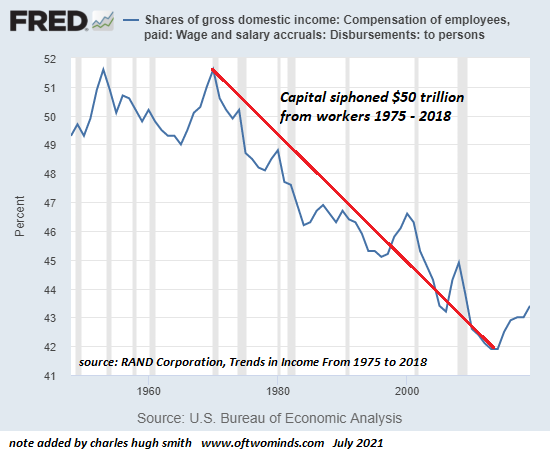

You want to fix the world with finance? Then fix this: wages’ share of a financialized, globalized, speculative-bubble dependent economy have been falling for decades. Fix this and you really will change the world. Anything less changes nothing. Let’s start by stipulating my perspective on cryptocurrencies is neither positive nor negative in the usual context of “to the moon” or “worthless,” nor does it track any of the conventional narratives (decentralized finance will conquer the world, etc.) I’ve thought a lot about “money” and its role in the economic-social order, and its role in the extreme asymmetries of wealth-power-income inequalities that are dismantling the social order in broad daylight. I’ve also thought a lot about work and its role in social

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, 6c) Crypto Currencies English, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

You want to fix the world with finance? Then fix this: wages’ share of a financialized, globalized, speculative-bubble dependent economy have been falling for decades. Fix this and you really will change the world. Anything less changes nothing.

Let’s start by stipulating my perspective on cryptocurrencies is neither positive nor negative in the usual context of “to the moon” or “worthless,” nor does it track any of the conventional narratives (decentralized finance will conquer the world, etc.)

I’ve thought a lot about “money” and its role in the economic-social order, and its role in the extreme asymmetries of wealth-power-income inequalities that are dismantling the social order in broad daylight. I’ve also thought a lot about work and its role in social cohesion, individual fulfillment and a productive, level-playing-field economy.

I’ve written two books on “money” and the potential utility of cryptocurrencies in reversing the extremes of wealth-power inequality that are destabilizing the social order. I invite you to read both books if these topics interest you:

Money and Work Unchained (2017)

Once you grasp the potential of community-based labor-backed cryptos, you realize cryptos took the greed-soaked path to the Dark Side of a destructive asymmetry of wealth and power: those who issued blockchain cryptos (in all their forms) would become the new Extractive Elite, the new Power Elite, the New Parasitic Elite, buying the wealth generated by the labor of others for peanuts.

Scrape away the high-falutin rhetoric, and blockchain/crypto distills down to the same old greed and avarice that powers traditional finance: those who own the mines gain wealth from the issuance of “money” and its proxy, credit, and those who control the spigots of “money” and credit then buy control of governance, labor and the productive assets that generate real-world wealth.

Whether the “money” is metals that labor extracts to the benefit of the mine owners, cryptos issued to the benefit of miners and insiders, or fiat currencies issued (or borrowed into existence) by central banks and private banks, the principle is the same: the few who control the “money” issuance spigots benefit at the expense of the laboring many.

| This is why I say if you don’t change the way money is issued and distributed, you change nothing. Cryptocurrencies–and not necessarily blockchain-based cryptos–have the potential to play a role in fundamentally changing the way “money” is issued and distributed, but this potential has been squandered in the Gold-Rush Greed of speculative schemes which depend on a greater fool volunteering to be the bagholder for an intrinsically utility-free (i.e. of no productive utility) speculative vehicle.

Swapping one set of extractive billionaires for another set of extractive billionaires doesn’t improve the world. Swapping billionaires changes nothing. As for the much-touted institutional participation: It’s just another greed-driven rush to front-run the next gold rush. The tech bubbles have shown that early adopters mint billions, and so Pavlov’s Institutional Managers all piled into blockchain and crypto schemes, no matter how flimsy and lacking in real-world utility, desperate to secure early equity rounds in what the institutions see as the next gold rush. The early mine claims got rich, everyone who came later got the shaft. As Mark Twain so entertainingly described, fortunes were made and lost with no relation to the actual prospects of the mining claims being traded. As for the claims of widespread utility of blockchain and crypto, all the claims are strained. Compare the rapid global distribution of mass produced spectacles lenses from Venice in the 1400s (glasses quickly reached Imperial China) with the supposed utility of blockchain and crypto: truly world-changing innovations that improve human life spread quickly. Where are the blockchain and crypto “innovations” that so improve human life that they’ve spread globally in a few years? There aren’t any. Scrape away the speculative frenzy, the search for greater fools and the gold-rush mob of greed-driven Pavlovian Institutions, and what’s left? If anything was truly world-changing in terms of improving human life, it would already be tracking the World Wide Web’s expansion, and several billion people would already be using blockchain and crypto utilities due to their vast practical advantages over previous utilities. The truly world-changing opportunities to improve human life with cryptos don’t enrich the issuers of the currencies or the early investors: they are distributed to those who are performing useful work in their communities rather than speculating. |

There are three false assumptions at the heart of blockchain/crypto:

1. We can all get stupidly rich while changing the world for the better. (The Internet model)

2. Blockchain/crypto is “open to everyone” because anyone earning fiat currency can use that to buy crypto.

Getting stupidly rich from being an early investor and front-running speculative bubbles doesn’t change the world. Confusing getting rich with “changing the world” doesn’t change the world.

As for “democratizing finance:” those without capital and no way to save up appreciable capital are left out of speculative assets. The already-wealthy have the means to jump on the bandwagon and so they end up owning the lion’s share of the new hot asset.

In this way, cryptos are no different from all the other asset classes dominated by the already-wealthy.A relative handful of early investors and issuers of cryptos became billionaires, the already-wealthy piled in and the bottom 90% were left to trade high-priced crumbs.

3. Fixing finance will fix the world. Just as those holding hammers see nails that can be pounded down, those steeped in the abstract world of speculation and finance think their expertise in making “money” is all that’s needed to fix whatever is broken in the world.

The reality is that finance has broken the world’s ability to adapt by pushing wealth-power inequality to extremes that are breaking down economies and societies. Finance looks at scarcities–artificially created by cartels and monopolies, or the real-world scarcities of depletion–as “opportunities” for profiteering. Governance and regulation are “opportunities” to distort public policy to benefit the few at the expense of the public good.

This is the ultimate fantasy of financiers of any stripe: I’m gonna do good while getting stupidly rich.But “doing good” quickly slides into the swamp of good intentions and glossy fantasies. The reality is greed and the desire for unearned wealth drives people to arrive to do good and stay to do well.

The reality is financiers hope to “change their world” by getting rich, and it’s easy to cloak this self-interest with noble-sounding goals and claims and persuade oneself that getting rich via speculation will magically ennoble the world. It won’t.

You want to fix the world with finance? Then fix this: wages’ share of a financialized, globalized, speculative-bubble dependent economy have been falling for decades. Fix this and you really will change the world. Anything less changes nothing.

Tags: Featured,newsletter