In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work. The Fed can’t determine the right gold price, or indeed control the price either. Nor would it work to declare the dollar to be gold backed. A high gold price won’t make gold circulate. Nothing less than redeemability will do. But you cannot retroactively declare the irredeemable dollar to be gold-redeemable.

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, dollar price, Featured, Free market, gold basis, gold bond, Gold co-basis, Gold Standard, newslettersent, silver basis, Silver co-basis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work. The Fed can’t determine the right gold price, or indeed control the price either. Nor would it work to declare the dollar to be gold backed. A high gold price won’t make gold circulate. Nothing less than redeemability will do. But you cannot retroactively declare the irredeemable dollar to be gold-redeemable. Every dollar in the system was borrowed into existence without the expectation of redemption. Changing this rule would create the greatest orgy of lobbying Washington has ever seen.

Interest Draws Gold into Circulation

Interest is the only force that can pull gold out of private hoards and into circulation. We have said many times, that interest is the regulator of flow in the gold standard. A lower rate will tend to push gold out of the market and into hoards. A higher rate will tend to draw it into the market.

Now let’s drill down into that. What’s the mechanism of circulation? We will incorporate into our discussion a point we touched last week—that buyers want a lower price and sellers want a higher price—and clarify what we mean by price in this context. It takes a market to find the right price.

We will also add another idea into the mix. That the dollar is not held up by faith or ignorance. It is not a wisp of cloud, waiting for one fact to come along and get everyone woke and dispel the illusion, and collapse the dollar.

To grow any business larger than a one-man workshop, the entrepreneur must raise money. In larger firms, this typically means obtaining financing from outside investors. The business spends this money on building its plant, hiring people, and buying raw materials. When the business succeeds, it sells its products and earns revenues. When it generates a profit, it can pay interest or dividends to its investors.

Think about this. The business borrows (just to keep it simple, our example is debt financing) money from investors, and spends the money. This is one step in circulation. Obviously, investors will not choose to lend money at 0% interest (not addressing how irredeemable paper currency disenfranchises them).

So if interest is zero, then gold is blocked from circulating. Even if gold were already circulating, savers are constantly saving, that is pulling gold coins out of circulation. If they are not lending those coins, then they are hoarding them. All the gold would be out of circulation soon enough, and the gold standard would dry up.

Resorption and Regrowth

An interesting illustration is bone in the human body. You may think of the ulna (the outer bone in your forearm) as having a fixed mass. It doesn’t seem to change, after you reach adulthood. However, two processes are occurring constantly. One is bone resorption, the removal of material. This is balanced by the other force, new bone growth.

In a working gold standard, the savers are performing the gold equivalent of resorption. Interest is performing the gold equivalent of new growth. Savers are pulling coins out of circulation to prepare for retirement. Interest is persuading them to remove it from the mattress and bring it to a bank.

Anyways back to our example, assuming a business can obtain the financing it needs, it spends it on construction, tool vendors, wages, and suppliers. Each of those companies services their debts, pays their employees, buys their raw materials, etc. And all the employees buy necessities and luxuries.

Gold flows from investors to borrowers to suppliers and employees to other suppliers and ultimately back to investors. Investors are an integral part of the economy, as any real economy is built on top of accumulated capital. Even food, let alone computer chips, does not come from pure labor. Modern production is very capital-intensive. That means very efficient and very productive.

In the gold standard, of course capital is denominated in gold and payable in gold. But that’s not what we have today. So the 64 trillion dollar question is how do we transition?

What Gives the Dollar Value?

This is a good segue into the question of what gives the dollar value today. When someone begins to realize that the dollar is unsound, that the debt is growing out of control, and that the dollar is a promise that cannot be kept, he often makes an error. “Nothing is holding it up,” he marvels. “It must be the madness of crowds, a shared delusion, nothing more than faith!” He worries, “It’s going to collapse soon.” Some writers seem to make a living off this, coming up with an endless series of factoids, fake news, conjecture, and wild conspiracy theories (remember that prediction of collapse scheduled for July 1? The the same promotional page is still online at the same URL, but it’s been revised. Doomsday has been postponed to Dec 31, 2018).

Yet the dollar keeps on keeping on.

