Swiss Franc The Euro has risen by 0.05% at 1.1331 EUR/CHF and USD/CHF, February 11(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Lifted by the re-opening of Chinese markets after the week-long Lunar New Year holiday, global equities are trading firmer. Outside of Japanese markets that were closed, the large markets in Asia–China, Taiwan, South Korea, and...

Read More »Swiss Consumer Price Index in January 2019: +0.6 percent YoY, -0.3 percent MoM

11.02.2019 – The consumer price index (CPI) fell by 0.3% in January 2019 compared with the previous month, reach-ing 101.3 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the pre-vious year. These are the results of the Federal Statistical Office (FSO). The decrease of 0.3% compared with the previous month can be explained by several factors including falling prices for clothing and...

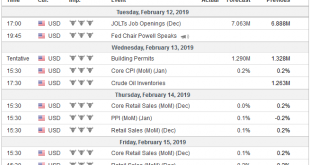

Read More »FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. “Why are you crying?” the boy asked, “you just conquered the world. “Yes'” Alexander wept, ” now there is nothing else for me to do.” Investors are not as cursed as...

Read More »Train delay data queries image of Swiss railways

Switzerland’s trains are renowned for their punctuality, but do they deserve this reputation? (Christian Beutler / Keystone) Trains operated by the state-owned Swiss national railway operator are less punctual than company statistics make believe. A private websiteexternal link, launched in 2017 and compiled from data provided by the transport ministry, found that on average one in six intercity trains – or just under...

Read More »2019: The Three Trends That Matter

Look no further than Brexit in Britain, the yellow vests in France and the Deplorables in the U.S. for manifestations of a broken social contract and decaying social order. Among the many trends currently in play, Gordon Long and I discuss three that will matter as 2019 progresses: 2019 Themes (56 minutes) 1. Final stages of the debt supercycle 2. Decay of the social order/social contract 3. Social controls:...

Read More »Telecoms firms awarded 5G mobile frequencies

A press conference to announce the results of the auction was held on Friday (© KEYSTONE / ANTHONY ANEX) The Swiss government has raised CHF380 million ($379 million) from auctioning fifth-generation (5G) mobile radio frequencies, it said on Friday. The three Swiss main providers, Swisscom, Sunrise Communications and privately owned Salt, each received part of the spectrum after newcomer Dense Air dropped out of the...

Read More »Swiss start-ups to benefit from multi-million fund

Left to right: board chair Swiss Entrepreneurs Foundation Urs Berger (Mobiliar), foundation managing director Peter Staehli, Johann Schneider-Ammann, Didier Denat (CS), Lukas Gähwiler (UBS) Start-ups and innovative small and medium-sized businesses are to be encouraged to stay in Switzerland thanks to a new fund of up to CHF500 million ($499 million). The initiative, from Swiss Entrepreneurs Foundationexternal link...

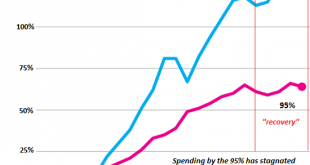

Read More »Brace for Impact

As credit-asset bubbles pop, the dominoes start falling. The economy is far more precarious than the surface boom/bubble suggests. A great many households, enterprises and municipalities are in overloaded boats whose gunwales are just a few inches above the water; the slightest wave will swamp and sink them. The cost structure of the economy is completely out of whack with what households and enterprises can...

Read More »Cool Video: Noise or Signal?

From the second half of last week through the first half of this week, the S&P 500 rallied. It surpassed our target of 2700 and made it to almost 2740, retracing more nearly 2/3 of the decline from the record high set last September. It stalled ahead of the 200-day moving average, which had previously offered support declines. The S&P 500 pulled back in the second half of the week. The fact the three-day...

Read More »Sunrise confirms talks to buy Liberty Global’s Swiss unit

Sunrise had 3.4 million customers in 2017, including 2.4 million mobile phone customers (© KEYSTONE / THOMAS DELLEY) Switzerland’s Sunrise Communications Group has confirmed it is in talks to buy Liberty Global’s cable operator UPC Switzerland. The company said in a statementexternal link on Tuesday: “Sunrise confirms it is in discussions with Liberty Global regarding a possible acquisition of UPC Schweiz. Sunrise will...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org