Summary China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again. Former President Cardoso called on his PSDB party to quit the government coalition. Press reports suggest that Brazil pension reform is dead in the water. Stock Markets In the EM equity space as measured by MSCI, Russia (+5.3%), Korea (+4.5%), and Colombia (+3.7%) have outperformed this week, while UAE (-3.7%), Qatar (-3.1%),

Topics:

Win Thin considers the following as important: emerging markets, Featured, Michel Temer, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

Stock MarketsIn the EM equity space as measured by MSCI, Russia (+5.3%), Korea (+4.5%), and Colombia (+3.7%) have outperformed this week, while UAE (-3.7%), Qatar (-3.1%), and Turkey (-2.6%) have underperformed. To put this in better context, MSCI EM rose 0.1% this week while MSCI DM fell -0.4%. In the EM local currency bond space, Hungary (10-year yield -10 bp), Poland (-7 bp), and Peru (-4 bp) have outperformed this week, while Lebanon (10-year yield +66 bp), Argentina (+54 bp), and Czech Republic (+21 bp) have underperformed. To put this in better context, the 10-year UST yield rose 6 bp to 2.39%. In the EM FX space, BRL (+1.2% vs. USD), MYR (+1.1% vs. USD), and COP (+1.0% vs. USD) have outperformed this week, while ILS (-1.1% vs. USD), ZAR (-1.0% vs. USD), and INR (-0.9% vs. USD) have underperformed. |

Stock Markets Emerging Markets, November 08 Source: economist.com - Click to enlarge |

ChinaChina announced that it will remove foreign ownership limits on banks and allow foreign companies to take majority stakes in local securities firms, fund managers, and insurers. The move is just the latest in China’s efforts to open up its financial system, and coincides with President Trump’s visit this week. Regulators are still drafting details, which Vice Finance Minister Zhu said will be released soon. TurkeyCentral Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. It estimated that about $1.4 bln in FX liquidity will be injected into the system as a result. The bank also said it will allow exporters to repay around $5 bln of loans coming due through February 1 in liras instead of FX at fixed preferential rates. US-Turkey relations appear to be thawing slightly. Officials confirmed reports that the US is partially lifting its ban on issuing travel visas in Turkey, with Turkey reciprocating the move. Prime Minister Yildirim traveled to Washington to meet with Vice President Pence this week, but his demands to extradite cleric Gulen is a non-starter. We do not see any significant improvement in US-Turkey relations ahead. LebaneseMiddle East tensions are rising on a variety of fronts. Lebanese Prime Minister Hariri abruptly and unexpectedly resigned, and comes just after Saudi Arabia arrested many princes and senior officials on corruption charges. This follows a missile attack in Riyadh by Yemen rebels, which Saudi Arabia claims was orchestrated by regional rival Iran. ArgentinaArgentina central bank unexpectedly hiked rates again. The move is the second in less than a month, and takes the policy rate up 100 bp to 28.75%. The bank said that beyond the resilience in headline and core inflation, it was anticipating the likely impact of a scheduled increase in natural gas and electricity rates by end-2017. BrazilFormer President Cardoso called on his PSDB party to quit the government coalition. Otherwise, he predicted that the party would only play a minor role in 2018 elections. He added that the PSDB must continue to support reforms proposed by the Temer administration even if it leaves the coalition. The PSDB is in turmoil, as interim party President Jereissati was just dismissed. Press reports suggest that Brazil pension reform is dead in the water. Globo writes that “After meeting with allied leaders on Monday, the team of President Michel Temer made the following diagnosis about the Social Security reform: it will no longer be approved in the current government.” Other press reports estimate that Temer has only 280 votes in the lower house supporting the reforms, whilst 308 are needed. |

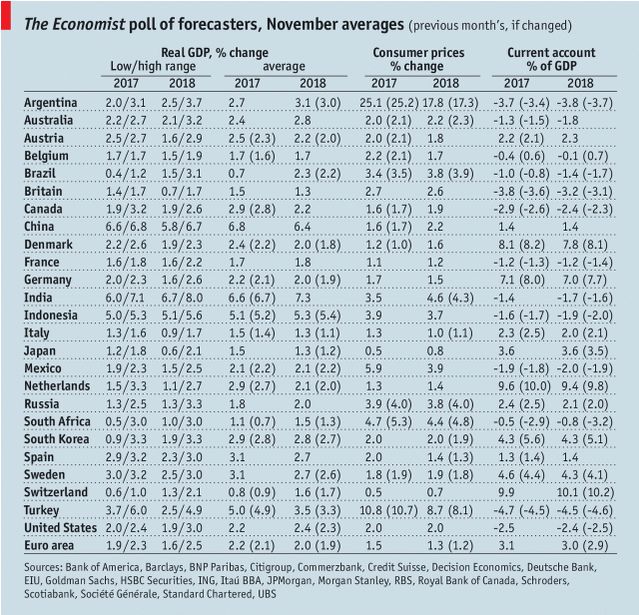

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, November 2017 Source: economist.com - Click to enlarge |

Tags: Featured,Michel Temer,newsletter,win-thin