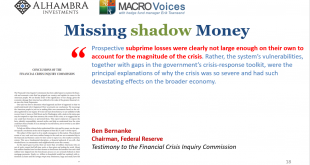

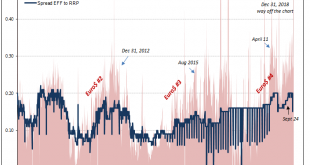

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing. What was going on in the shadows wasn’t...

Read More »February 2019 PBOC/RMB Update

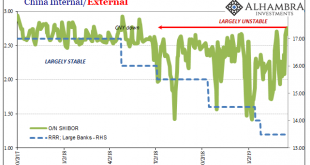

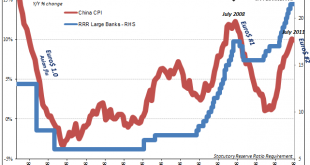

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

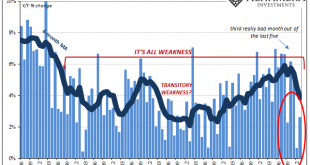

Read More »The World Economy’s Industrial Downswing

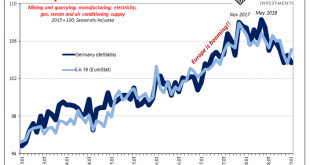

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

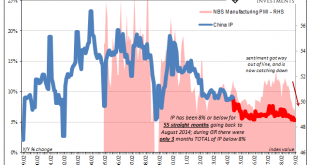

Read More »No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

Read More »Downturn Rising, No ‘Glitch’ In Retail Sales

You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that? Last month, the Census Bureau reported that retail sales during the Christmas holiday were a disaster. It was Christmas...

Read More »China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China. This was amended in...

Read More »FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances. Interpretations matter. Conventional wisdom seems settled...

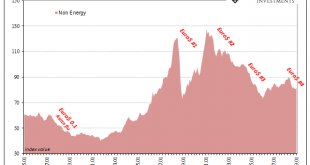

Read More »China’s Big Money Gamble

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018. The last time they had fallen by that much it was May 2016. World Bank Pink Sheet Commodity Indices...

Read More »Inflation Falls Again, Dot-com-like

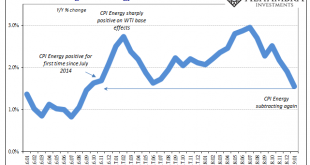

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

Read More »Lost In Translation

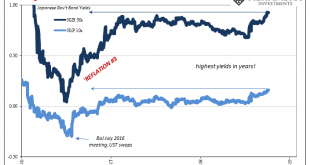

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish. At the end of last July, BoJ’s governing body made a split...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org