US GDP growth in the third quarter was good, and momentum may be firmer than we expected. There are upside risks to our 2018 growth forecast.US GDP grew 3.0% q-o-q SAAR in Q3 2018, pushing up the y-o-y print to 2.3%. In a word, the US economy is doing fine, although it still lacks sparkle. The impact of August hurricanes was barely perceptible. IT investment was particularly solid, rising 8.6% y-o-y, and consumer spending growth was tepid (up 2.6% y-o-y), with some softness in services.Looking ahead, recent indicators show that momentum may be firmer than we expected. Global capex improvement could provide a f tailwind, as seen in recent robust capital orders data while the domestic energy sector could be boosted by the recent modest rise in oil prices. This implies some upside risks to

Topics:

Thomas Costerg considers the following as important: Macroview, US economic growth, US GDP growth, US growth forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US GDP growth in the third quarter was good, and momentum may be firmer than we expected. There are upside risks to our 2018 growth forecast.

US GDP grew 3.0% q-o-q SAAR in Q3 2018, pushing up the y-o-y print to 2.3%. In a word, the US economy is doing fine, although it still lacks sparkle. The impact of August hurricanes was barely perceptible. IT investment was particularly solid, rising 8.6% y-o-y, and consumer spending growth was tepid (up 2.6% y-o-y), with some softness in services.

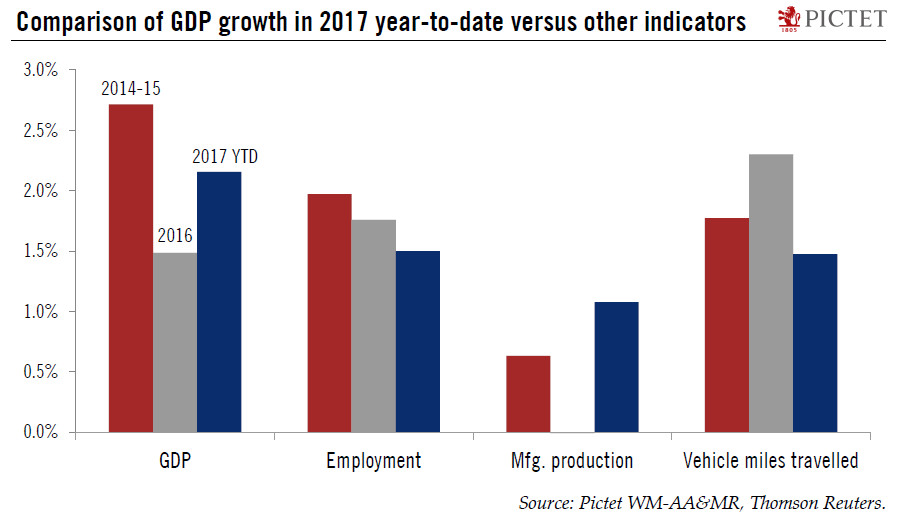

Looking ahead, recent indicators show that momentum may be firmer than we expected. Global capex improvement could provide a f tailwind, as seen in recent robust capital orders data while the domestic energy sector could be boosted by the recent modest rise in oil prices. This implies some upside risks to our 2018 annual growth forecast (currently 1.7%).

Our rising optimism for next year remains limited for a couple of reasons.

First, the US consumer seems to be close to have ‘maxed out’ on credit, as the sharp fall in the household saving rate to 3.4% suggests (from 3.8% in Q2). This means consumer spending may skate on thin ice next year, especially if incomes do not accelerate more markedly. Second, the recent upswing in capex shows that firms may not be waiting for Congress to pass tax reform before investing. This year’s very loose financial conditions may have helped, suggesting that the potential boost from tax reform may not be all that important. And tax reform may be so heavily diluted anyway that tax cuts end up being merely ‘symbolic’, in our view.

A further uncertainty involves housing, which has stagnated lately (new home sales excepted). The continued uptick in house prices may be at risk of asphyxiating the market. Recent data suggest housing could continue to flat line in the near term and take a backseat as far as growth is concerned next year.

Our 2017 GDP growth forecast of 2.2% remains unchanged. From a Federal Reserve perspective, the GDP release does not affect the probability of a December rate hike. We continue to see the Fed hiking in December, and again at its March meeting. The risk of a further hike in June 2018 hike is increasing.