Macroview Bank lending grew at a record pace in Q1, in spite of challenging environment for banks Read the full report here The expansion of bank credit to euro area non-financial corporations slowed in March, to EUR 1bn compared with a rise of EUR 24bn in January and EUR 19bn in February. By contrast, credit to households continued to increase at a decent pace in March and was slightly stronger than in previous months. Although credit flows eased in March, the three-month moving average reached a record high in the first quarter overall, in spite of a very challenging quarter for banks in credit and equity markets. Meanwhile, the annual rate of expansion of broad money supply (M3) was roughly stable. The three-month average for M3 growth from January to March stood at 5.0%. All in all, the latest credit data and leading indicators, such as April’s Bank Lending Survey (BLS), remain consistent with ongoing credit growth and strong domestic demand in the first half of 2016, supporting our above-consensus forecast for euro area real GDP growth of 1.8% for 2016. The ECB will take comfort from evidence of ongoing credit growth despite concerns about the impact of negative rates and quantitative easing on the banking sector. In summary, to quote ECB president Mario Draghi: “ECB measures are working; just give them more time.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: bank lending, credit flows, euro area, euro zone, Macroview, Money Supply

This could be interesting, too:

Keith Weiner writes The Anti-Concepts of Money: Conclusion

Joseph Y. Calhoun writes Weekly Market Pulse: A Very Contrarian View

Jeffrey P. Snider writes Testing The Supply Chain Inflation Hypothesis The Real Money Way

Cesar Perez Ruiz writes Weekly View – Big Splits

Bank lending grew at a record pace in Q1, in spite of challenging environment for banks

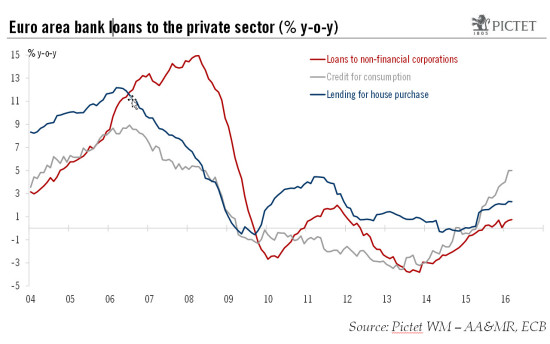

The expansion of bank credit to euro area non-financial corporations slowed in March, to EUR 1bn compared with a rise of EUR 24bn in January and EUR 19bn in February. By contrast, credit to households continued to increase at a decent pace in March and was slightly stronger than in previous months.

Although credit flows eased in March, the three-month moving average reached a record high in the first quarter overall, in spite of a very challenging quarter for banks in credit and equity markets. Meanwhile, the annual rate of expansion of broad money supply (M3) was roughly stable. The three-month average for M3 growth from January to March stood at 5.0%.

All in all, the latest credit data and leading indicators, such as April’s Bank Lending Survey (BLS), remain consistent with ongoing credit growth and strong domestic demand in the first half of 2016, supporting our above-consensus forecast for euro area real GDP growth of 1.8% for 2016. The ECB will take comfort from evidence of ongoing credit growth despite concerns about the impact of negative rates and quantitative easing on the banking sector. In summary, to quote ECB president Mario Draghi: “ECB measures are working; just give them more time.”