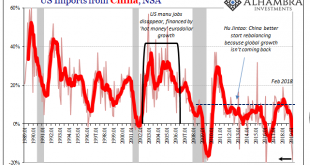

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year. In the entire series which goes back to 1988, there are only three...

Read More »Monthly Macro Monitor – October 2018

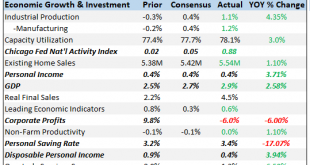

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

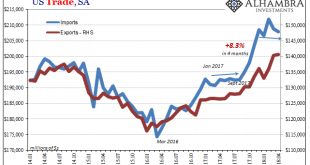

Read More »US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods. Since December,...

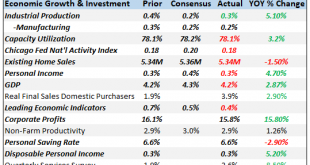

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

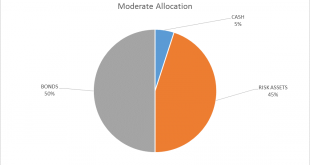

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

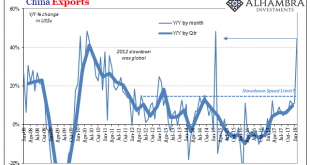

Read More »China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative. A strengthening U.S. recovery is helping underpin China’s outlook as Asia’s biggest economy seeks to cut excess capacity and transition to reliance on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org