This week’s episode of the Gold Exchange Podcast explores the idea of profits, and why it matters how you get them. Much of the financial world has confused the idea of profit with price appreciation. Or as we like to say, they confuse investment with speculation. Investment is deploying capital productively in a business for a yield. Speculation is betting one’s capital on an asset price rising. There’s a reason why this confusion exists. Central Banks have manipulated and distorted the most important market on planet earth – the market for money and credit. Interest rates are unhinged, and have been falling for over four decades. This has created an investment environment where more and more activity is speculative, and less and less is real investment. While

Topics:

Dickson Buchanan considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, Featured, newsletter, The Gold Exchange Podcast

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

This week’s episode of the Gold Exchange Podcast explores the idea of profits, and why it matters how you get them. Much of the financial world has confused the idea of profit with price appreciation. Or as we like to say, they confuse investment with speculation. Investment is deploying capital productively in a business for a yield. Speculation is betting one’s capital on an asset price rising.

This week’s episode of the Gold Exchange Podcast explores the idea of profits, and why it matters how you get them. Much of the financial world has confused the idea of profit with price appreciation. Or as we like to say, they confuse investment with speculation. Investment is deploying capital productively in a business for a yield. Speculation is betting one’s capital on an asset price rising.

There’s a reason why this confusion exists. Central Banks have manipulated and distorted the most important market on planet earth – the market for money and credit. Interest rates are unhinged, and have been falling for over four decades. This has created an investment environment where more and more activity is speculative, and less and less is real investment. While both actions may produce a “profit” there is a significant difference. The results of one build civilization. The results of the other, tear it down.

In this podcast Keith and John discuss:

Additional Resources:

Where Does Your Profit Come From?

Investing in Gold vs Gold Investing

What’s the Real Purpose of Money

The Wealth Effect: Silver Edition

Transcript

John Flaherty: Hello again and welcome to The Gold Exchange Podcast. I’m John Flaherty and I’m here with Keith Weiner, founder and CEO of Monetary Metals. Today we’re going to talk about profits.

Profit is the return to those actors who put their capital at risk, and the profit motive is one of the key tenets of western civilization. What, therefore, could possibly be wrong with profits? Well, it turns out there might be something going on beneath the surface that we need to shine a light on. To do that, we turn to Keith and some key principles he addresses in his recent article, Where Do Your Profits Come From?

So Keith, to start, just want to put on the table, do you agree that profits are a good thing?

Keith Weiner: In a free market, yes. In a free market the only way to make a profit is by serving your customer. You have to create economic value in some way. You’re buying something, adding value to it, buying more things, combining them together, adding value, and then selling the output for greater than the sum of the costs. And that profit is the proof that you’ve done good.

And in fact, all you have to know is you’ve made a profit and that is the proof, you don’t have to try to trace through all of the elements. There’s a famous economic story, ‘I, Pencil’ written by Leonard Read, that traces all of the things that go into manufacturing a pencil from the graphite, and the steel, and the wood, and the rubber, and all those different places. And none of those people really understand how to make a pencil, they just know how to make their component and they make a profit.

The fact of making a profit is sufficient without any further… It’s a necessary and sufficient condition. However, in a not free market where government is interfering in the market, then it’s possible to make a profit, not for creating value, but perhaps even for destroying value.

And a big theme of my work is how does that happen in a falling interest rate environment? Because that’s the environment that we’ve been in for most of the people that would be listening to this, it would either be their entire adult career or most of it. We’ve had a falling interest rate since 1981.

John Flaherty: Right. So you sort of hint at this in the title of your article, What’s Going Wrong With Profits. And you start by drawing a distinction between speculation and true investment, and how the latter has been all but extinguished by the Fed. Please help us define these terms: speculation and true investment.

Keith Weiner: Well I think the key distinction, a lot of people hear the word speculation and they think either gamble or high risk is what speculation means. And then they turn around and say all investment has risk. Therefore speculation is investment, investment is speculation. No, no, no. I’m making a distinction that’s black and white, it’s not a degree of risk.

In investment you’re financing the creation of either production of something new entirely or at least additional production of something that already exists. You’re financing added production that doesn’t exist at the time of your investment. And your investment is what enables that production.

So for example, if I want to go into the business of manufacturing pencils, to use the example of ‘I, Pencil’ a minute earlier, I need to buy a certain set of machines and tools to do so. And a building, presumably to put those tools in.