If the dollar had value due to nothing more than illusion, then it should have been dispelled by now. Whatever holds it up, is not fragile but quite robust. We have argued before: it’s the struggles of the debtors. Every farmer who owes a million bucks is frantically planting as much wheat as he can, to harvest as many bushels as he can. He has to sell an awful lot of them, at $5.15 to service his loan. Every burger joint is frantically grilling as many burgers as he can. Every manufacture of cars is frantically producing as many as he can.

If one measures the value of the dollar by how much one can purchase with it, then the debtors are working very hard to increase the value of the dollar!

The more the interest rate falls, the more farmers borrow to produce more, and the harder it becomes to make the profit margin to service the debt much less repay it in full. We say that the net present value of all debt rises, as interest falls.

And it’s not just farmers, as we noted. It’s burger joints, carmakers, and manufacturers of pencils. Nearly every producer of everything owes dollars. They couldn’t accept gold in payment for goods even if they wanted to, as that would introduce a price risk. They sell their goods for dollars—thus pushing up the purchasing power of the dollar—because they owe dollars. Dollars circulate, all capital assets are financed in dollars, all wages are paid in dollars, and all goods are bought with dollars. It looks like an unbreakable cycle.

How Much Gold Needed for Gold Standard?

Meanwhile, all the gold ever mined in human history sits on shelves deep in vaults, gathering dust. How much gold does it take to run the gold standard? There is no equation to generate a precise answer (we know that, in the 1890’s at the peak of when Britain ran the world’s commerce and monetary system, there was about 150 tons of gold in London).

We propose that the amount of gold needed is inversely proportional to the interest rate. At a rate of zero, this quantity is undefined, infinite. And that’s what we see today. No matter how much gold comes out of the mines, it disappears just as fast into hoards.

Yet with revenues in dollars, no one can offer interest on gold (except us). It’s a serious catch-22.

Benefits of Borrowing in Gold

Actually, there is one group who has an income in gold, and therefore can pay interest in gold. Keith has argued that it’s in their financial interest to do so, because it removes gold price risk.

Unfortunately, even gold producing enterprises (and gold taxing governments) are borrowing in dollars today. This creates a price risk—if the price of gold drops, then it becomes harder for them to service their debts. So they must hedge, which adds moving parts, cost, complexity, and other risks. Even if nothing changes in the economy, these companies and governments should replace their dollar bonds with gold bonds.

Keith has been proposing for many years that the debtor can use the gold bond to get out of debt at a discount (and a sovereign government debtor can use the gold bond to avert Armageddon). When it sells the new gold bond, the debtor should use the opportunity to retire its existing dollar bonds. It’s not trying to go deeper into debt, but replace dollar with gold debt. So, at auction, it tells the buyers to tender outstanding dollar bonds, not dollars (and not gold).

At first, we expect the market to price the paper bond at par. That is, in a hypothetical 1000oz bond, buyers should bid $1.25M worth of outstanding paper bonds (at a $1,250 gold price). However, with each successive auction, the market exchange rate of paper bonds to gold bonds will rise above par. This is because the bond repays the principal over many years. The dollar is undergoing constant debasement by a central bank whose explicit goal is stated at two percent per annum (and which can overshoot, of course).

You Can’t Discount the Dollar in Dollars!

Therefore, the present value of a dollar to be paid in a decade should be discounted. This cannot be expressed in dollar terms. The only discount in dollar terms, is for the interest rate. There is no way to express a discount for devaluation of a future dollar in present dollars. However, it can be expressed in gold: the dollar bond to gold bond exchange rate. This is a separate phenomenon from interest. And a separate phenomenon from the price of gold.

Needless to say, getting out of debt at a reduced price is another good reason to issue gold bonds!

But back to our point, this is a market mechanism to set a price for the transition to gold. It’s not the price of gold (though that will likely rise through this period) but the dollar-bond price of the gold-bond. The market continuously updates this price.

Without too much hyperbole, we could call this a market for the vehicle to convey us the gold standard.

After gold producers, the next logical issuer of gold bonds is the producer of commodities. First, copper production will be financed in gold, then oil, and then wheat. The mechanism is a bit more complicated than that for gold mining companies, so we will not delve into it here.

We don’t define the gold standard in terms of gold being used to buy and sell goods (as we don’t define money as the medium of exchange). A working definition is when anyone who wants to, can earn interest on their gold. However in the gold standard, people do exchange gold for goods and services. A big step towards this is taken when commodity producers finance production in gold. They will want gold revenue to service their gold debts. This will lead to commodities markets where goods are exchanged for gold.

