Overview: Rising rates and falling stocks provided the backdrop for the foreign exchange market this week. The dollar appreciated against all the G10 currencies but the Swedish krona, which is still correcting higher after the hawkish pivot by the central bank. The market looks for a later and higher peak in the Fed funds rate. This coupled with the risk-off sentiment helped the dollar extend its recovery after falling since last September-October. The yen's...

Read More »Fed Tightening Seen Extending into Q3

Overview: The prospect that the Federal Reserve tightening cycle continues into early Q3 is underpinning the greenback today against most of the G10 currencies. The dollar bloc is the notable exception, and they are posting minor gains, perhaps encouraged by the firmer equity markets. The minutes of this month’s FOMC meeting appear to show wide support for quarter point hikes going forward and there did not seem to be much discussion of the conditions that would...

Read More »Monday: A Short Note while US is on Holiday

The dollar is mostly softer, but turnover is mostly quiet. The Swedish krona leads the move after higher-than-expected underlying inflation. It is a mild risk-on day with equities moving higher too. In the Asia Pacific region, China stood with the CSI 300 up almost 2.5%. Europe’s Stoxx 600 is up fractionally to recoup most of the pre-weekend decline. US equity futures are narrowly mixed. European bond yields are little changed, with a couple of exceptions: ...

Read More »Dramatic Swing in Sentiment Extends the Greenback’s Rally

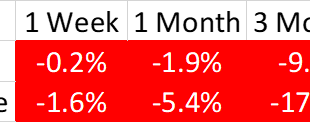

Overview: A series of strong US high-frequency data points after a poor finish to last year has spurred a dramatic shift in market expectations. And talk among a couple of (non-voting) FOMC members of a 50 bp hike has provided added fodder. The greenback is extending its recovery today against all the major currencies, with the Australian and New Zealand dollars hit the hardest. Emerging market currencies have also been knocked back. This is part of a larger risk...

Read More »A Day of Surprises

(I am on a business trip and did not intend to post any analysis today. However, there have been a number of unexpected developments that warrant some commentary. Thanks for bearing with me.) Japanese press reports that the BOJ Deputy Governor Amamiya turned down the opportunity to become the next BOJ governor. Instead, next week, former BOJ board member Kazuo Ueda will be nominated. The market reacted dramatically, taking the yen sharply higher and sold JGBS....

Read More »US Interest Rate Adjustment Post-Jobs is Over as the 2-Year Yield Backs Away from 4.50%

Overview: The capital markets have shrugged off the more than 1% loss of the Nasdaq and S&P 500 yesterday and have jumped back into risk assets. The stocks and bonds have been bought and the dollar sold. Chinese and Hong Kong shares gained more than 1% today. Japan was mixed and Taiwan and South Korean equites saw minor losses. Europe's Stoxx 600 is up over 1%. Nasdaq futures are up nearly 1.2% while the S&P 500 is lagging slightly. European bonds yields are...

Read More »Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »Dismal UK Retail Sales Weigh on Sterling, While the Yen Softens

Overview: The US dollar is mostly softer today against the G10 currencies, with the notable exception, yen, Swiss franc, and sterling. The risk-on mood is seen in the foreign exchange market with the Antipodean and Scandi currencies leading the move against the greenback. The yen has fallen by about 1.3% this week, leading losers, while sterling's 1.1% gain puts it at the top. Despite the poor showing of US equities yesterday, risk appetites returned and most of the...

Read More »Is it Too Easy to Think the Market Repeats its Reaction to a Soft US CPI?

Overview: The market expects a soft US CPI print today, which has recently been associated with risk-on moves. The US 10-year yield is holding slightly above 3.50%, the lowest end of the range since the middle of last month. The two-year yield is a little above 4.20%, also the lower end of its recent range. Most observers see the Federal Reserve slowing the pace of its hikes to a quarter point on February 1. The dollar has spent the last few days consolidating after...

Read More »Greenback Consolidates Near Recent Lows Ahead of Tomorrow’s US CPI

Overview: Fed Chair Powell did not push against the easing of US financial conditions when he ostensibly had an opportunity yesterday. This coupled with expectations of another decline in the US CPI, which will be reported tomorrow, has kept the greenback mostly consolidating the losses seen last Friday and Monday. With a light calendar today, continued sideways movement is the most likely outlook for the North American session today. The rise in US yields seen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org