Headlines Week January 02, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. The last ECB meeting showed that the ECB might be dovish for a longer...

Read More »Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

Headlines Week Ending December 23 , 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. The last ECB meeting showed that the ECB might be dovish for a...

Read More »Weekly Sight Deposits: Week December 09, 2016

Headlines Week December 09, 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. Last week’s ECB meeting showed that the ECB might be dovish for a...

Read More »Weekly Sight Deposits: No SNB Interventions, Short CHF nearing records

Headlines Week December 09, 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. Last week’s ECB meeting showed that the ECB might be dovish for a...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Week December 09, 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. Last week’s ECB meeting showed that the ECB might be dovish for a...

Read More »Weekly Sight Deposits: Investors hedge with Swiss Franc again for the coming inflation cycle.

Headlines Week November, 25 2016 We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up U.S. wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump...

Read More »Weekly Sight Deposits: Investors hedge against Trump’s inflationary policy with Swiss Franc.

Headlines Week November 18, 2016 We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up wages. According to Lars Christensen Trumpeconomics is also about monetary stimulus: Trump would...

Read More »SNB Sight Deposits November 7: No interventions, EUR/CHF under 1.08 with political jitters

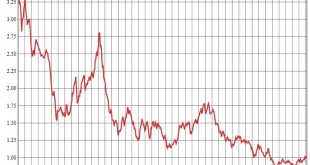

Headlines Week November 04, 2016: No interventions, EUR/CHF under 1.08 with political jitters Sight Deposits: show that the SNB has not intervened to sustain the euro, that dipped under EUR/CHF 1.08. We considered the 1.08 as line in sand for the SNB. FX: The odds of Trump are rising. This causes fear and demand for Swiss Franc. The EUR/CHF fell to 1.0750. Euro/Swiss Franc FX Cross Rate, November 07(see more posts...

Read More »Central Bank Independence in Switzerland: A Farce

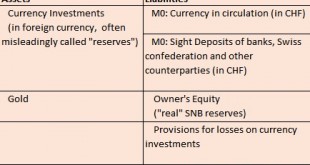

Each week we will publish the best articles by Marc Meyer, one of the most critical voices against the SNB.This post explains 3 points: That the SNB does not understand what assets and liabilities are – and due to this misunderstanding – it speculates with massive leverage. The difference between good and bad deflation, and that Switzerland has good deflation. That both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org