Share this article The New Year is usually associated with a new beginning, a fresh start, or a “clean slate”. Unfortunately, for millions of Americans, these are wishes that are bound to remain unfulfilled – for them, the New Year has nothing “new” to offer at all: it will only perpetuate all the same burdens, obligations and worries of the past year and of the ones that came before. One physical, practical manifestation of this (though it is certainly not a unique, or even a rare,...

Read More »A perfect storm in the making

The New Year is usually associated with a new beginning, a fresh start, or a “clean slate”. Unfortunately, for millions of Americans, these are wishes that are bound to remain unfulfilled – for them, the New Year has nothing “new” to offer at all: it will only perpetuate all the same burdens, obligations and worries of the past year and of the ones that came before. One physical, practical manifestation of this (though it is certainly not a unique, or even a rare,...

Read More »Le prix de l’or est manipulé. Egon von Greyerz

La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans. Source image:...

Read More »The Three Headed Debt Monster That’s Going to Ravage the Economy

Mass Infusions of New Credit “The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.” – John Steinbeck, The Grapes of Wrath Something strange and somewhat senseless happened this week. On Tuesday, the price of gold jumped over $13 per ounce. This, in itself, is nothing too remarkable. However, at precisely the same time gold was jumping, the yield on the 10-Year...

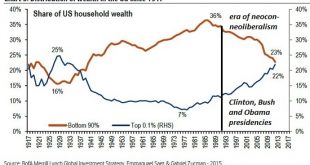

Read More »Do the Roots of Rising Inequality Go All the Way Back to the 1980s?

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse. I presented this chart of rising wealth inequality a number of times over the past year. Do you notice something peculiar about the inflection points in the 1980s? US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org