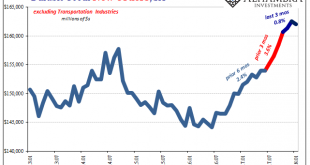

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading. The seasonally-adjusted data gives a better sense of the distortions created by those storms. New...

Read More »US IP On The Other Side of Harvey and Irma

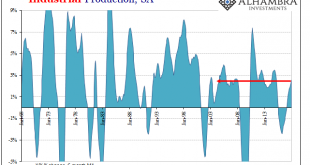

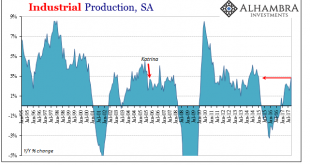

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017). US Industrial Production, Jan 1995 - 2018(see more posts on U.S. Industrial...

Read More »FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

Swiss Franc The Euro has fallen by 0.24% to 1.1535 CHF. EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The significant development this week has been the recovery of equities after last week’s neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the...

Read More »How Global And Synchronized Is A Boom Without China?

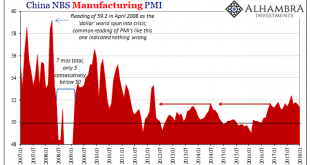

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already. Without China, growth won’t...

Read More »The Dismal Boom

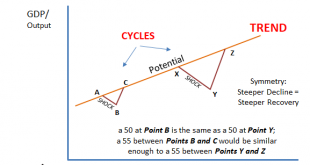

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

Read More »Is Un-Humming A Word? It Might Need To Become One

Industrial Production in the US was up 3.6% year-over-year in December 2017. That’s the best for American industry since November 2014 when annual IP growth was 3.7%. That’s ultimately the problem, though, given all that has happened this year. In other words, despite a clear boost the past few months from storm effects, as well as huge contributions from the mining (crude oil) sector, American production at its best...

Read More »FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

Swiss Franc The Euro has risen by 0.04% to 1.1766 CHF. EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the...

Read More »FX Daily, December 15: Premium for Dollar-Funding is not Helping Greenback Very Much

Swiss Franc The Euro has risen by 0.28% to 1.168 CHF. EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The cross-currency basis swap continues to lurch in the dollar’s direction, especially against the euro, and yet the dollar is not drawing much support from it. The increasing cost reflects pressure for the year-end and does not appear to...

Read More »Business Cycles and Inflation, Part II

Early Warning Signals in a Fragile System [ed note: here is Part 1; if you have missed it, best go there and start reading from the beginning] We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18...

Read More »Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. US Industrial Production, Jan 1995 - Nov 2017(see more posts on U.S. Industrial Production, ) - Click to enlarge That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org