So I turn to investors and say I want to either raise equity capital from you, or I want to borrow from you, or some combination of both. And here’s my business plan. I’m going to buy this building, I’m going to buy all these tools, assemble them, and then I can stamp out a million pencils a day or whatever it is and that’s how I’m going to make money. And that’s how you’re going to get repaid.

My manufacturing of pencils is going to give me one cent profit per pencil, times a million pencils a day is $10,000 a day in profit. My mortgage on all of this that I owe you is, whatever, $30,000 a month. I can easily service the mortgage and please invest with me.

Assuming I’m successful, then a profit to the investor comes from my increase in production. And they’re getting essentially part of that production because they enabled it with their money.

Speculation is when you’re not actually financing anything. And so I’ll go back to my favorite punching bag, which is Bitcoin. But the same thing applies to all markets in a falling interest rate environment.

I buy a Bitcoin and today it’s, what, $41,000. I’m not financing anything by doing that. I’m literally giving $41,000 to someone who has a Bitcoin and I’m turning over some savings to him that he can go spend or whatever, because I expect someone is going to buy it off of me for, let’s say $82,000. I’m going to double my money. That’s my belief, that’s why I’m doing this.

And suppose I’m right and it goes to 82,000 and I sell it. Well, I now have my original $41,000 in capital back, plus another $41,000 in someone else’s capital, essentially, that I can now consume. I can now spend it. We haven’t enabled by any of these transactions any new production. I’m just going to go and spend it on something that already got financed by some other means. I’m just going to go consume.

And so the difference between investment and speculation, investment is creating new production. Speculation is consuming results of something that’s already in production. And, of course, all machines that produce wear out. So in the process of production, a little bit of the productive capacity is itself consumed. And so this is a process of consuming capital.

John Flaherty: So you stated in your article that where your profits come from matters a great deal. Why is this?

Keith Weiner: That economic distinction of either you’re creating more or enabling the creation of more productive capacity, versus just consuming productive capacity, that’s the difference between a civilization that is ascending and a civilization that is descending.

I recently had an interesting thing happen. I’m a member of a private email list for finance professionals adhered to the Austrian school of thinking economics. So I had posted the press release that we, Monetary Metals, just did that we had issued a gold bond, the first one since FDR broke the gold standard in 1933.

We issued this at the end of 2020. And now here we are, late in 2021, and the bond matured and investors are repaid. And I just thought, “Okay, these guys are finance professionals, they’d be interested in seeing that. Gold being used to finance something rather than as a speculative bet.” And there was somebody on the list who is a very eminent person, economist professor, very well known person who said,” Well, I’m sure that the only reason why it was able to be repaid is because the price of gold went down.”

Which I thought, first of all, it’s kind of funny. I mean, here I am, I’m the one who issued that bond. You would think you would ask me about that before you would presume to say in a public forum, no less, but okay, whatever. But the whole thing to him in his mind wasn’t really about financing anything. It was about speculation and making a directional bet on price.

And so, of course, in speculation, you don’t just have to bet on price going up, it’s also possible to bet on price going down. You can borrow something, like shorting a stock, you borrow shares and sell them short so that the price will go down. And it’s the same mechanism, just you want the price to go in the other direction.

And that’s what he assumed this was. And so I said, “No, no, let me clarify. We didn’t succeed in this because the price of gold went down. We succeeded in this because the gold mine that we financed was successful in extracting gold out of the ground.” Which they could have done regardless of what the price was.

I mean, if you’re digging gold out of the Earth, assuming that you’re competent at digging and assuming the Earth has gold in it, you will get the gold regardless of where the price might happen to be. Anyway, what ensued after that was just a discussion about whether gold was a good asset class or whether you’re better off putting your money into shares or real estate or whatever.

And this is an email list about finance, and yet finance has descended, if I can use that analogy, into mere speculation, what to bet on. Who to give your capital to to get what asset so that it will go up and someone else will give you their capital to buy that asset off of you later. And that’s the difference between a civilization that’s failing and a civilization that’s growing.

John Flaherty: So you’ve already touched on this at a surface level, but this is a common theme that emerges among the articles that you’ve written. This concept that speculation, particularly the type that we’re experiencing on a global scale thanks to the manipulated and falling interest rates, is destroying the capital on which our civilization is founded.

And this phenomenon is hidden in plain sight in the form of a Bull market in just about every asset class, including, ironically, precious metals. I know it’s probably unfair to ask you to explain the principle in just a few minutes, but I suspect you’ll be up to the challenge. Do you want to take us a little deeper about how this capital is effectively destroyed?

