Summary: The relationship between stocks and bonds does not appear to have changed much. It is difficult to eyeball correlations. Question the meaning of a chart that has two time series and two scales and. This Great Graphic comes from Bloomberg. It is a more complicated look at the relationship between the US stocks and bonds. In particular, we are looking at the S&P 500 and the 10-year US generic...

Read More »Is This The Greatest Stock Market Bubble In History? Goldnomics Podcast

GoldNomics Podcast (Episode 2) Is This The Greatest Stock Market Bubble In History? In our second GoldNomics podcast, we take a look at one of the important financial questions of our day – is this the greatest stock market bubble in history? Listen on iTunes, SoundCloud and BlubrryWatch on YouTube below [embedded content] GoldCore CEO Stephen Flood and GoldCore’s Research Director and world renowned precious metals...

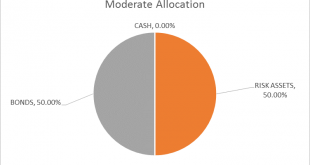

Read More »Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org