The status quo response would be amusing if the consequences weren’t so dire. Rather than stare at empty shelves, you have two options for distraction: you can don a virtual-reality headset and cavort with dolphins in the metaverse, or you can trade various forms of phantom wealth that always go up (happy happy!) because the Fed. Neither distraction actually solves any real-world problems, a reality we can call the Revenge of the Real World We’ve entered a peculiar phase in American history in which illusions of wealth and control are the favored distractions from the unraveling of the real world economy and social order. Printing trillions of currency units can’t restore the global supply chain or social cohesion, Rather, jacking phantom wealth to the moon is

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The status quo response would be amusing if the consequences weren’t so dire.

Rather than stare at empty shelves, you have two options for distraction: you can don a virtual-reality headset and cavort with dolphins in the metaverse, or you can trade various forms of phantom wealth that always go up (happy happy!) because the Fed.

Neither distraction actually solves any real-world problems, a reality we can call the Revenge of the Real World We’ve entered a peculiar phase in American history in which illusions of wealth and control are the favored distractions from the unraveling of the real world economy and social order.

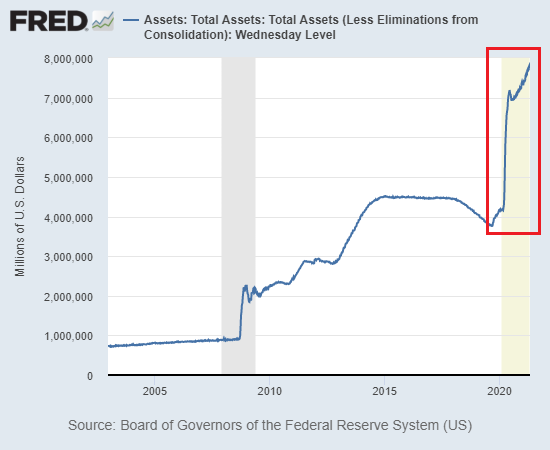

Printing trillions of currency units can’t restore the global supply chain or social cohesion, Rather, jacking phantom wealth to the moon is only accelerating the collapse of the social order and the economy even as it accomplishes absolutely nothing in terms of solving real-world problems.

|

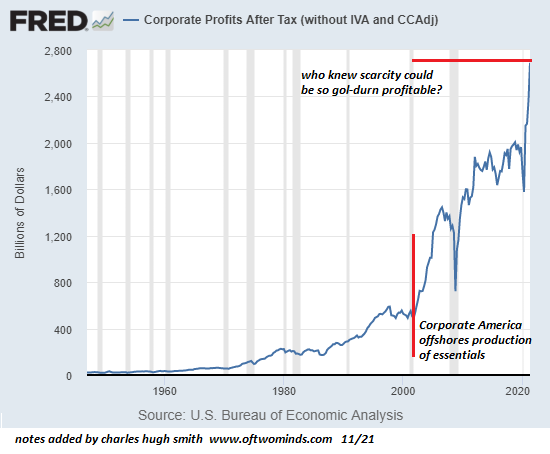

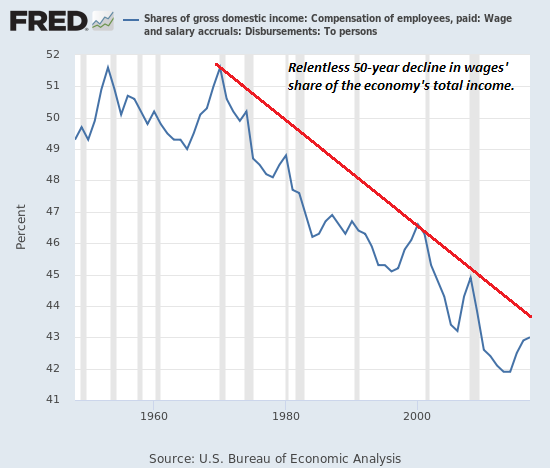

Let’s start with the core economic realities of the 21st century: 1.The number of high-consumption (“middle class”) people doubled from 1 billion to 2 billion. The human populace has expanded to 7.9 billion individuals, but poor people who don’t have enough money to consume large quantities of energy, goods and services delivered by the global supply chain don’t have much of an impact on global consumption of energy and resources. It’s the number of people jetting around the world playing their part in the landfill economy (toss the old one, buy a new one) who drive “growth” (i.e. waste is growth). Strangely enough, there are actual physical limits to resources being transformed into junk being dumped in the landfills. Humanity’s rapacious appetite for stuff has extracted all the cheap-to-extract resources and now all that’s left are the increasingly expensive-to-extract resources. 2. Corporate America offshored most of the production of essentials to exploit the low labor and energy costs, minimal environmental standards and currency arbitrage of overseas production. The net result has been an astounding increase in corporate profits.(see chart) But a funny thing happened on the way to Corporate Profit Nirvana: America became dependent on foreign supply chains. In essence we traded national security for corporate profits. Now the real-world costs of that myopic greed are becoming apparent. |

|

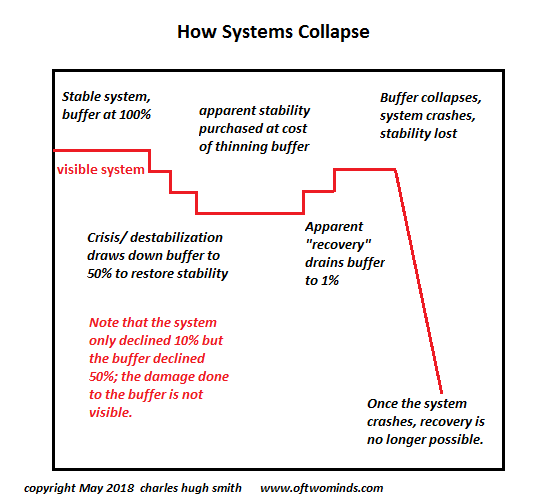

| 3. Global supply chains have been optimized for cheap energy and cheap credit. This optimization stripped away all the buffers as a means of maximizing profits. Once the system veered outside the narrow band of optimization, the entire system lost coherence and unraveled.

Now that the entire global supply chain has been optimized to maximize profits as the expense of buffers, the buffers are too thin to save the system from collapse. (see chart) The entire dependency chain depends on cheap energy (all those cheap seats on wide-body aircraft were subsidizing the air cargo beneath the passengers’ feet) and cheap credit, as consumers can’t buy enough with earnings to keep the machine well-oiled. And firms in the dependency chain need ample cheap credit to function, as many have receivables that stretch out over 90 days. Without cheap credit, these firms would have to close down. The status quo response would be amusing if the consequences weren’t so dire: we don’t need no stinking buffers! The supply chain for the landfill economy will be back up to full speed any day now, or maybe next year, but don’t you worry, the conveyor belt from China to big-box store to the landfill will be fully restored. In the meantime, cavort with dolphins in the metaverse and trade tokens of phantom wealth to amuse yourself. We’re counting on magic to put it all right, and if that doesn’t work, then the real world’s revenge will be something to behold. |

Tags: Featured,newsletter