Summary: Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows. There are powerful moves underway in the capital...

Read More »FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

Swiss Franc EUR/CHF - Euro Swiss Franc, November 23(see more posts on EUR/CHF, ). Source: - Click to enlarge The GBPCHF rate has slipped a little in early morning trading today as investors await the UK budget due today. Amongst the usual leaks and rumours there appears likely to be a budget which will not be overly generous as some expect but will seek to keep the UK economy on a fairly stable course. UK...

Read More »FX Daily, November 18: Revaluation of the Dollar Continues

Swiss Franc EUR/CHF - Euro Swiss Franc, November 18(see more posts on EUR/CHF, ). - Click to enlarge FX Rates Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days...

Read More »Cool Video: Bloomberg Interview – Peso, Equities, Yuan

Mark Chandler - Click to enlarge Even before the my polling station opened today, I had the privilege of being on Bloomberg Surveillance today with Gina Cervetti and Tom Keene. We talk about a wide range of issues directly and tangentially related to the US election. We discuss the outcome the market appears to be discounting. We talk about peso’s strength, which began in the second half of last week, before the FBI...

Read More »FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Swiss Franc With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions. Moreover, I expect significant...

Read More »The Yen in Three Charts

Summary: The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen. One of the big stories in the foreign exchange market this year has been the strength of the Japanese yen. It is up 17.3% so far this year, despite negative interest rates through 10-years and among the worst...

Read More »Great Graphic: Stocks and Bonds

Summary: The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015. As market participants, we are sensitive to changing inter-market relationships. This Great Graphic, from Bloomberg shows the correlation...

Read More »FX Daily, September 12: Markets Off to a Wobbly Start

Swiss Franc The EUR/CHF retreated today together with falling stock prices. Later during the European day, U.S. stocks recovered. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure. Click to enlarge. FX Rates Stocks and bonds have begun the new week much like last week ended. Sharp losses...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

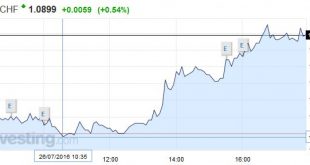

Read More »FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

Swiss Franc The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. USD/CHF Finally over 200DMA? After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org