The Swiss National Bank (SNB) retains the ability to wage currency market interventions if necessary, Martin Schlegel, one of the SNB’s alternate governing board members, said on Wednesday, according to Bloomberg. Key quotes The balance sheet is the result of our monetary policy. That means that if we need to loosen monetary policy we still have the room to expand the balance sheet. There is no alternative to the SNB’s negative interest rate, currently at minus 0.75%. The US on Tuesday added Switzerland to its watch list of currency manipulators, squeezing out whatever little room the SNB had to intervene in the FX markets to stall the rally in franc. As a result, markets put a bid under the franc, sending it to its strongest in nearly three years against the

Topics:

Omkar Godbole considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

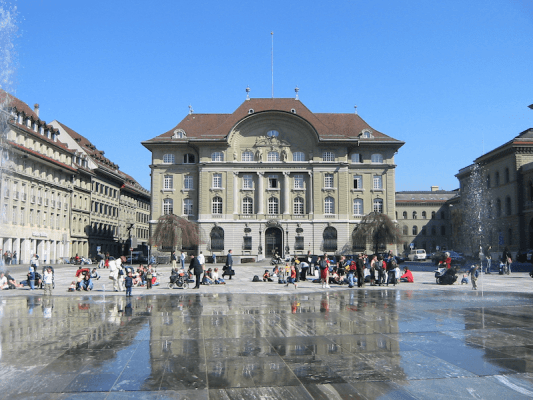

The Swiss National Bank (SNB) retains the ability to wage currency market interventions if necessary, Martin Schlegel, one of the SNB’s alternate governing board members, said on Wednesday, according to Bloomberg.

The Swiss National Bank (SNB) retains the ability to wage currency market interventions if necessary, Martin Schlegel, one of the SNB’s alternate governing board members, said on Wednesday, according to Bloomberg.

Key quotes

The balance sheet is the result of our monetary policy. That means that if we need to loosen monetary policy we still have the room to expand the balance sheet.

There is no alternative to the SNB’s negative interest rate, currently at minus 0.75%.

The US on Tuesday added Switzerland to its watch list of currency manipulators, squeezing out whatever little room the SNB had to intervene in the FX markets to stall the rally in franc. As a result, markets put a bid under the franc, sending it to its strongest in nearly three years against the euro.

Tags: Featured,newsletter