Keith Weiner: Thanks for setting me up there. If I can’t get that done in a minute, then I fail. But I’ll try. Keynes, John Maynard Keynes is famous for saying a number of things. He talks about the euthanasia of the rentier, killing the savior who collects interest who Keynes believed was a functionless parasite, his term. He said there’s no surer way to overthrow the capitalist order, but I want to really emphasize capitalism whenever aspects of it are allowed to function to any degree, that’s the degree to which you have civilization.

When you destroy all aspects of the free market, you destroy, ultimately, all aspects of production and man is reduced to the level of brutes and everything collapses. When he says collapsing or overthrowing capitalism he’s really saying overthrowing civilization. Although he doesn’t really believe that, or fully understand that, I guess.

But anyways, it’s a long quote and at the end of the quote, he says, “And you’re engaging all the hidden forces of economics.” which today our term for that would be incentives. So you’re leveraging all the incentives, but in favor of disruption. And he’s gloating and smirking, “But not one in a million could diagnose what it is.”

And since he had said currency debasement, everyone assumes he means inflation. I’m just old enough to remember the late 70s. Everybody talked about inflation every day. But for Keynes to say not one in a million can recognize it, he’s either really glaringly stupid, which I do not believe. Or he wasn’t talking about inflation, he was talking about something else.

What he’s talking about is driving the interest rates to zero. And the reason why nobody can see how that’s destroying is because that means an endless Bull market. Asset prices are the inverse, roughly, or perceptually you can say the asset price is the inverse of the interest rates. If the interest rate is cut in half, then the asset price roughly doubles. And so you have an endless Bull market.

And nobody can understand that this is destroying the world because everybody loves a Bull market. You buy something, it goes up, you sell it, you make money. Everybody goes to Las Vegas and buys new cars and jewelry for the wife and all those things. Everybody’s happy and it’s inconceivable to them.

And again, they’re making a profit. So profit is good, right? How can this possibly be bad? And the answer is it’s a process of capital destruction whereby each speculator is forking over some capital to the previous speculator, who consumes at least part of it in hopes somebody else will fork over even more capital to him so that he can consume it. And that’s what Keynes was envisioning and I think he was smirking at the prospect of it.

John Flaherty:

Thank you, Keith. So I want to bring this down as I’ve tried to understand this principle. I want to tie it to a real world example from my own life and see if we can help impart some understanding. Also there was a comment in your article posted by one of the readers that sort of overlaps this. So here we go.

So I bought a house across the street about two years ago, paid $275,000 for it. I sold it in the first quarter of this year for about $425,000. So a gross profit of $150,000 in less than two years. I also need to mention that I invested about $20,000 in the property before I sold it, including a new roof and a new AC unit. Also, I rented it out the entire time I owned it for just over double the mortgage, adding to my gross profits substantially.

So Keith, I want to know, are you telling me that by engaging in this transaction I’m contributing to the demise of western civilization?

Keith Weiner:

It’s your fault. Catch him, get him. I always try to say this in my articles, and I’ll say it here as well. When the government and the central bank sets up a perverse incentive, we have to blame the root cause, which is the perverse incentive, not the people who take that incentive.

And actually this raises an interesting point because I’ve had this argument a number of times. And a number of people, often of the objectivist persuasion try to say, “Well, come on. You’re saying people are stupid. They can’t see through the fake price signals and do the right thing that everyone is led like lemmings over the cliff because they’re just too stupid.”

I say, “No, I’m not saying they’re stupid. I’m saying that the pricing isn’t fake. If the house was offered at 275 two years ago, and that’s what you bought it for. And then someone’s offering 425 today and that’s what you sold it for. That price, that signal is not fake, that’s real. That really was 275,000. That really was 425,000.

How are you supposed to say, “Well, sure, that’s the nominal price being offered in the actual market, at which price the houses are actually being bought and sold. But in my mind, there’s a real house price, which I can calculate by adjusting for CPI or money supply, or who knows what.”

Nobody can do that. Nobody should do that. I mean, if that’s the price that things are being bought and sold, then all you can do is respond to that price incentive, there is no other signal. I mean, you can hypothetically calculate what would it be if the interest rate weren’t falling or something like that. But that’s great for an academic paper, that’s not great for somebody in the real estate business. So blame the Fed, don’t blame the actor.

And then as far as renting it out. Well, there you’re actually providing value to the market. If there are a lot of people who don’t want to buy a house, they either don’t qualify or don’t choose to, and so they rent. And that’s a mutually beneficial transaction where you’re providing the capital for the house and somebody is paying to rent it by the month. So I would exclude all that from the destroying western civilization part. Just focus on the alleged gain in the house.

