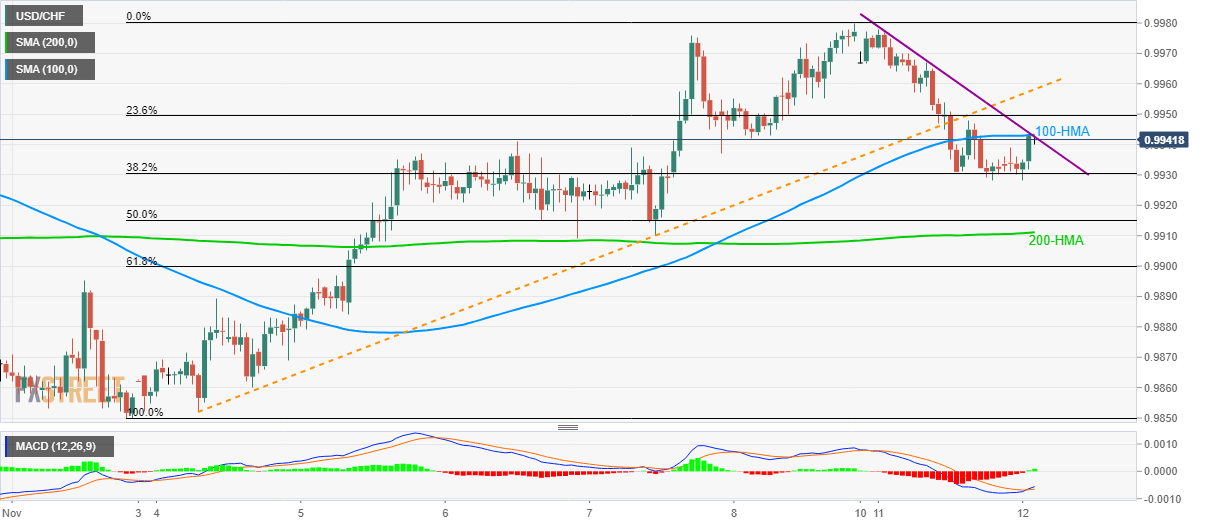

The USD/CHF pair’s recent recovery confronts 100-HMA, adjacent resistance line. 38.2% Fibonacci retracement, 0.9900 act as nearby supports. Following its bounce off 38.2% Fibonacci retracement of the current month upside, USD/CHF confronts near-term key resistance confluence while taking the bids to 0.9942 during early Tuesday. However, a sustained break of 0.9945 becomes necessary for the quote to extend recent recovery towards the support-turned-resistance line of 0.9960 and then to a monthly high near 0.9980. Given the bullish signal from Moving Average Convergence and Divergence (MACD) supporting buyers beyond 0.9980, 1.0000 psychological magnet will be on their radars ahead of October month top near 1.0030. Alternatively, pair’s declines below 38.2% Fibonacci

Topics:

Anil Panchal considers the following as important: 1) SNB and CHF, 1.) FXStreet on SNB&CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

- The USD/CHF pair’s recent recovery confronts 100-HMA, adjacent resistance line.

- 38.2% Fibonacci retracement, 0.9900 act as nearby supports.

| Following its bounce off 38.2% Fibonacci retracement of the current month upside, USD/CHF confronts near-term key resistance confluence while taking the bids to 0.9942 during early Tuesday.

However, a sustained break of 0.9945 becomes necessary for the quote to extend recent recovery towards the support-turned-resistance line of 0.9960 and then to a monthly high near 0.9980. Given the bullish signal from Moving Average Convergence and Divergence (MACD) supporting buyers beyond 0.9980, 1.0000 psychological magnet will be on their radars ahead of October month top near 1.0030. Alternatively, pair’s declines below 38.2% Fibonacci retracement level of 0.9930 highlights 200-Hour Simple Moving Average (HMA) as the next key support, at 0.9910 now, a break of which could fetch the quote to 0.9895 and then towards monthly bottom surrounding 0.9850. |

USD/CHF hourly chart(see more posts on USD/CHF, ) |

Trend: Bullish

Tags: Featured,newsletter,USD/CHF