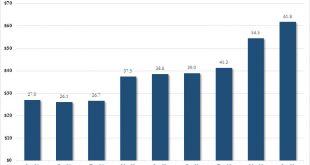

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank… Value of Swiss National Bank US Stocks Holdings(see more posts on SNB Holdings, )Value of Swiss National Bank US Stocks Holdings - Click to enlarge … which has shown a particular appetite for AAPL stock: Swiss National Bank Top Holdings(see more...

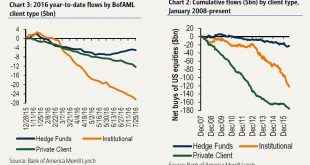

Read More »666: The Number Of Rate Cuts Since Lehman

BofA’s Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, “global central banks have now cut rates 666 times since Lehman.” One would think this attempt by central banks to push everyone into risk assets, certainly the Swiss National Bank which as we showed yesterday has increased its US equity holdings by 50% in the first half of 2016 … …...

Read More »“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling… Click to enlarge. … yesterday we got the answer. In the second quarter, the Swiss National Bank added $7.3 billion to its US equity portfolio, and according to its just filed 13-F, is now long a record $61.8 billion in US stocks, up...

Read More »Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors’ exuberance over bouncing crude oil prices, the world’s crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss next. Having urged investors “don’t panic” last year, and seeing dollar reserves drying up rapidly earlier this year, recent “lies” about the nation’s statistics have raised fears of a looming devaluation as FX forwards have crashed to 291...

Read More »Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. There was some confusion as to why the jump and then it was revealed that none other than that “other” billionaire, Warren Buffett, has decided to start building a stake in the world’s biggest cell phone company to the tune of 9.8 million shares or about $1.07 billion as of March 31. Making some more sense of the transaction, CNBC adds this...

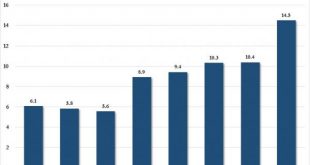

Read More »As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL’s biggest cheerleader, even coming up with price targets north of $200, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake. But as Icahn was selling, or just before as we don’t know precisely when Icahn, who has since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org