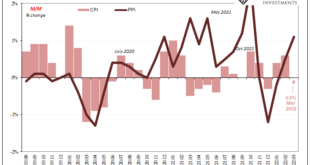

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%. Balancing those were the prices for main food staples, especially pork, the latter having declined an rather large 9.3% last month from the month before. Keeping energy but removing...

Read More »China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

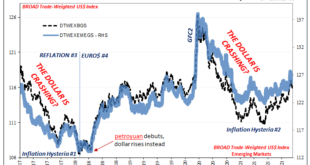

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike. Basically, the Fed had “printed” too much “money” and the Chinese playing some “long game” were purportedly ready at any moment to snatch the role of world reserve by manipulative force from the out-to-lunch Americans. Those...

Read More »Restricted Market Trading Comments

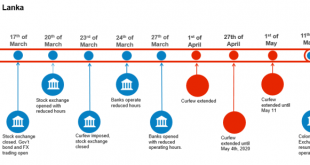

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More »China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy....

Read More »Why the World’s Central Banks hold Gold – In their Own Words

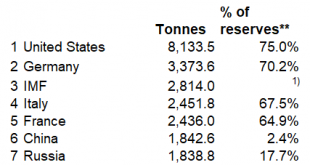

Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range. This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org