Today, gold is increasingly viewed by German investors as a regular form of saving: 25% of those surveyed in 2016 said their gold purchase had been part of a regular review of their investments, while 23% said it was part of their retirement planning. We should all learn some German If we are to believe Western media then this year’s decision by various central banks to start unwinding easy monetary policy is a signal that the gold price is set to fall. However Germans gold demand suggests otherwise. It is clear that German investors are not swayed by the ‘newspeak’ the rest of the West seems so taken by. Whilst it is undoubtedly the 2008 financial crisis that set off the boom in gold demand, it is the value placed

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Today, gold is increasingly viewed by German investors as a regular form of saving: 25% of those surveyed in 2016 said their gold purchase had been part of a regular review of their investments, while 23% said it was part of their retirement planning.

We should all learn some GermanIf we are to believe Western media then this year’s decision by various central banks to start unwinding easy monetary policy is a signal that the gold price is set to fall. However Germans gold demand suggests otherwise. It is clear that German investors are not swayed by the ‘newspeak’ the rest of the West seems so taken by. Whilst it is undoubtedly the 2008 financial crisis that set off the boom in gold demand, it is the value placed on gold as a diversifying asset that has sustained the market. The ratio of investors buying gold bars and coins compared to those selling is around 10:1. This is despite the economy looking healthy and unemployment at its lowest since the 1990 reunification. Clearly, German confidence in the economy is not expressed through their gold investments any longer. Instead it is their confidence in gold that keeps the market strong. Investors and savers would be wise to pay attention to such investment logic. In countries such as the UK unemployment and wage growth are nowhere near as desirable as we see in Germany. Additionally, there are increased further uncertainties. When the Germans sensed uncertainty following the financial crisis they did not panic about the global situation. They instead took a long hard look at their own banking system and began to diversify their savings. As a result they rediscovered their trust in gold which continues to grow year by year. |

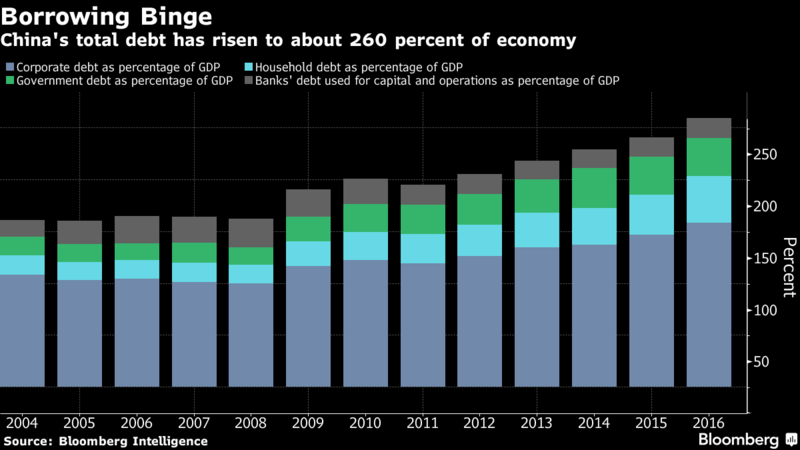

China Total Debt, 2004 - 2017 |

Tags: Daily Market Update,Featured,newslettersent