John Flaherty:

Gotcha. I think there’s a back end of this too. And that is you say it matters where your profits come from, whether it’s from speculation or from true investment. And I think you drew the distinction between the rental income versus just the nominal price going up and the gain resulting from that. But also how those profits are spent.

So I took the profits from that transaction and did a few things with it. I just took a vacation to Hawaii, so I did consume part of that. Would that be part of my neighbor’s capital that’s now destroyed?

Keith Weiner:

Yes, it’s your neighbor’s capital, or more likely, his bank’s capital because he borrowed the money to buy it from you for 425, I would guess. And it’s really not the bank’s capital, it’s actually the depositors’. So depending on what bank he borrowed the money from, it could actually be your capital that you have deposited at that bank. You didn’t think of that, did you? So it’s a giant circular thing.

But you make an interesting point that, of course, the person who receives that capital gain, somebody else’s capital, is not obligated to consume it. And if he invests it, again, not speculation but invest. So Monetary Metals, we have at least two, I think more, but at least two shareholders that I personally know have made big speculative gains in crypto currencies and then invested in Monetary Metals one or more of our equity rounds to finance this business.

And so it’s possible for somebody to take speculative gain and put it into an investment that’s leading to the creation of more value. That’s certainly possible. And I imagine that most speculators do that to some degree or another.

But most speculators also consume to some degree or another. And so there’s a capital consumption component that, yes, as you rightfully point out, 100 percent of all the speculative gains isn’t being consumed. There’s some fraction thereof that’s less than 100 percent but certainly more than zero.

John Flaherty:

So what about gains that are used to say, pay down debt? Where would that fall in the creation or destruction camps?

Keith Weiner:

Yeah, that’s not destructive, I guess I’d say that. You have to know more about the context of what was the debt used for. I mean, if you borrowed money to go to Las Vegas last year and got yourself into $50,000 gambling debt and then had a house flip work out and you paid off the gambling debt with that, then I’d say, well, the capital destruction occurred last year, and now you’re paying off the debt this year. So I’d say the repayment of the debt is itself neutral, it’s kind of what was the debt used for that’s kind of determining that.

John Flaherty:

Right. So we have these nuances going on on both sides. It seems that the source of the profit matters. And also, once those profits are realized, the consumption element can occur, but also it could be reinvested into productive purposes, like the final example I was going to give. And it’s a shameless plug, but I took part of those gains and bought some gold and invested them in Monetary Metals deals. So I want to hear that I’m doing my part, Keith.

Keith Weiner:

