USD/CHF focuses more on China’s official PMI-led optimism that the US-China tussle. A few second-tier Swiss data can offer intermediate moves ahead of the US statistics. Trade/political news will continue driving the markets in the case of strong headlines. Technical Analysis October month high near 1.0030 can become immediate resistance ahead of May-end tops surrounding 1.0100. Alternatively, sellers will look for entry below November 08 high near 0.9980. Technical Analysis - Click to enlarge With the most Asian markets up for Monday’s trading session, USD/CHF takes the bids to 1.0005 despite Axios conveying the news of delays in the US-China trade deal. The reason could be the underlying optimism offered through China’s official activity numbers. Market’s

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF focuses more on China’s official PMI-led optimism that the US-China tussle.

- A few second-tier Swiss data can offer intermediate moves ahead of the US statistics.

- Trade/political news will continue driving the markets in the case of strong headlines.

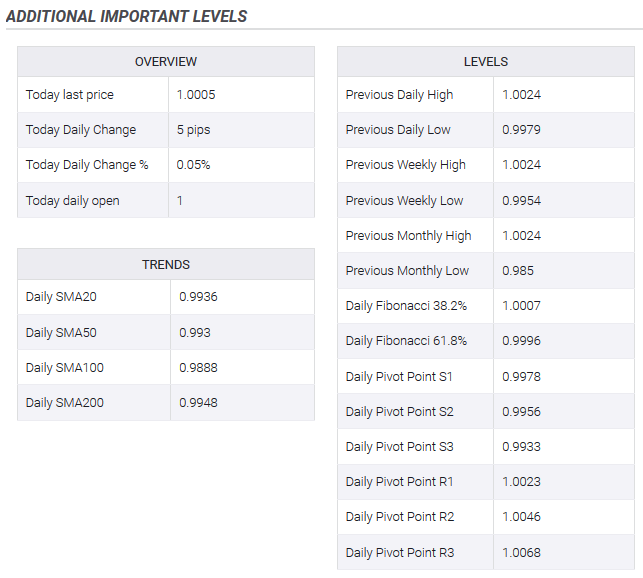

Technical AnalysisOctober month high near 1.0030 can become immediate resistance ahead of May-end tops surrounding 1.0100. Alternatively, sellers will look for entry below November 08 high near 0.9980. |

Technical Analysis |

With the most Asian markets up for Monday’s trading session, USD/CHF takes the bids to 1.0005 despite Axios conveying the news of delays in the US-China trade deal. The reason could be the underlying optimism offered through China’s official activity numbers.

Market’s risk sentiment has recently improved in a response to China’s November month official readings of Manufacturing Purchasing Managers’ Index (PMI). The key activity gauge rose to the highest since April and cleared 50.00 contraction figures for the first time after many months of below-50 levels.

On the contrary, Axios reports that the phase-one deal between the United States (US) and China may now come around the next year. The reasons cited are differences over tariff rollback, agricultural purchases and Hong Kong Act. A lack of response could be attributed to China’s silence and the nearness to data.

Risk tone seems to favor more to the China data as the US 10-year treasury yields gain more than three basis points (bps) to 1.87% while Japan’s NIKKEI and Australia’s ASX 200 marking 1.0% and 0.55% gains by the press time.

Investors will now focus on October month Swiss Real Retail Sales and November month SVME – PMI ahead of the US manufacturing PMIs from Markit and ISM. While forecasts suggest downbeat prints of the Swiss data, the expected recovery in the US economics can help extend the recent run-up.

Tags: Featured,newsletter