Policy makers’ forecast for rate hikes this year likely to be raised, but central bank will be much more cautious on view further out.The Federal Reserve’s 12-13 June meeting takes place amid a strong economic backdrop at home, and the Fed is unlikely to hesitate about hiking rates by another quarter-point to a range of 1.75-2.00% this week. The US labour market is particularly solid: the unemployment rate dropped to 3.8% in May, the lowest rate since April 2000. The three-month average gain in non-farm payrolls was a solid 179,000.The Fed has entered a de facto routine of one rate hike per quarter and we see no reason to expect this to change in the near term – hence our view that there will be further rate hikes at meetings with press conferences: after a likely hike on 13 June, the

Topics:

Thomas Costerg considers the following as important: Fed dot chart, Fed dot plot, Fed preview, Fed rate forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Policy makers’ forecast for rate hikes this year likely to be raised, but central bank will be much more cautious on view further out.

The Federal Reserve’s 12-13 June meeting takes place amid a strong economic backdrop at home, and the Fed is unlikely to hesitate about hiking rates by another quarter-point to a range of 1.75-2.00% this week. The US labour market is particularly solid: the unemployment rate dropped to 3.8% in May, the lowest rate since April 2000. The three-month average gain in non-farm payrolls was a solid 179,000.

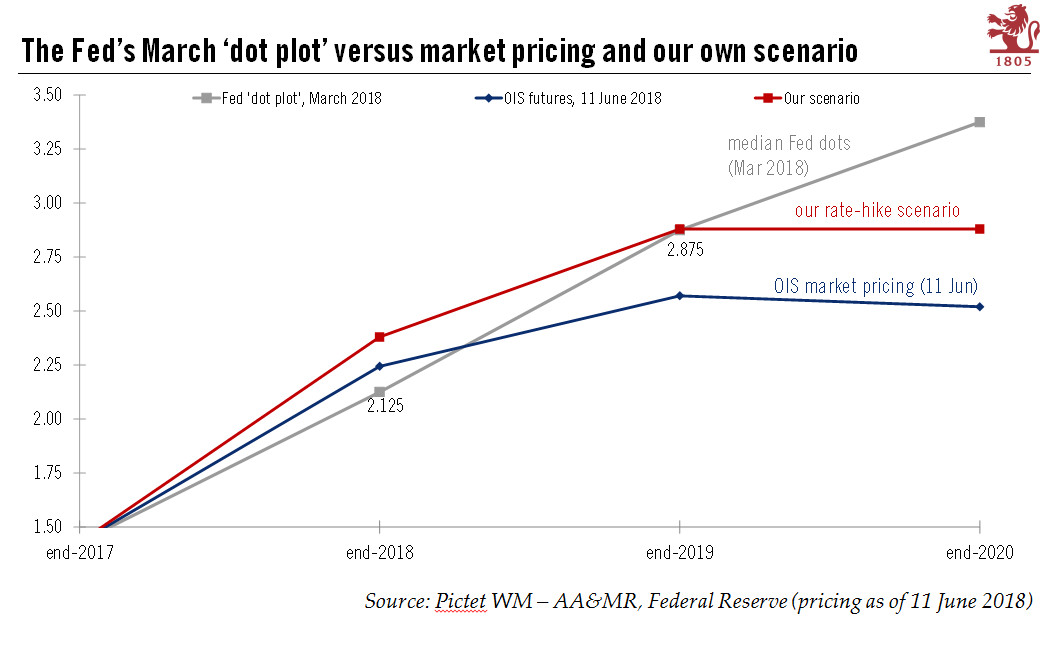

The Fed has entered a de facto routine of one rate hike per quarter and we see no reason to expect this to change in the near term – hence our view that there will be further rate hikes at meetings with press conferences: after a likely hike on 13 June, the next hikes should come in September and December. Our scenario remains that the Fed will hike rates by a total of four times this year and twice next year. This is above what the market is pricing in (see chart).

By also this week raising the median ‘dots’ for 2018 (the illustration of Fed members’ rate hikes views, released alongside the Fed’s decision), the Fed is likely to consolidate the case for a total of four rate hikes this year, up from three in March.

While it is ‘business as usual’ in the near term, we think the Fed’s tone will be cautious regarding tightening signals further out, in 2019-20. In a nutshell, we do not think the Fed is yet convinced about the risk of ‘overheating’ of the US economy. Chiefly, US wage growth – the alpha and omega for Fed members – remains below the psychologically-crucial bar of 3.0%. Also, many Fed members are likely to highlight the still-poor underlying productivity picture, as well as the need to verify the pick-up in corporate investment post-tax cuts.

A key upside risk to this Fed scenario would be much stronger inflation (in particular core inflation) coupled with stronger wage growth and a drifting higher of inflation expectations. But while core inflation remains on a gradual upward path, broadly consistent with the improvement in the economy, inflation expectations and wage growth are still under control. We expect wage growth to nudge slowly up to 3% later this year.

A crucial downside risk would be the negative effect that escalating trade rhetoric could have on US business confidence. This year is supposed to be about rising corporate investment, which is the main factor supporting our 3% annual GDP growth forecast for the US. So far, business surveys suggest we are on track for that level of growth, but additional uncertainty related to US trade policy could upset the apple cart.