasionally make a semi-rational allocation decision. Other than that, they were “groping in the dark” as Mises once put it.

Is it any better today? It certainly is in the sense that there is now a large private sector in China and market prices do exist. But what do China’s “policymakers” see when they look toward the West today? They see severely hampered market economies run by a bunch of crypto-socialist bureaucrats.

They see economies run on the basis of Keynesian and monetarist precepts (a mixture that oddly enough is often called “neo-liberalism”), for which every ad hoc utterance by central bankers seems to be of paramount importance. They see economies drowning in regulations and subsidies and burdened to the hilt by government spending and high taxes.

What they definitely do not see is what used to be known as capitalism – a truly free market economy. Funny enough, the closest approximation to an unhampered free market economy is right at China’s doorstep – namely Hong Kong. It is quite ironic that one of the few remaining islands of economic freedom in this world is actually part of China.

The Rolling Bust

We have little doubt that there is indeed a debate within China’s leadership as to how to best proceed. China’s policymakers are no doubt aware that a huge amount of malinvestment exists across the economy as a result of the enormous credit expansion of recent years – including a truly breathtaking real estate bubble.

It is generally held that renewed intervention (if “done right”) will make it possible for such problems to be overcome in painless fashion (and hence with as little embarrassment for the ruling class as possible). Such a painless fix is referred to as a so-called “soft landing”, a term popularized in modern times. We believe this is what China’s leadership is actually trying to accomplish.

Shanghai Stock Exchange Composite IndexThe Shanghai Composite Index continues to be under pressure. Speculators have in the meantime moved on to different playgrounds – and the outcome is likely to be similar. |

The problem is that there is actually no such thing as a “soft landing”. With the means at the disposals of the planners, the boom will either continue or it will give way to a bust. China’s policymakers seem to want to have it both ways: on the one hand, they want to implement much-needed economic reform, on the other hand they want to do it without letting the economy go through the pain of a liquidation of malinvested capital and unsound credit.

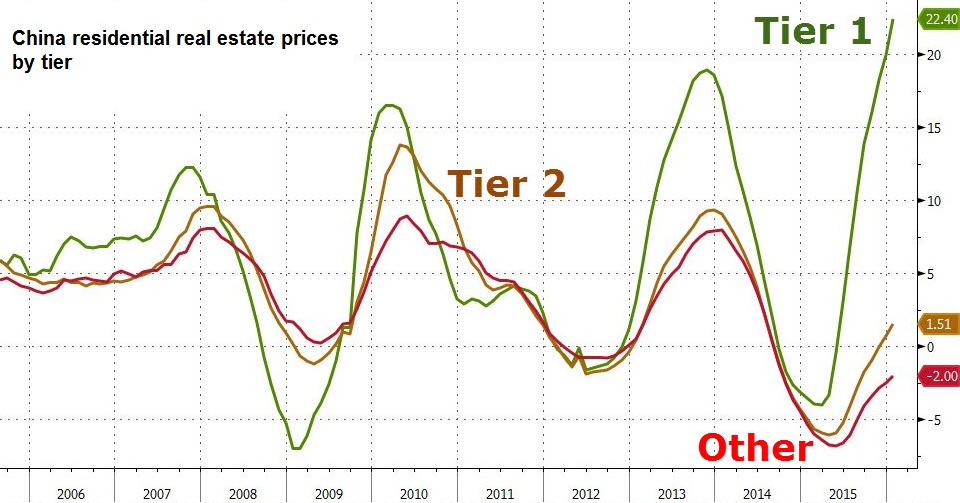

The result of this is a kind of “rolling boom-bust cycle” that seems to be moving from one sector to another. Real estate is probably a special focus of the planners, as it seems that credit expansion is switched on and off primarily in reaction to recent trends in home prices. Below is a chart that shows the ups and downs of residential property prices by “tiers” (the largest cities, mid-sized cities and the rest).

The most recent acceleration in credit expansion has followed on the heels of a period of mild price declines – which has now once again given way to soaring prices, especially in “tier one” cities. This illustrates the concept mentioned above well – as soon as home prices are falling for a while, China’s authorities seem to be getting cold feet and are opening the monetary spigots again.

In the process, volatility keeps increasing, the mountain of outstanding debt keeps growing and prices keep moving to ever more extreme levels. Whatever progress has been achieved previously is squandered again, as even more capital is misallocated.

China residential real estate prices by tierChina real estate prices, y/y change rate. China’s closed capital account is supporting the huge advance in prices, as many people buy property for a perceived lack of alternatives. |

In the wake of the recent decline in stock prices, speculators have decided to move on to China’s commodity markets (see also our recent discussion of commodities), pushing up prices amid a truly stunning expansion in trading activity. After a clampdown by regulators, trading volume in commodity futures has declined sharply and prices have corrected rather precipitously as well.

China commodity futures total daily turnoverCombined trading volume of all Chinese commodity futures exchanges: a huge spike in trading volume followed by a just as rapid plunge. |

Below is a daily chart of the most active steel rebar futures contract, which has in the meantime given back its entire March-April advance. Interestingly, steel rebar futures remain in backwardation, which suggests that yet another run-up in prices may be in the offing:

Shanghai, October Steel Rebar futuresOne of the objects of desire of China’s newly-minted commodity speculators: steel rebar futures. |

All in all it seems that this on/off approach to monetary pumping is creating ever greater distortions instead of producing the desired “soft landing”. At some point the situation is likely to get out of control (although it is not certain yet in what manner, as that will also partly depend on how the authorities react).

Conclusion

If China’s planners have indeed decided to step on the brakes again, market volatility is likely to increase markedly in coming months. As a side effect, we can probably also look forward to even more inflation in the use of the term “uncertainty” in future FOMC statements. Eventually, something is going to break.

Charts by: St. Louis Federal Reserve Research, TradingEconomics, CLSA, StockCharts, ZeroHedge, BarChart

Previous post