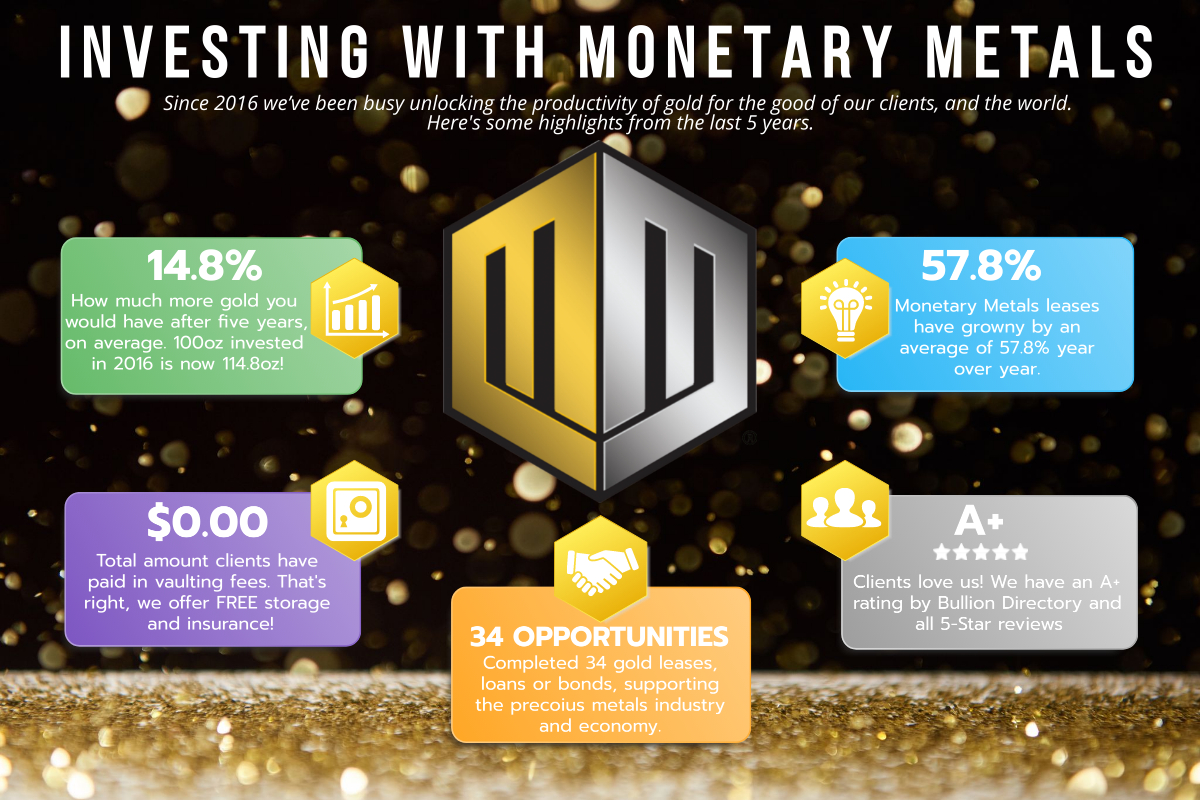

Yeah, I mean, when you invest gold at Monetary Metals then that gold is being used to finance something productive. Our leases are helping finance businesses that are either manufacturing, or distributing, or retailing. And then our bonds are financing companies that are producing a gold income.

So if anybody has any speculative gains that they want to invest, give us a call. But the real economy is obviously big and it’s messy. I mean, you have everything from just pure destruction to pure creativity. And often one person is mixed.

There’s certainly some very high profile prominent billionaire businessmen who, on one hand, are advocating that the government do something destructive, usually to subsidize one of their businesses. And on the other hand are creative powerhouses developing cool things and actually financing them and bringing them to fruition. And both are going on at the same time.

And then the same thing with speculation. Somebody makes $100,000 speculative gain, they consume 15 to a productive thing that creates more than $100,000 of fresh value. So on net maybe in that case it was positive for the economy.

But overall, as the Fed is enabling a greater and greater rate… I mean, it’s interesting, you said you made $150,000 in two years, but you made more than 50 percent in two years. So as a percentage level, the rate of speculative mania is getting very large in magnitude.

And is all of that being reinvested into productive things? The answer is no, of course not for a lot of reasons. One is it’s tempting to consume, you feel like you’re getting rich. The so-called wealth effect, it’s tempting to spend it because spending is fun. But then number two, because of other government policies, regulation and tax being two of them, but then also zoning, there’s a lot of other restrictions. There isn’t necessarily a plethora of productive opportunities to invest in anyways.

I mean, as the economy is just becoming more and more sporadic, people are speculating in a fixed pool of assets that just keep going up and up in price. And that’s part of the dynamic too.

John Flaherty:

So before the interest rate was really under assault and we were in more or less a free market back on the gold standard, what role did speculation play in a free economy?

I think we addressed this in a prior episode, and I think you gave an example of a land speculator who could foresee the path of growth in his hometown and buy a bunch of acreage on the outskirts of town, but in the path of development, and reaped the gains of that once the development got out there. Is that a “healthy” speculation in a free market gold standard?

Keith Weiner:

I would say that speculator, yes, is actually adding value. Because he’s taking that, presumably agricultural or wilderness land, giving the person who held it since whatever antiquity or since the Homestead Act or depending on where that land was, giving that person enough money to make that person go away happy. And now he’s putting it in play so that as there’s a demand for development and real estate coming out his corridor, that that property was available, it’s not still being farmed or it’s not still, whatever, wilderness.

Keith Weiner:

And I was going to say the other thing in a free market is agricultural speculation. The speculators are mitigating the risk of Mother Nature, which is fundamentally unpredictable, unhedgeable risk. And so the speculator is playing there and providing value to the market, versus an environment where the interest rate is not stable, the speculator is essentially front running the actions of the central bank, which is entirely unhealthy and entirely a different thing. We shouldn’t have a central planner that’s messing up our interest rate. In the United States before 1913 we didn’t.

John Flaherty:

All right. Well, that is all the time we have today, Keith. As usual, we appreciate your thoughtful insights on this important topic. Be sure to check out the show notes for related content. And if you’d like to dive deeper on this topic, I believe episode 12 ties in with Yield Purchasing Power goes deeper. Thank you for joining us on The Gold Exchange.

Don’t forget to subscribe to our YouTube channel for all our podcast and video content!

Tags: Featured,newsletter,The Gold Exchange Podcast