Stable Bond Price During Transition

There is one final virtue to this transition path. Look at the conventional dollar bond. Some analysts, even in the mainstream, predict a collapse in bond prices. Collapse is not a good thing. We need a graceful changeover, where banks, insurers, pensions, and annuities remain solvent in nominal terms.

The market price mechanism, for redeeming paper bonds to get gold bonds, will ensure a very robust bid for paper bonds. As the paper bonds are the currency to buy gold bonds, they will be sought out by investors who eagerly snap them up, to exchange them for more gold bonds.

Isn’t this precisely the behavior that we should want? Not a mad rush for the gold exit door, with people trampled to death, and a wake of bankruptcies left behind. Not a sudden “moment of wokeness”, when everyone comes to the same realization at the same time—that paper bonds and the dollar itself are worthless—and a stampede of selling everything, that Mises called the “crack up boom”.

We should want an orderly market, quoting firm bid and offer prices for paper even as the transition proceeds. We should not want to find out what it looks like when gold backwardation becomes permanent, and a crisis of confidence.

We should all want the opposite of collapse. Not a reset, but an upgrade.

Supply and Demand Fundamentals

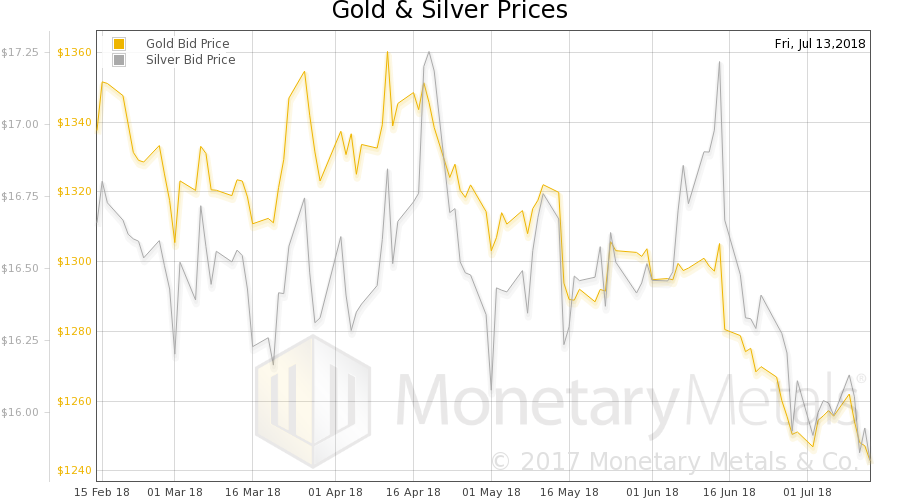

The price of gold fell $13, and that of silver $0.23.

Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why?

Obviously, this week the sellers were more aggressive, and the buyers more leisurely. Even the so-called digital gold, bitcoin, fell about 6% this week. It seems those struggling debtors are not only selling the wheat and burgers they produce. They are selling financial assets they hold.

Soy dropped 20% in June and the first half of July. Wheat fell only 8% since late May, but has been in an epic falling trend since 2012, having lost 45%. And that wheat price in 2012 was about a third down from the peak of 2008. Soy, by the way, is down over 50% from its peak in 2012. Oil, as much as it’s come up in the last two years, is down 34% from its 2014 peak.

We have to bite our tongues every time someone says “inflation”, with or without breathlessness. Wheat is down from $13 a bushel to under $5 since 2008 (with rising money supply). People insist on inflation, “the government is lying to us about the consumer price index.” We don’t know that CPI is a lie, but we do know that the price of wheat is real.

If the spread between retail bread and commodity wheat has widened, blame taxes and regulations. The effects of monetary policy will be seen most clearly in commodity markets. And least clearly seen where the impact of government is greater. State, county, and city governments all get their pound of flesh. They have permitting, licensing, zoning, labor law, restricted loading hours (with mandatory time and a half). Retail stores lose more and more productive floor space due to regulations like Americans with Disabilities Act. Lawsuits drive up insurance costs. And rising “user fees” charged by desperate municipalities, for permission to be in business. California makes gasoline more expensive by mandating changes to the blend. And now, tariffs will spike some prices. The price of soy have dropped due to tariffs.

Contra Milton Friedman, who said “inflation is everywhere and always a monetary phenomenon”, often prices rise due to nonmonetary factors.

