Summary:

Bubbles always look unstoppable, yet they always burst.When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By “marginal” I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent. In bubble manias, buyers of real estate reckon the potential appreciation gains are worth the risk of buying a house they really can’t afford with the intention of flipping the home for a profit. Workers moving to high-rent cities reckon they’ll either make more money going forward or find a cheaper flat later, so they pony up the high rent. When there’s steady overtime or generous tips adding to the household income,

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Bubbles always look unstoppable, yet they always burst.When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By “marginal” I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent. In bubble manias, buyers of real estate reckon the potential appreciation gains are worth the risk of buying a house they really can’t afford with the intention of flipping the home for a profit. Workers moving to high-rent cities reckon they’ll either make more money going forward or find a cheaper flat later, so they pony up the high rent. When there’s steady overtime or generous tips adding to the household income,

Topics:

Charles Hugh Smith considers the following as important: Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

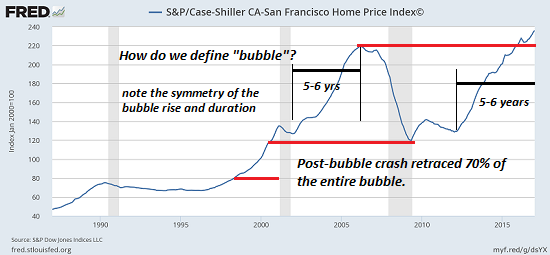

Bubbles always look unstoppable, yet they always burst.

When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By “marginal” I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent.

When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By “marginal” I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent.

In bubble manias, buyers of real estate reckon the potential appreciation gains are worth the risk of buying a house they really can’t afford with the intention of flipping the home for a profit.

Workers moving to high-rent cities reckon they’ll either make more money going forward or find a cheaper flat later, so they pony up the high rent.

When there’s steady overtime or generous tips adding to the household income, buying a new car or getting a new auto lease looks do-able.

It’s difficult to assess how many recent buyers, borrowers and renters are marginal, but given the stagnation in household incomes and rising debt loads, it seems reasonable to guess that a substantial number of recent buyers, borrowers and renters are one lay-off or one missed bonus or one unexpected expense away from being unable to pay their mortgage, loan payment or rent.

On the surface, home and auto sales and the rental market all look robust because there’s no differentiation in sales data between people paying cash, qualified buyers/renters and marginal buyers/renters for whom every month is a stretch.

There have been times in my life when I was down to my last $100, and if things don’t turn up very quickly and in a sustained fashion when finances are that fragile, then payments will be missed at the first unexpected drop in income or first unexpected expense. Budget-killers include medical emergency, illness/lost work time, major car repairs and a host of other everyday risks.

There’s another layer of recent buyers who don’t feel they’re marginal–but their financial stability is more contingent than they realize. Their employment seems solid, but their employers sales and profits are more contingent and fragile than they realize.

When good times reverse to bad times, every enterprise with marginal sales takes a hit, and layoffs follow as night follows day. When times are good, layoffs are not even on the horizon. But when the economic tides recede, skittish, hollowed-out, and/or debt-burdened employers push the layoff button sooner rather than later because their own financial structure is so fragile.

Those laid off assume they will find another job quickly because in good times, there appears to be a labor shortage. But when the tide ebbs, the job offers dry up seemingly overnight.

The Grand Illusion being pushed by central bankers and conventional pundits is that another round of interest rate cuts and quantitative easing (QE) will restart the economy should it falter. This is illusion because it ignores how much of the market is dependent on marginal businesses, buyers, borrowers and renters who will not benefit from QE or a tiny decline in interest rates.

book's website.

Tags: Featured,newsletter