Share this article An attempt at an analysis from the perspective of a free Swiss individual What you’re about to read is the abridged and condensed English translation of a speech I gave in Munich in November 2023. You can find the full speech, in German with English subtitles, here. It tackles the very difficult, but also very crucial, subject of individual freedom, or what is left of it these days, and it seeks to offer a constructive analysis from a Swiss perspective. It is...

Read More »Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess it, mistrust and question it and the...

Read More »Inflation on the rise – The blame game

After months of outright denials and fiery persistence that inflation is not a problem and never will be, central bankers in the US, the EU and other advanced economies are now being forced to face reality, as well as the consequences of their own actions. Instead of doing that, however, they have partnered up with their peers from the political world and together, they have embarked on a campaign to disperse and deflect the blame and entirely avoid accountability. For months now,...

Read More »Swiss stocking up on gold!

How planning ahead and preparing for what lies ahead is a lesson everyone needs to learn Over the last couple of months, it has become clear from conversations with friends and partners from the gold industry that there is a marked increase in retail demand for physical gold from Swiss investors. The most interesting thing about this development is that the bulk of new orders is coming from smaller accounts, showing that it’s ordinary savers and citizens that are driving this...

Read More »Merger mania: Consolidation in the gold mining sector

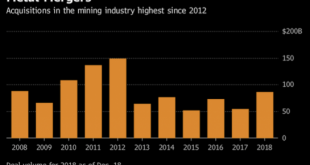

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for...

Read More »Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion. The deal, that is largely expected to go ahead and be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org