Falcon is offering a social plan to staff who will lose their jobs. (Keystone) The Abu Dhabi-owned Falcon private bank says it is winding down activities in Switzerland and is in talks with a Swiss rival to take on its existing clients next year. Falcon was taken to task by regulators in both Switzerland and Singapore for its role in channelling assets from the Malaysian 1MDB fraud. The company says it has changed its name to “Falcon Private” but will remain under...

Read More »Different Type of Crisis, Some Old Concerns

Over the past two months we have witnessed historic turmoil followed by unprecedented intervention by policy makers and central banks in supporting the capital markets (and more). In many ways the 2020 COVID-19 pandemic is very different from the 2008 global financial crisis, but for some, certain old concerns still linger. In the face of short selling bans and worries about market liquidity, we discuss below how best to navigate some of the common objections and...

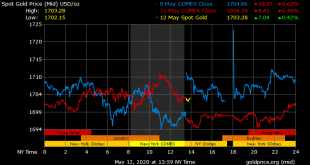

Read More »Pandemic, Lockdowns, Fake and Manipulated Markets – Gold and Silver Outlook

Watch Video Update (Live 12/05/2020 ◆ The massive global debt driven “Everything Bubble” is bursting due to the pandemic and more specifically the governments draconian economic lockdowns ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion ◆ Wall Street has just been bailed out at the expense of Main Street and families and businesses in the U.S. and throughout most of the...

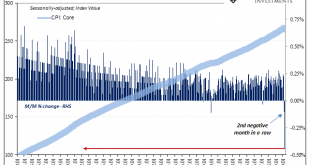

Read More »A Big One For The Big “D”

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy. Thus, a little steady inflation as insurance against the real evil....

Read More »FX Daily, May 12: Markets Tread Water, Looking for New Focus

Swiss Franc The Euro has risen by 0.02% to 1.0515 EUR/CHF and USD/CHF, May 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly...

Read More »SNB COVID-19 refinancing facility expanded to include cantonal loan guarantees as well as joint and several loan guarantees for startups

The Swiss National Bank announced the establishment of the SNB COVID-19 refinancing facility (CRF) on 25 March 2020. This facility allows banks to obtain liquidity from the SNB by assigning credit claims from corporate loans as collateral. In so doing, the SNB enables banks to expand their lending rapidly and on a large scale. To date, the SNB has accepted as collateral for the CRF only credit claims in respect of loans guaranteed by the federal government under the...

Read More »The Way of the Tao Is Reversal

As Jackson Browne put it: Don’t think it won’t happen just because it hasn’t happened yet. We can summarize all that will unfold in the next few years in one line: The way of the Tao is reversal. This is the opening line of Chapter 40 of Lao Tzu’s 5,000-character commentary on the Tao, The Tao Te Ching. There are many translations of this slim volume, and for a variety of reasons I favor the 1975 translation by my old professor at the University of Hawaii, Chang...

Read More »Most think Switzerland is reopening fast or too fast, according to survey

© Hdesislava | Dreamstime.com A survey published on 7 May 2020, suggests only 36% of Swiss support the government’s calendar for reopening the country after the Covid-19 shutdown. 23% think the plan to reopen is too slow, while 42% think it is fast or too fast. However, 60% said they had confidence in the government. The most controversial aspects of the plan were reopening schools and reopening restaurants, bars and nightclubs. 37% thought restaurants were opening...

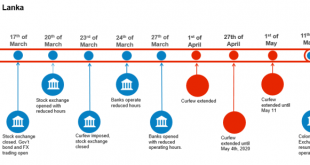

Read More »Restricted Market Trading Comments

Restricted Market Trading Comments By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations today following an extended period of closure. Foreign exchange trading is...

Read More »Three Reasons Why the Eurozone Recovery Will Be Poor

The eurozone economy is expected to collapse in 2020. In countries such as Spain and Italy, the decline, more than 9 percent, will likely be much larger than in emerging market economies. However, the key is to understand how and when the eurozone economies will recover. There are three reasons why we should be concerned: The eurozone was already in a severe slowdown in 2019. Despite massive fiscal and monetary stimulus, negative rates, and the European Central...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org