Next week’s Fed policy meeting is likely to confirm that the central bank is still on the path of gradual rate hikes, but could also see some hawkish signals on future policy.The Fed is very likely to raise rates by 25bps on 26 September, dismissing the trade war risk and emphasising the strong domestic economy and healthy job market instead.With a rate widely anticipated, the focus will be on any signals about future rates. We expect Chairman Jerome Powell’s press conference and the update ‘dot plot’ chart (which presents Fed members’ forecasts for policy rates) to contain some hawkish signals, including some that point to another rate increase in December.There has already been a hawkish tilt in recent Fed rhetoric, reflecting strong domestic data (solid GDP growth, the pick-up in wage

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Next week’s Fed policy meeting is likely to confirm that the central bank is still on the path of gradual rate hikes, but could also see some hawkish signals on future policy.

The Fed is very likely to raise rates by 25bps on 26 September, dismissing the trade war risk and emphasising the strong domestic economy and healthy job market instead.

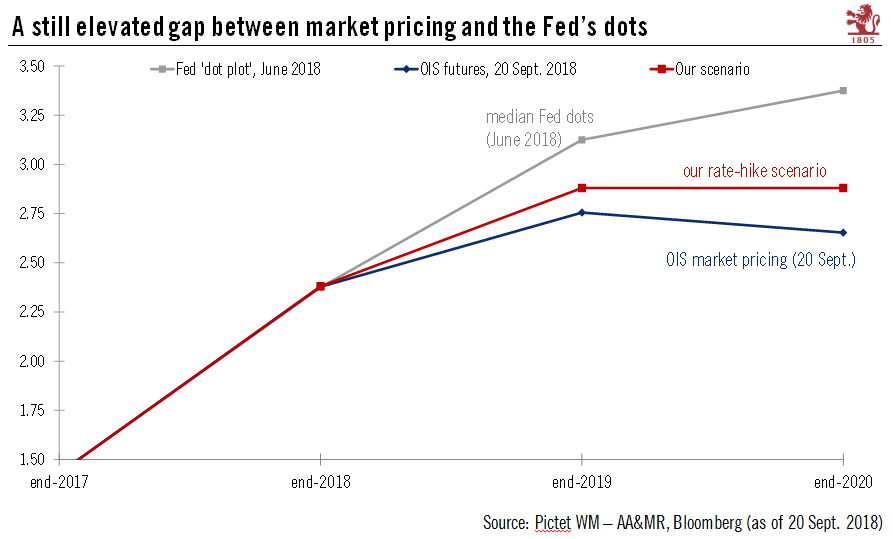

With a rate widely anticipated, the focus will be on any signals about future rates. We expect Chairman Jerome Powell’s press conference and the update ‘dot plot’ chart (which presents Fed members’ forecasts for policy rates) to contain some hawkish signals, including some that point to another rate increase in December.

There has already been a hawkish tilt in recent Fed rhetoric, reflecting strong domestic data (solid GDP growth, the pick-up in wage growth etc..).

Next week, the Fed could indicate that it is increasingly likely that it will push rates above their theoretical ‘neutral’ rate in the future, whereas the message up to now has been that it would stop at neutral. Powell, while pragmatic, is enamoured by mechanical rate rises, which could mean the ‘auto-pilot’ 25 bps per quarter rate hikes could continue for longer than expected. We currently expect a pause in the Fred rate hiking cycle in mid-2019, but there are rising risks that the rate pause could come later.

There is the possibility that the Fed rate will surpass the 3% rate level many Fed officials previously identified as a potential ceiling in 2019. This year’s strong growth is creating expectations that the potential rate ceiling has shifted up. The Fed continues to be of the view that trade tensions should not be given undue importance as long as they do not affect hard data, such as jobs or GDP.

At the same time, the Fed is also likely to want to avoid making any waves in the run-up to the upcoming mid-term elections, and will therefore most likely keep potential rate hikes within certain limits.