Of course, if the price of a double latte doubles due to a double dose of regulation and taxation, that is not a driver for the price of gold to go up. The price of gold does not track this kind of inflation.

Keith is going to be at the Sprott Natural Resources Symposium this week in Vancouver. Please contact us if you want to meet. Sprott gave us a discount code for $100 off registration: MDA2018.

Gold and Silver PricesSo whither the price of gold next? We will provide a picture of the changing gold and silver fundamentals. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It went up this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

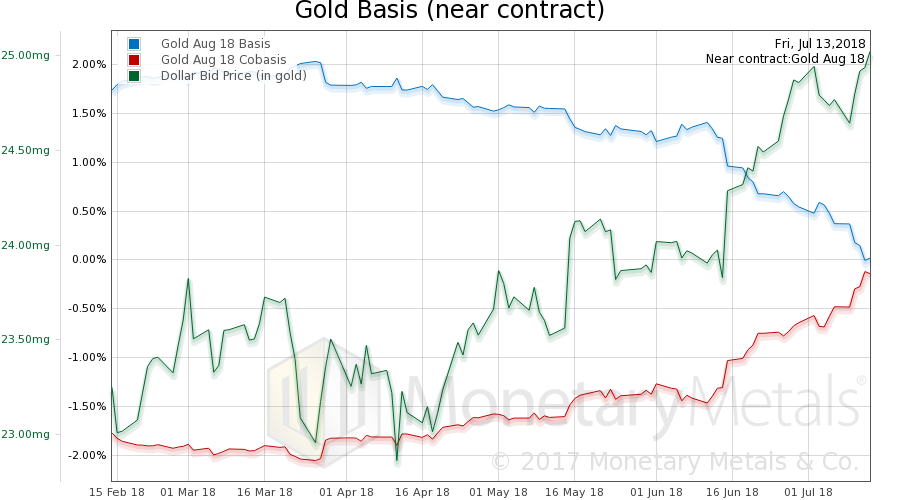

Gold Basis and Co-basis and the Dollar priceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. Once again scarcity (i.e. cobasis) rising with price of the dollar (i.e. inverse of the price of gold, measured in dollars). It’s times like this when you want a picture of the fundamentals. It is easy to think that demand for gold is going down. But is it? Not this week. The Monetary Metals Gold Fundamental Price remains at $1,300 (well $1299). |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

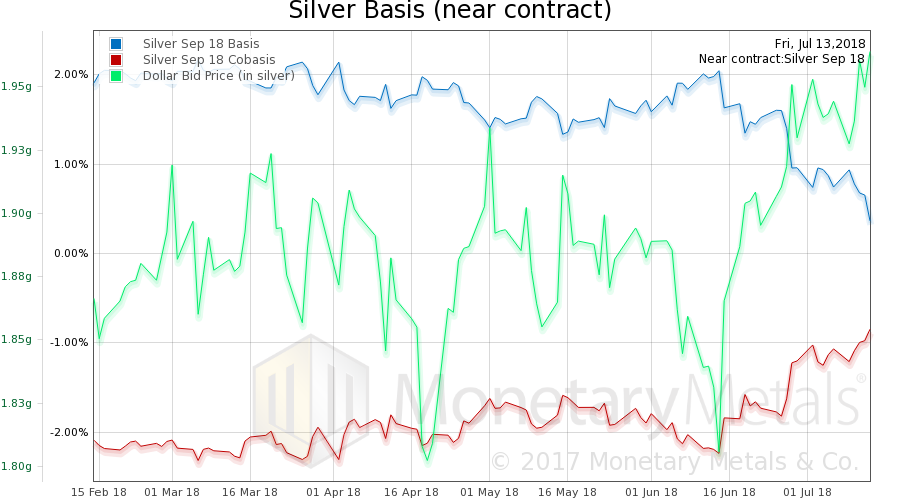

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The same thing in silver, rising cobasis, with a drop in price. The Monetary Metals Silver Fundamental Price rose 4 cents, to $17.48. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

So in both metals, most people would say that we had a bad week. However, a look at the fundamentals shows it wasn’t as bad as the people with only price charts think.

© 2018 Monetary Metals

Tags: Basic Reports,dollar price,Featured,Free market,gold basis,gold bond,Gold co-basis,gold standard,newslettersent,silver basis,Silver co-basis