◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch ◆ Growing stresses in U.S. banking and financial system should support gold Spot Gold Price - Click to enlarge Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World [embedded content] Related posts: FX Daily, September 18: FOMC Meets Amid Money Market Pressures Swiss tourist chief warns against Europe-only

Topics:

Mark O'Byrne considers the following as important: 6a.) GoldCore, 6a) Gold & Bitcoin, Daily Market Update, Featured, JPMorgan, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| ◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’

◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch ◆ Growing stresses in U.S. banking and financial system should support gold |

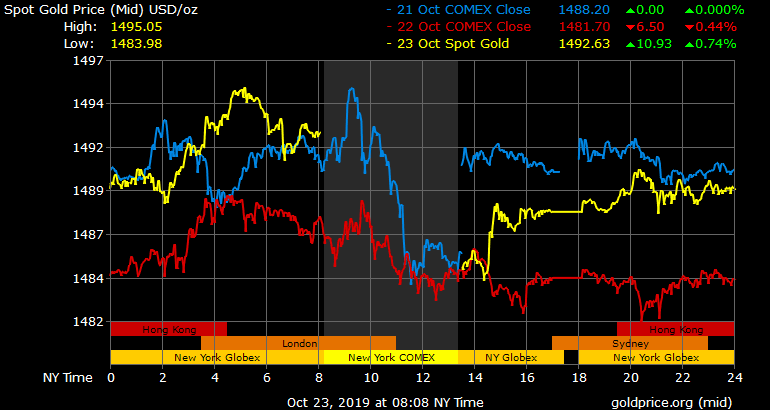

Spot Gold Price |

Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World |

Tags: Daily Market Update,Featured,JPMorgan,newsletter