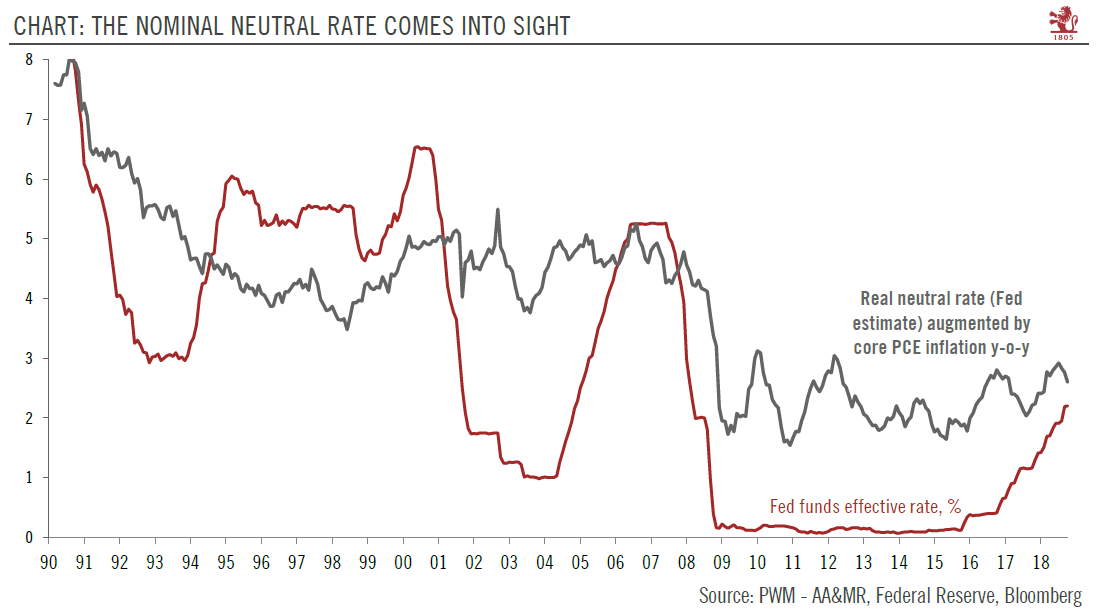

Next year is likely to mark the end of the tightening cycle as the Fed fund rates moves closer to the Fed’s estimate of the nominal neutral rate.The Federal Reserve estimated the theoretical, inflation-adjusted (‘real’) neutral rate at 0.8% in Q3 18, slightly down from 0.9% in Q2, but in line with the average since 2016.Adding core PCE inflation of 1.8% year-on-year in October (down from 1.9% in September), this means a ‘spot’ nominal neutral rate of 2.6%.The Fed’s strategy has been to gradually increase the Fed funds rate at least to a neutral level, which the Fed has put in its ‘dot plot’ at around 3%. This implies the Fed expects a slight pick-up in the real neutral rate, which has yet to happen.Bottom line, the neutral rate remains stuck at much lower levels than before the financial

Topics:

Thomas Costerg considers the following as important: Fed rate forecast, Fed rate hikes, Macroview, Uncategorized, US neutral rate

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Next year is likely to mark the end of the tightening cycle as the Fed fund rates moves closer to the Fed’s estimate of the nominal neutral rate.

The Federal Reserve estimated the theoretical, inflation-adjusted (‘real’) neutral rate at 0.8% in Q3 18, slightly down from 0.9% in Q2, but in line with the average since 2016.

Adding core PCE inflation of 1.8% year-on-year in October (down from 1.9% in September), this means a ‘spot’ nominal neutral rate of 2.6%.

The Fed’s strategy has been to gradually increase the Fed funds rate at least to a neutral level, which the Fed has put in its ‘dot plot’ at around 3%.

This implies the Fed expects a slight pick-up in the real neutral rate, which has yet to happen.

Bottom line, the neutral rate remains stuck at much lower levels than before the financial crisis, meaning the peak in Fed rates is likely to be much lower than before as well (the Fed funds rate stood at 5.25% on the eve of the crisis in 2007).

While many Fed policy makers, including Chairman Jerome Powell himself, have tried to dilute the importance of the neutral rate as the lodestar of Fed tightening, recent communication suggests it remains an important anchor and many policymakers are reluctant to push rates above it.

The Fed is still poised to hike rates on 19 December, supported by the still-solid domestic macro backdrop. But the 2019 outlook looks particularly blurry, especially as the neutral rate remains ‘stuck’ at a relatively low level. We still see additional rate hikes in 2019, but the big picture remains that next year is likely to mark the end of the Fed’s tightening cycle.