Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen – as he told CNBC two days ago – is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt....

Read More »How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich’s nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at...

Read More »Life Expectancy Indicates A Nation’s Overall Well Being – So Why Is America’s Dropping?

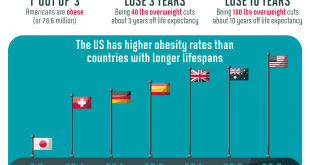

‘Exceptional’ America is seriously lagging behind in global life expectancy… Via: MesoTreatmentCenters.org Some additional details… Life Expectancy Indicates a Country’s Overall Well Being—So Why Is Ours Dropping? The last time U.S. life expectancy declined at birth 1992-1993: 75.8 to 75.5 years Resulting from high death rates from AIDS, flu epidemic, homicide, and accidental deaths After years of life expectancy...

Read More »Life Expectancy Indicates A Nation’s Overall Well Being – So Why Is America’s Dropping?

‘Exceptional’ America is seriously lagging behind in global life expectancy… Via: MesoTreatmentCenters.org Some additional details… Life Expectancy Indicates a Country’s Overall Well Being—So Why Is Ours Dropping? The last time U.S. life expectancy declined at birth 1992-1993: 75.8 to 75.5 years Resulting from high death rates from AIDS, flu epidemic, homicide, and accidental deaths After years of life expectancy...

Read More »The Market Has Its Head Buried Deep In The Sand

The Market Has its Head Buried Deep In The Sand Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets. The most immediate problem is the Treasury...

Read More »Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.) But let’s just suppose that, when the European leaders sat down for lunch at the Quirinal Palace, some of them had a little too...

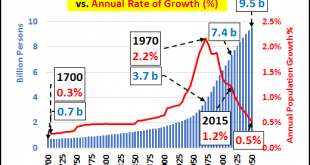

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

Read More »The Psychological Impact Of Loss

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising. In this past weekend’s missive, I discussed a variety of “extremes” being...

Read More »Davos (According To Donald Trump)

Bloomberg’s Anne Swardson, Zoe Schneeweiss, and Andre Tartar perfectly summed up the state of play right now during their discussion of the World Economic Forum’s annual get-together: “Never before has the gap between Davos Man and the real world yawned so widely.” As the world’s top executives, financiers, academics, and politicians make their way to Switzerland, Trump – who won’t have an official representative there...

Read More »Lagarde Urges Wealth Redistribution To Fight Populism

IMF Managing Director Christine Lagarde, Italian Finance Minister Pier Carlo Padoan and Founder, Chairman and Co-CIO of Bridgewater Associates, Ray Dalio - Click to enlarge As we scoffed oveernight, who better than a handful of semi, and not so semi, billionaires – perplexed by the populist backlash of the past year – to sit down and discuss among each other how a “squeezed and Angry” middle-class should be fixed. And...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org