Swiss Franc Once again the SNB was heavily intervening and the pound fell against both euro and CHF.Thanks to SNB interventions, the Euro did not even dip under 1.08. Click to enlarge. Brexit What a difference a few days make. Many saw last week’s equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now....

Read More »Who Is The “European Movement” And Why The Answer May Change How You Vote On “Brexit”

Werner’s main points: The “EU Movement” has been created by the US Government and their secret services in order centralise their influence over Europe. Big business, banks, central banks and the IMF want to excercise their power through unelected officials. The free trade area with the EU is beneficial and will surely be maintained, even in the Brexit case. The election outcome is not so clear as it seems to the...

Read More »FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

EUR/CHF The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. Click to expand USD/CHF After a relatively steady week, the dollar lost 130 bips on Friday. Click to expand Continued by Marc Chandler:...

Read More »FX Weekly: Dollar Set to Snap Three-Month Decline

EUR/CHF The EUR/CHF moves lower, following the descent of EUR/USD. This happens often, when European and global growth is sluggish. USD/CHF But the Swiss franc weakened against the dollar. Continued by Marc Chandler: The US dollar was mostly firmer over the past week. There were two exceptions among the major currencies: Sterling and the Canadian dollar. GBP/USD Many linked sterling’s outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU,...

Read More »Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

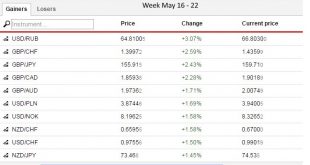

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed against all the major currencies but sterling (+0.9%). Sterling was aided by some polls indicating a shift toward the Remain camp. The...

Read More »FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

The US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable that it begins recovering first. Its recent resilience was noted, but that has evaporated today, but a 0.8% drop by early European activity. We had noted the divergence between what...

Read More »Dollar’s Technical Tone Improves, but No Breakout (Yet)

The US dollar continued the recovery begun May 3 and rose against most of the major currencies over the past week. A nearly 3.5% rally in oil prices, the fifth weekly gain in the past six weeks (a $9.5 advance over the period), helped the Norwegian krone turn in a steady performance. The Canadian dollar's 0.2% decline put it in second place. With the strongest rise in US retail sales in a year, prompting the Atlanta Fed's GDPNow tracker to rise to 2.8% for Q2, many observers are...

Read More »FX Daily, May 06: Bottoming against the Dollar-Bloc

The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put in at least a medium-term top. We hasten to note that the fundamental developments have not shifted a more dollar-friendly near-term direction. Investors, judging from...

Read More »Will the Dollar Bloom like May Flowers after April Showers?

April was a cruel month for the US dollar. It fell against all the major currencies; even those whose central banks have negative yields. The greenback also fell against nearly all the emerging market currencies, but the Philippine peso and the Polish zloty. Through the first four months of the year, the dollar is lower against all the major currencies save sterling, which is off about 0.6%. Following the reluctance of the BOJ to ease policy further last week, the yen has moved back...

Read More »FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried the S&P 500 above 2100 since last November, small gains in Tokyo (0.2%), Australia (0.5%) were sufficient to keep the MSCI Asia-Pacific Index flat. European...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org