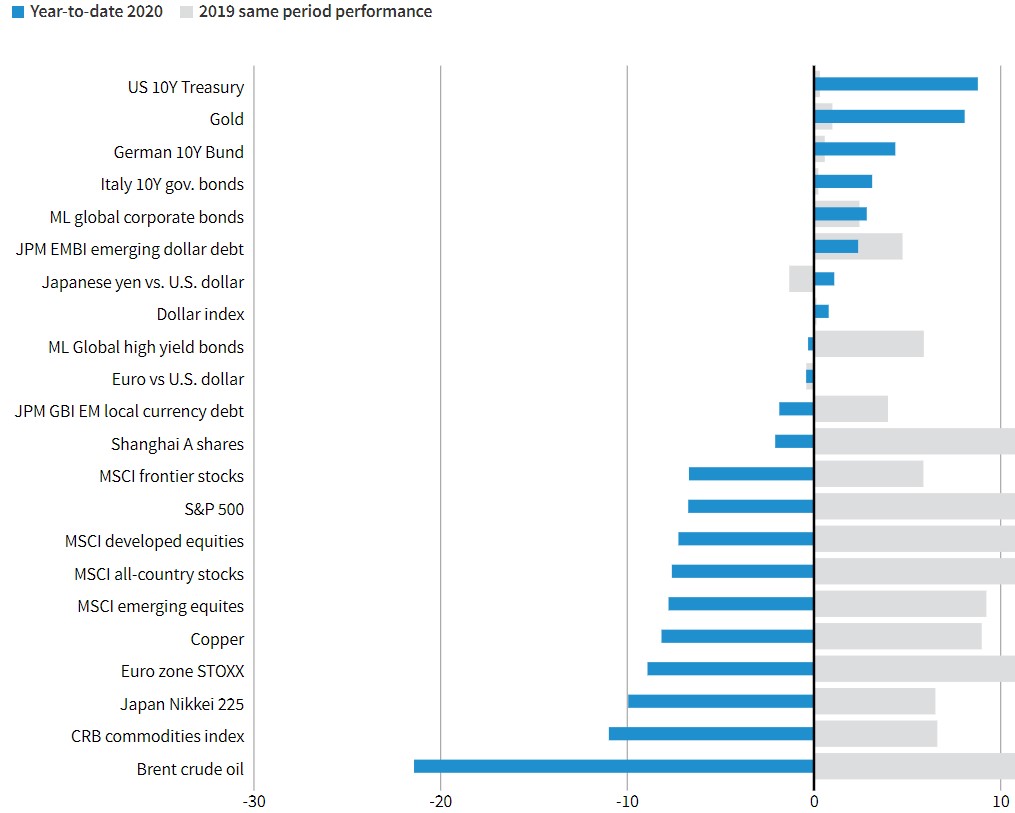

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table) ◆ G7 officials say there will be “appropriate” policy moves in a desperate attempt to prevent the the COVID-19 epidemic from leading to a global recession and financial crisis; it appears likely that there will be coordinated central bank action in a move to ultra loose monetary policies 2020 ASSET PERFORMANCE (Reuters) – Gold surged over 3% yesterday after the U.S. central bank cut interest rates

Topics:

Mark O'Byrne considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008

◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table)

◆ G7 officials say there will be “appropriate” policy moves in a desperate attempt to prevent the the COVID-19 epidemic from leading to a global recession and financial crisis; it appears likely that there will be coordinated central bank action in a move to ultra loose monetary policies

|

2020 ASSET PERFORMANCE

(Reuters) – Gold surged over 3% yesterday after the U.S. central bank cut interest rates to help cushion the economy from damage caused by the coronavirus outbreak and on expectations of policy easing by other major central banks. Spot gold climbed 2.9% to $1,636.25 an ounce by 02:19 p.m. EST (1919 GMT), set for its biggest one-day percentage rise since June 2016. U.S. gold futures settled 3.1% higher at $1,644.40. Prices earlier soared as much as 3.3% after the U.S. Federal Reserve cut interest rates in an emergency move to safeguard the world’s largest economy from the impact of the coronavirus. “Clearly the Fed delivered a very strong signal that they are ready to support the U.S. economy against the growing threat of the virus and this is quite a green light for other central banks to do the same,” said Daniel Ghali, commodity strategist at TD Securities. The Fed said it is cutting rates by a half percentage point to a target range of 1.00% to 1.25%. In a news conference following the decision, Fed Chair Jerome Powell said the coronavirus would weigh on the U.S. economy for some time. “An intermeeting cut, the first since 2008, also sends a message that the Fed is all-hands on deck,” said Tai Wong, head of base and precious metals derivatives trading at BMO. “This should be positive for equities and positive for gold, at least short term, with rates lower and potentially other central bank action on the way.” Lower interest rates reduce the opportunity cost of holding non-yielding bullion and also weigh on U.S. yields and the dollar, in which gold is priced. The dollar index fell to its lowest in nearly 2 months against a basket of currencies. “Gold is back above the $1,600 an ounce level and could be poised for another run towards the $1,700 level once governments announce the details to the major fiscal stimulus response,” said Edward Moya, a senior market analyst at broker OANDA, in a note. |

Gold 2020 performance |

| Financial Contagion – What Are The Risks? |

Tags: Daily Market Update,Featured,newsletter