– FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making – Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’ – Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’ – Members seem oblivious to impact of inflation on households and savings – Physical gold and silver remain the only assets...

Read More »Gold Coins and Bars Saw Demand Rise 17percent to 222T in Q3

– Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China – Chinese investors bought price dips, notching up fourth consecutive quarter of growth– Jewellery, ETF demand fell while gold coins and bars saw increased demand – Central banks bought a robust 111t of gold bullion bars (+25% y-o-y) – Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand – Turkey increased gold...

Read More »Russia Buys 34 Tonnes Of Gold In September

– Russia adds 1.1 million ounces to reserves in ongoing diversification from USD – 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest – Russia’s gold reserves are at highest point in Putin’s 17-year reign – Russia’s central bank will buy gold for its reserves on the Moscow Exchange – Russia recognises gold’s role as independent currency and safe haven Russian Central Bank Gold Reserves, 2006 -...

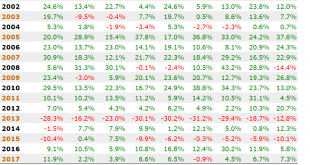

Read More »Gold Up 74% and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

– 10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th– Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP– Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later– S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value– Gold’s performance is slowly forcing...

Read More »Gold Up 74percent and One Of Top Performing Assets Since Last Market Peak 10 Years Ago

– 10 year anniversary of pre-Global Financial Crisis market peak in S&P 500 on October 9th– Gold up 74% since the last market peak a decade ago; 11% pa in USD, 9.4% pa in EUR and 12.4% pa in GBP– Precious metal has climbed $736/oz on Oct 9th 2007 to $1278.75 ten-years later– S&P 500’s 102% climb is thanks to asset-pumping policies by central banks, rather than value– Gold’s performance is slowly forcing...

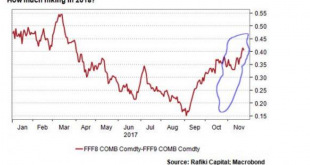

Read More »U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

– US Mint gold coin sales and VIX at weakest in a decade– Very low gold coin sales and VIX signal volatility coming– Gold rises 1.7% this week after China’s Golden Week; pattern of higher prices after Golden Week– U.S. Mint sales do not provide the full picture of robust global gold demand– Perth Mint gold sales double in September reflecting increased gold demand in both Asia and Europe– Middle East demand likely high...

Read More »Gold Matches S&P 500 Performance In First 3 Quarters; Up 12% 2017 YTD

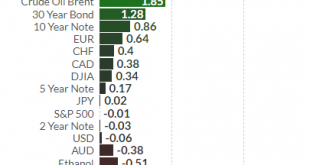

– Gold climbs over 12% in YTD, matching S&P500 performance– Palladium best performing market, surges 36% 2017 YTD– Gold outperforms Nikkei 225, Euro Stoxx 50, FTSE and ISEQ– Geo-political concerns including Trump and North Korea supporting gold– Safe haven demand should push gold higher in Q4 – Owning physical gold not dependent on third party websites and technology remains essential Year to Date Relative...

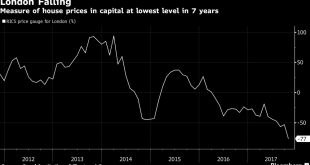

Read More »Pensions and Debt Time Bomb In UK: £1 Trillion Crisis Looms

– £1 trillion crisis looms as pensions deficit and consumer loans snowball out of control– UK pensions deficit soared by £100B to £710B, last month– £200B unsecured consumer credit “time bomb” warn FCA– 8.3 million people in UK with debt problems– 2.2 million people in UK are in financial distress– ‘President Trump land’ there is a savings gap of $70 trillion– Global problem as pensions gap of developed countries...

Read More »Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

– Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy– Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower– Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%– Geo-political concerns including North Korea, falling USD push gold 2.1% in week – Gold prices reach $1,355 this morning following Mexico earthquake– Safe haven demand sees gold over one year high,...

Read More »Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August Gold posts best month since January, up nearly 4% Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month Platinum is best performing metal climbing over 5% Palladium climbs over 4% thanks to seven year supply squeeze Fear, uncertainty and political sanctions are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org