Alongside clear signals that policy rates will continue to rise in the near term were some dovish hints about policy further down the road.Chairman Jerome Powell’s congressional testimony on 17 July contained limited new information about the Federal Reserve’s monetary policy intentions. Conveying the impression that he maintained a steady hand on the tiller, Powell seemed unfazed by the recent escalation in trade. Instead, Powell remained positive about the global economy. He also highlighted the robustness of US growth, singling out continued strong job growth.In other words, Powell provided signals that the Fed is not ready yet to switch off its ‘auto pilot’ tightening (one rate hike per quarter) given the strong macro backdrop at home and abroad. Even though Powell did not explicitly

Topics:

Thomas Costerg considers the following as important: Fed monetary policy, Macroview, US Fed testimony, US neutral rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Alongside clear signals that policy rates will continue to rise in the near term were some dovish hints about policy further down the road.

Chairman Jerome Powell’s congressional testimony on 17 July contained limited new information about the Federal Reserve’s monetary policy intentions. Conveying the impression that he maintained a steady hand on the tiller, Powell seemed unfazed by the recent escalation in trade. Instead, Powell remained positive about the global economy. He also highlighted the robustness of US growth, singling out continued strong job growth.

In other words, Powell provided signals that the Fed is not ready yet to switch off its ‘auto pilot’ tightening (one rate hike per quarter) given the strong macro backdrop at home and abroad. Even though Powell did not explicitly say as much, the next quarter-point rate hike should therefore be in September.

Alongside the hawkish message about near-term rate tightening were some dovish hints about rate hikes further down the road, echoing messages already sent at the June post-Fed meeting press conference. First, Powell stressed that “gradual” rate hikes in the near term are based on an economy that is strong “for now” – two words that suggest some uncertainty about the outlook. Second, Powell gave the impression he still saw inflationary risks as limited, again highlighting “moderate” wage growth despite the low unemployment rate. Also, Powell sounded relaxed about core inflation rising slightly above 2% on a temporary basis (which would simply offset downside deviations in recent quarters).

Asked about how flattening of the Treasury yield curve (the difference between short-dated and long-dated yields) might influence Fed thinking, Powell tread a middle ground, making clear that the Fed viewed the 10-year yield as a gauge for where the market puts the theoretical ‘neutral rate’, but hinting that the yield curve was not an important signal in itself.

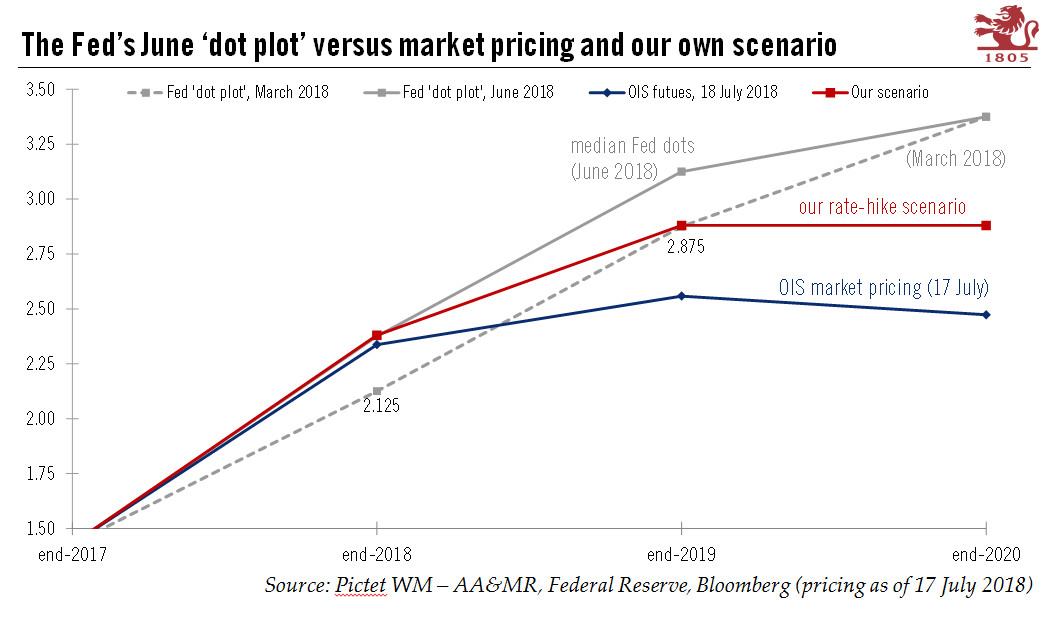

The Fed chairman’s core message seemed to be that a 10-year yield that remained anchored below 3% meant there was some risk that the Fed halts the hiking cycle earlier than currently implied by the Fed’s ‘dot plot’ rate projections), which are based on a forecast of a gradually increasing theoretical neutral rate.

While Powell did not say as much, we think the Fed will change its view of US monetary policy to “neutral” from “accommodative” sometime in the second half of this year. This could be the next key policy event to watch as it would reinforce our scenario of a rate pause by mid-2019.